You have imported your existing portfolio to Kuvera. The next step is to switch your Regular Mutual Fund plans to Direct Mutual Fund plans and stop paying commissions.

Switching away from commission laden Regular Mutual Funds used to be cumbersome with uncooperative brokers, and a lot of paperwork. We are changing that. We have made importing your existing portfolio and switching to Direct Plans easy. So easy that you have no excuse left to continue to pay expensive commissions.

Four things to watch for while switching from Regular Plan Scheme A to Direct Mutual Fund Plan Scheme B:

1/ Short-Term Capital Gains Taxes: the selling of units of Scheme A will attract Short Term Capital gains tax if the units are held for less than 1 year for equity funds and 3 years for debt funds. STCG is calculated as 15% for gains in equity funds. If your investment is in loss then STCG is not an issue.

2/ Long-Term Capital Gains Taxes: the selling of units of Scheme A will attract Long Term Capital gains tax if the units are held for more than 1 year for equity funds and 3 years for debt funds. LTCG is calculated as 10% of the gains for equity funds with an exemption on the first Rs 1 lakh of gains. If your investment is in loss then LTCG is not an issue.

3/ Exit Load: the selling of units of Scheme A will attract exit load if the scheme charges exit load. Most schemes do not charge exit load after 1 year of holding the units.

4/ Lock-in period: this applies mostly to ELSS schemes. If your ELSS units are within the 3-year lock-in, then the switch in such schemes is not allowed. Switch order placed in units under lock-in period will fail.

Keep the above list in mind, as you go through the 3 options you have to switch to Direct Mutual Fund plans on Kuvera.

TradeSmart

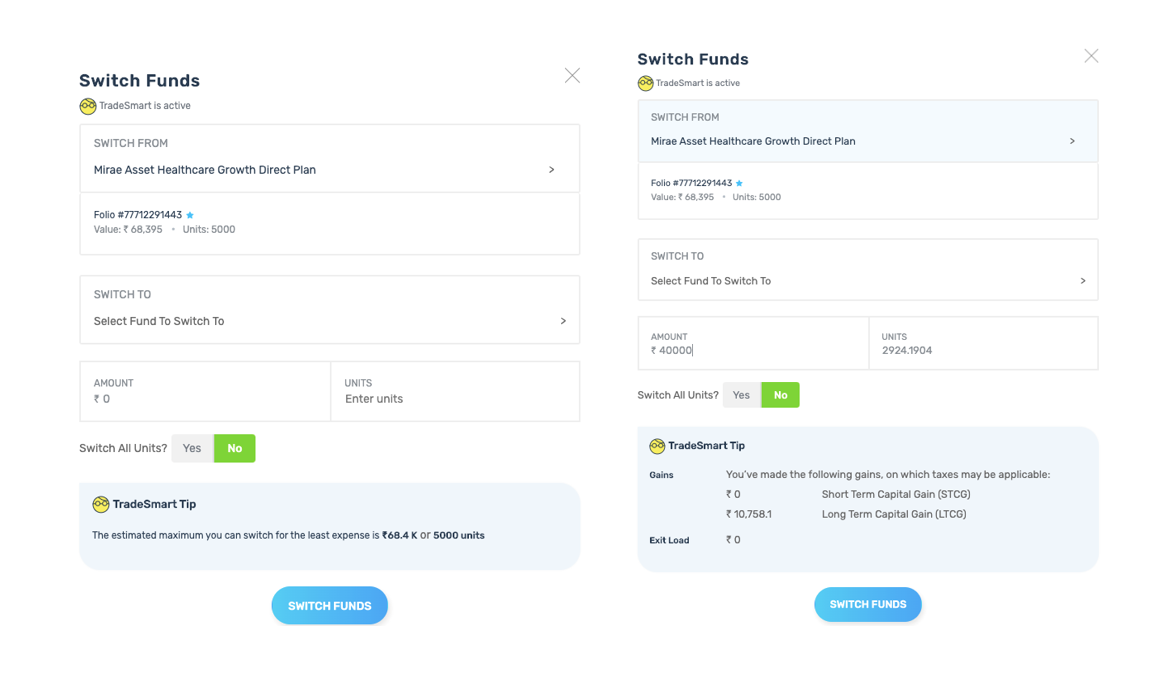

The TradeSmart option shows your units that are outside the STCG window i.e 1 year for equity funds. While placing your order we will also show you applicaple LTCG and exit load so you can make better decisions. LTCG is grandfathered till Jan 31st, 2018. So if your funds NAV is below Jan 30th NAV then LTCG will not apply. Further, you have a Rs 1 lakh exemption for LTCG taxes. You can enable TradeSmart by using 300 Coins.

