Vedanta Resources is a multinational natural resource company based in India. The company’s main operations include mining and exploration of metals and minerals, as well as oil and gas exploration. Vedanta Resources is one of the largest mining companies in India and is listed on the London Stock Exchange.

Vedanta’s principal products are copper, aluminum, zinc, lead, silver, iron ore, oil & gas, and commercial power. It operates in India, Zambia, Namibia, South Africa, Ireland, Australia, Liberia and Sri Lanka. Vedanta has large reserves of zinc, lead, silver, copper, iron ore, and aluminum and is one of the world’s leading producers of these metals.

Vedanta’s main subsidiary, Vedanta Limited, is listed on the Bombay Stock Exchange (BSE) and the National Stock Exchange of India (NSE). Vedanta Limited is engaged in the exploration, mining, and production of oil and natural gas, non-ferrous metals and other minerals, and power generation.

However, the company faced some controversies and criticisms over the years, mainly due to the company’s operations and its impact on the environment and local communities. The company faced accusations of human rights violations, environmental degradation, and illegal mining activities. Vedanta denied most of the allegations and stated that it had been working to improve its environmental and social performance.

History of Vedanta

Vedanta Resources was founded in 2003 by Anil Agarwal, a businessman based in India. The company was originally established as a diversified natural resources company and focused primarily on the mining and exploration of metals and minerals, as well as oil and gas exploration.

In 2003, the company made its first major acquisition by purchasing Sterlite Industries, a copper and power company based in India. This acquisition helped to establish Vedanta as one of the leading players in the Indian mining industry. In the following years, Vedanta continued to make strategic acquisitions and expand its operations both in India and internationally. This helped the company become a global player and one of the largest mining companies in India.

In the first half of the 2000s, the company’s financial performance was strong and its share price increased rapidly. Vedanta Resources IPO was successful in the London Stock Exchange in 2003 and raised significant funds for the company’s growth.

However, Vedanta faced criticisms and controversies over the years for various reasons, such as human rights violations, environmental degradation, and illegal mining activities. The company faced opposition from various stakeholders including local communities, NGOs and Government. For example, the company faced accusations of polluting a sacred river in India, and some of its mining operations were shut down by the Indian government.

Despite the controversies, Vedanta Resources continues to be one of the largest mining companies in India and continues to expand its operations globally. The company has been working to improve its environmental and social performance and implementing measures to address the concerns raised by various stakeholders. The company has taken steps to improve its environmental and social performance, such as implementing sustainable development policies and investing in local communities.

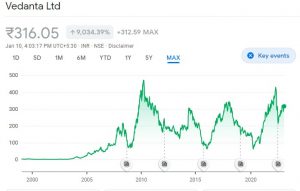

Growth of Vedanta Share prices

Vedanta Limited is an Indian diversified natural resources company with interests in zinc, lead, silver, copper, iron ore, aluminum, power, oil & gas and commercial explosives. The company is listed on the Bombay Stock Exchange and the National Stock Exchange of India.

Like all publicly traded companies, the share price of Vedanta is determined by supply and demand in the stock market. The price can be influenced by a number of factors, including the company’s financial performance, industry trends, and overall market conditions.

You can check the historical prices of the company from the graph above for the analysis of stock price movement. Vedanta share price touched it’s peak in April, 2010 when the share price touched INR 471.55. It is always important to keep an eye on the company’s performance, announcements, and other industry developments in order to make informed investment decisions.

Check latest Vedanta share price here.

However, please keep in mind that past performance does not indicate future performance and it’s important to do your own research before making any investment decisions.

Should you invest in Vedanta?

When investing in any company’s shares, it’s important to consider a number of factors to help you make an informed decision. Some key factors to consider when investing in Vedanta shares specifically include:

1. Financial performance: Look at the company’s financial statements, such as its income statement, balance sheet, and cash flow statement, to get a sense of its overall financial health and performance. Look for trends in revenue, earnings, and profitability, as well as the company’s debt levels and cash reserves.

2. Industry trends: Vedanta is a mining and resource extraction company, so it’s important to keep an eye on trends in the commodity markets, as well as any regulatory changes that may affect the company’s operations.

3. Management and governance: Look at the company’s management team and board of directors to assess their qualifications, experience, and track record. A strong management team and good governance practices can help ensure that the company is well-run and that shareholders’ interests are protected.

4. Market and competitive environment: Evaluate the company’s competitive position in its industry, including its market share, brand strength, and relationships with customers and suppliers.

5. Risk: Consider the risks that come with investing in a particular company, including regulatory risks, litigation risk, political risk, as well as any risks related to the company’s specific industry.

6. Valuation: Look at the company’s valuation relative to its peers, as well as its historical valuations to assess whether the stock is currently overvalued or undervalued.

It’s also recommended to do your own research and consult with a financial advisor before making any investment decisions.

Check here today’s Vedanta share price.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit Kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.