Canara Bank is a public sector bank in India that offers a wide range of banking and financial products and services to its customers. It was founded in 1906 as Canara Hindu Permanent Fund and later it was nationalized in 1969. It is headquartered in Bengaluru, Karnataka, India. Canara Bank has a strong presence in India with over 6,600 branches and more than 10,000 ATMs across the country.

The bank offers a wide range of products and services to its customers, including savings and current accounts, fixed deposits, personal loans, home loans, car loans, credit cards, debit cards, and various other types of loans. In addition to these traditional banking products, the bank also offers internet banking and mobile banking services, which allow customers to access their accounts and perform transactions online or through a mobile app.

Canara Bank also provides services such as NRI banking, agriculture and corporate banking, SME banking, and investment banking. The bank is also actively involved in various social welfare activities and CSR initiatives, such as education, health, and environment.

It is listed on the Bombay Stock Exchange and the National Stock Exchange of India. It is one of the leading public sector bank of India, and the bank’s shares are traded in the stock market. As a Public sector bank, Canara Bank is also governed by Reserve Bank of India (RBI) rules and regulations.

History of Canara bank

Canara Bank is a public sector bank in India that was founded in 1906 as Canara Hindu Permanent Fund. The bank was established by Shri Ammembal Subba Rao Pai in Mangaluru, Karnataka, India, with the goal of providing banking services to the underbanked communities of the region. Initially, the bank focused on accepting deposits and providing loans to farmers and small businesses.

In the following decades, the bank expanded its operations and opened branches across the country, with a focus on South India. The bank was nationalized in 1969 along with 13 other major banks in India as part of the government’s efforts to increase financial inclusion and improve the country’s economic development.

After nationalization, Canara Bank continued to expand its operations and open new branches, and it also started to offer new products and services such as personal and home loans, credit cards, and internet banking.

In the 21st century, the bank has continued to expand its operations, with a focus on digital banking and financial inclusion. In 2020, Canara Bank merged with Syndicate Bank, which resulted in the bank having one of the largest branch network in India.

Throughout its history, Canara Bank has played a significant role in the Indian economy, providing banking services to millions of customers and supporting the country’s economic development.

Growth of Canara bank

Canara Bank has experienced significant growth since its establishment in 1906. The bank was initially established as Canara Hindu Permanent Fund, with the goal of providing banking services to the underbanked communities of the region. After its nationalization in 1969, the bank continued to expand its operations and open new branches across the country, with a focus on South India.

In terms of financial growth, Canara Bank has seen a steady increase in revenue and profit over the years. The bank’s total income has grown from around Rs. 8,000 crore in FY 2000-01 to around Rs. 2,20,000 crore in FY 2020-21. Similarly, the bank’s net profit has grown from around Rs. 300 crore in FY 2000-01 to around Rs. 2,400 crore in FY 2020-21.

Canara Bank has also expanded its customer base, with the number of savings accounts growing from around 20 million in 2000 to around 120 million in 2021. The bank has also increased the number of ATMs and branches, and it has been actively involved in various social welfare activities and CSR initiatives, such as education, health, and environment.

The bank has also been focusing on digital banking services, with increasing number of customers using internet banking and mobile banking services.

However, Canara Bank also faced some challenges in recent years, such as increased competition from private sector banks and NBFCs, rising NPAs and regulatory pressure. The bank also had a merger with Syndicate Bank in 2020 which has also brought its own set of integration challenges.

It is always recommended to consult a financial advisor before making any investment decisions.

Canara bank share price

Canara Bank is a public sector bank in India with a strong presence in the country. The bank’s performance can be evaluated based on various financial and operational metrics, such as revenue, profit, asset quality, and customer base.

In terms of revenue and profit, Canara Bank has seen a steady growth over the years, with total income growing from around Rs. 8,000 crore in FY 2000-01 to around Rs. 2,20,000 crore in FY 2020-21 and net profit growing from around Rs. 300 crore in FY 2000-01 to around Rs. 2,400 crore in FY 2020-21.

However, the bank has faced some challenges in recent years, particularly in terms of asset quality. The bank has a high level of non-performing assets (NPAs), which are loans that are not being repaid by the borrower. The bank had a gross NPA ratio of 7.53% and net NPA ratio of 3.19% as of December 2020, which is higher than the industry average.

The bank has been taking various steps to improve its asset quality, such as increasing the provisioning for bad loans and implementing a comprehensive asset quality review. The bank also had a merger with Syndicate Bank in 2020 which has also brought its own set of integration challenges.

In terms of customer base, Canara Bank has been successful in expanding its customer base, with the number of savings accounts growing from around 20 million in 2000 to around 120 million in 2021. The bank has also increased the number of ATMs and branches across the country.

In terms of digital banking, Canara Bank has been focusing on digital banking services, with an increasing number of customers using internet banking and mobile banking services.

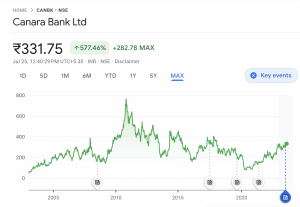

The above image shows the Canara bank share price past trend. Currently Canara bank share prices is at INR 331.85 (as of 25th July)

Check the latest Canara bank share price here.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch here: ELSS: Saving tax through mutual funds

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.

Shyam nandan kishore Singh

March 19, 2023 AT 11:50

Very good service and excellent quality of service

P.Thoyaja kumari

July 3, 2023 AT 12:50

Sir,I have account in canara bank, kundanbagh,hyderabad, I want small help from canara bank, I have two shops newly constructed at Allywan colony,beside vivakananda colony, kukatpally, hyderabad I want to give for ATM on lease so I want your guidance for propossing what is the process please help me since shops are in main rpaf of allwyan colony and there no ATM in this place