Once enabled, you will see TradeSmart recommendations in the order page –

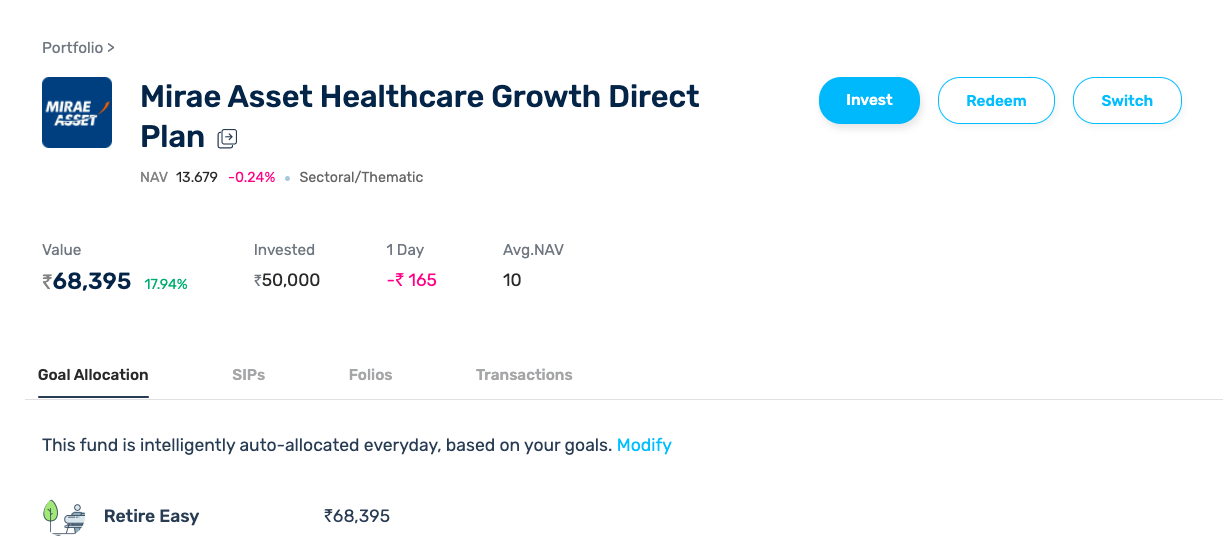

Do It Yourself “Switch”

You can find the “Switch” button when you click on any scheme name in the “Portfolio” tab. As the name suggests, this is a “Do It Yourself” option, so make sure you check for STCG, exit load, and LTCG before placing the switch order.

Use Systematic Transfer Plan (STP) to Switch to Direct Mutual Fund Plans:

Setting up an STP from Regular plan Scheme A to Direct Mutual Fund plan Scheme B is a smart way to switch over time. Say, you had a regular plan SIP in equity Scheme A and you ran it from Jan 2016 to May 2018. You learned about Kuvera and now want to switch to Direct Mutual Fund Scheme B.

A smart course of action would be to:

1/ Switch all units accumulated between Jan 2016 to Apr 2017 in one go (either calculate the units yourself or use TradeSmart ).

2/ Setup an STP from regular Scheme A to direct Scheme B of the same amount as the SIP and run it for 12 months. So for the month of Jun-2018, the units bought in May-2017 will be switched through the STP transaction and so on and so forth.

This will automate your switch to match your buying schedule, which was monthly.

There you have it, three ways to switch to Direct plans and zero excuses to continue paying commissions. Switch today at Kuvera.in

FAQ1: If I switch my existing units to Direct plans will my SIP order with my current broker also switch automatically to Direct plan SIP on Kuvera?

No, the three ways to switch we have discussed above only switch your existing regular plan units to direct plan units. For your SIP’s you will need to take the two steps below:

1/ Set Mandate amount in your profile and complete the mandate setup process. You will need an active mandate to be able to place SIP order.

2/ START your direct plan SIPs on Kuvera in the same folio as your current plans and then STOP your SIPs with other platforms.

Ps: if your regular plan platform does not agree to stop your SIPs (saying you need minimum months etc), read this

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit Kuvera to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!

Karthik Kanniyappan

July 5, 2018 AT 07:50

It would be really great if you could provide the Taxation component as well as part of the software which helps us to understand what would be the implication of STCG , LTCG and Grand Fathered Net tax which would need to be paid. This can be as part a report as well for easy understanding.

Gaurav Rastogi

July 9, 2018 AT 06:26

Noted Karthik. We will add it soon.

Syed

June 6, 2021 AT 09:38

Hi Gaurav. Just checking to see if this feature has been added in Kuvera. Coz this is the feature I was mainly looking out for. Thanks.

Gopalakrishna

July 26, 2018 AT 02:08

The only problem with Switch is you lose the overall impact of your investment growth.

I mean you invested in Fund A. Then switched to Fund B. After you switch, the investment cost for Fund B is your investment value of Fund A. Where as actually your cost (from investment perspective) is what you put in Fund A.

If you could add a way to track this, that would be simply awesome. I perfectly understand if you cannot.

Gaurav Rastogi

July 27, 2018 AT 03:05

We do track it in your portfolio XIRR. Your portfolio XIRR captures realized and unrealized gains so you will see that a switch does not change the portfolio level XIRR.

Laxmikant Nemade

August 30, 2018 AT 12:28

I am myself an IFA having client’s AUM of more than 11 Cr. operating via NSE Platform.

I am having a portfolio of 1.0 Cr.plus in 6-7 AMC’s (of my own investment) mostly under Regular plan. I wish to switch the whole to some platform and to Direct plan. I Learn your platform charges no transaction fees irrespective of portfolio size. What other charges, if any, do you levy? Subsequently, I would like to open 4 more accounts of my family members under Kuvera. They too have quite good volume of existing AUM. You may send me contact number of your representative so that one to one talk can be done.

Gaurav Rastogi

September 1, 2018 AT 02:19

Thanks for reaching out Laxmikant. We do not charge any fees – we are the first completely free Direct Plan platform in the country.

To move completely to Kuvera and to Direct plan, we recommend the following steps (entire process is online) –

1/ Import your existing units to Kuvera so you can track them here

Setup an account with Kuvera and complete KYC check and bank account set up.

After logging in, please follow the steps in the Import Portfolio tab. Do read the “Import Portfolio” FAQ: https://kuvera.in/faq/import

We read and process your Consolidated Account Statement in real time and you can start placing orders in the same folios as your current regular and Direct plans immediately.

2/ Move your SIPs from current platform to Kuvera

Set Mandate amount in your profile and complete the mandate setup process. You will need an active mandate to be able to place SIP order.

Start your direct plan SIPs on Kuvera in the same folio as your current plans and then STOP your SIPs with other platforms. Ps: if your regular plan platform does not agree to stop your SIPs (saying you need minimum months etc), read this – https://blog.kuvera.in/how-to-stop-your-sip-when-your-distributor-refuses-to-stop-sip/

3/ Switch your Regular plan units to Direct plan units – there are 3 ways that Kuvera makes it easy to switch from Regular plan units to Direct plan units. You can read in detail about them here – https://blog.kuvera.in/3-ways-to-switch-your-regular-plans-to-direct-mutual-fund-plans/

Hope the above helps. Let us know at support@kuvera.in if you get stuck on any step.

As an IFA you can manage all your clients portfolio in Direct plans using our Managed Account feature as well – https://blog.kuvera.in/managed-accounts-link-and-invest-across-kuvera-accounts/

Padmanabh Shenoy

September 11, 2018 AT 05:16

Hi Gaurav,

Read your answer reg XIRR calcation for a regular fund importe into kuvera and switched to direct plan. But if an existing investment in a Direct Plan is imported into kuvera, will the XIRR be calculated from the date of first investment done on the AMC portal and will kuvera show these returns on the portfolio performance.

Gaurav Rastogi

September 11, 2018 AT 07:03

Yes, Padmanabh. We import at the transaction level, so it does not matter if it is a regular or a direct scheme. We will show XIRR from the first investment date.

Padmanabh Shenoy

September 11, 2018 AT 13:34

Thanks Gaurav.

Ravi

September 15, 2018 AT 06:21

Hi Gaurav

While transferring from regular plans to direct plans, can I move to better performing funds on direct plans? In this context if I use the plans suggested by kuvera and How do I execute the same. Bit confused on this. It will be helpful if you could throw some simple steps

Gaurav Rastogi

September 17, 2018 AT 05:59

Yes Ravi, when you switch from an existing Regular plan you can switch to any Direct plans scheme in the same fund house. While placing the switch order we will ask you to select the switch in scheme – it can be any scheme within the same fund house and not just the Direct counterpart of the regular scheme you are switching.

Jigar

October 23, 2018 AT 16:28

Hi,

Would you plan to provide better switching to direct plan from fund house A to Different scheme of fund house B?. This will be great.

Abhishek

November 12, 2018 AT 08:06

I just want to know, units will transfer, or current value will be transferred.

Gaurav Rastogi

November 22, 2018 AT 05:00

Switch will be unit based.

biswaji

November 19, 2018 AT 09:55

sir how to regular plan direct

Gaurav Rastogi

November 22, 2018 AT 04:50

Thank you for writing to our team. To move completely to Kuvera, we recommend the following steps (entire process is online) –

1/ Import your existing units to Kuvera so you can track them here

Setup an account with Kuvera and complete KYC check and bank account setup. http://www.kuvera.in

After logging in, please follow the steps in the Import Portfolio tab. Do read the “Import Portfolio” FAQ : https://kuvera.in/faq/import

We read and process your Consolidated Account Statement in real time and you can start placing orders in the same folios as your current regular and Direct plans immediately.

2/ Move your SIPs from current platform to Kuvera

START your direct plan SIPs on Kuvera in the same folio as your current plans and then STOP your SIPs with other platforms. Ps: if your regular plan platform does not agree to stop your SIPs (saying you need minimum months etc etc), read this – https://blog.kuvera.in/how-to-stop-your-sip-when-your-distributor-refuses-to-stop-sip/

3/ Switch your Regular plan units to Direct plan units – there are 3 ways that Kuvera makes it easy to switch from Regular plan units to Direct plan units. You can read in detail about them here – https://blog.kuvera.in/3-ways-to-switch-your-regular-plans-to-direct-mutual-fund-plans/

Hope the above helps. Let us know if you get stuck on any step.

Deepak

December 11, 2018 AT 10:05

Hi Kuvera team

I have 4 MFs that i am investing 20000 per month through Geojit. I wish to move all of them to Kuvera. Can you please suggest or contact me.

Gaurav Rastogi

December 12, 2018 AT 01:36

Could you please email us at support@kuvera.in so we can send detailed instructions? Do mention if your current account is demat or not.

Selva

January 15, 2019 AT 07:39

Hi Kuvera Team,

I have 3 Regular plans which are around Rs.4000 each. I’m trying to switch it to Direct plans and while doing so I get an error that the minimum amount to switch should be Rs.5000. Is there any specific condition for switch,as for new investments most of the mutual funds allow to start from Rs.1000?

Gaurav Rastogi

January 18, 2019 AT 08:45

Different AMCs have different minimum switch requirements. It is usually driven by the scheme you are trying to switch into – if it has a min investment amount of Rs5k then you will see the above message.

Navin Kumar Aggarwal

January 26, 2019 AT 16:57

hi gaurav. if i switch from plan A (in which my investment is running for last 9 yrs)to plan B (from regular to direct scheme only)and after 6 months i want to redeem from plan B,will the gain be counted as short term gain.Or it will come under LTG.

Gaurav Rastogi

February 2, 2019 AT 07:27

Switch resets the purchase clock. After 6 months STCG will apply.

rohit bansal

February 1, 2019 AT 05:14

I have around 11 different MF. I want to consolidate the list to 4 to 5 MFs only. How Can I switch regular plan to different companies Direct Plan?

Gaurav Rastogi

February 2, 2019 AT 07:25

You can only switch to another plan within the same AMC. To switch between AMCs, we request to sell regular plan first and then buy in the different AMC once the money is debited to your account.

Hariharasankar

May 7, 2019 AT 08:32

Hi Kuvera,

I am a NRI. Is it possible for me to start direct plan SIPs in the same folio without switching from the regular plan ?

Thanks

Gaurav Rastogi

May 13, 2019 AT 08:56

Yes, you can. For NRI’s, just confirm your setup by placing a small sell or switch order so we can confirm that the setup on Kuvera is same as setup at the AMC. Then you can buy in the same folio.

Sacheen Bheemkar

May 7, 2019 AT 18:12

I plan to shift my Regular plan for 7 MF which i have taken from Bajaj Capital.Currently it is 20k per month for the past 30 months and i plan to move to different funds in Kuvera as direct plan.The SIP would be increased to 40K in the coming months.

Please let me know the steps here in detail. I understand i do not need KYC again.Please consider this while providing the details TO Do steps.

What specific actions are needed with to Bajaj Capital, Bank and Kuvera.

Gaurav Rastogi

May 13, 2019 AT 08:54

To move completely to Kuvera, we recommend the following steps (entire process is online)

1/ Import your existing units to Kuvera so you can track them here

Setup an account with Kuvera and complete KYC check (not a new KYC, just a check) and bank account setup.

After logging in, please follow the steps in the Import Portfolio tab. Do read the “Import Portfolio” FAQ : https://kuvera.in/faq/import

We read and process your Consolidated Account Statement in real time and you can start placing orders in the same folios as your current regular and Direct plans immediately.

2/ Move your SIPs from current platform to Kuvera

START your direct plan SIPs on Kuvera in the same folio as your current plans and then STOP your SIPs with other platforms.

We will ask you to setup a mandate as part of the SIP placement process

Ps: if your regular plan platform does not agree to stop your SIPs (saying you need minimum months etc etc), read this – https://blog.kuvera.in/how-to-stop-your-sip-when-your-distributor-refuses-to-stop-sip/

3/ Activate TradeSmart and switch your Regular plan units to Direct plan –

Go to the “Portfolio” (https://kuvera.in/holdings) page and click on “Manage”

Choose “Switch” to start switching your regular plans to direct plans

Hope the above helps. Let us know if you get stuck on any step.

Lakshminarayanan Iyer

March 13, 2020 AT 09:51

I have units in around 14 mutual funds in NJ Invest. All the units are in demat form. Will I be able to switch from NJ to Kuvera through the switch option.

Gaurav Rastogi

March 14, 2020 AT 02:03

Unfortunately, we cannot switch demat units. You will have to ask NJ to remat your units and then you can swtich to direct on Kuvera. We can send you all the details if you email us at support@kuvera.in

SHREENA KRISHNAN

March 17, 2020 AT 18:01

Using the app .. really appreciate it..I would like to have some more features..like sip or lumpsum calculator for each fund.

Gaurav Rastogi

March 19, 2020 AT 01:57

Thanks for the feedback Shreena

Harsh Gupta

March 31, 2020 AT 04:45

Is kuvera charging any fees in any manner even though if we are investing in direct MF?

Gaurav Rastogi

April 9, 2020 AT 13:56

None.

A Das

April 4, 2020 AT 07:23

I have been maintaining a monthly SIP in an Equity Fund with Growth option in a Regular Fund in icicidirect for the last 3 years. Would it be beneficial to stop SIPs there and open a SIP of the same Fund with you to get the benefit of the direct category.

When the market recovers, exit can be done from icicisecurities suitably ? Say after 2-3 years? Please reply to the point.

Gaurav Rastogi

April 9, 2020 AT 13:55

yes, please you should use this drop in the market to move completely to Direct plans. We can help.

AJIT KHETLE

April 4, 2020 AT 09:24

I WOULD LIKE TO INVEST MUTUAL FUND, KINDLY GUIDE THE PROCEDURE

Gaurav Rastogi

April 9, 2020 AT 13:54

Please email support@kuvera.in and we will help

satyakam patel

April 25, 2020 AT 08:23

we are three family member our sip is axis bluechip 5000 hdfc midcap opportunities 10000 hdfc hybrid eq div 10000 x 2 all div in low duration dsp black rock 1000 parag parikh long eq 1000 icici eq&debt fund gr 10000 invesco 2000 :L & t 2000 two so please suggest me

Gaurav Rastogi

April 28, 2020 AT 01:17

It would be better if you add your financial goals on Kuvera and see if you SIP amounts are adequate – https://kuvera.in/goals

Krishna

May 23, 2020 AT 07:34

When i transfer external MF investments i see that there many discrepancies in the holding value, holding folio which is inconsistent with CAMS report. how to rectify this,

Gaurav Rastogi

May 26, 2020 AT 02:26

Pls email us at support@kuvera.in and we will fix it.