In India, income tax return filing is a mandatory requirement for all taxpayers, including individuals and businesses. The Central Board of Direct Taxes (CBDT) sets the deadline for filing returns, which falls on 31st July of every year (in case of Income Tax Return filing on time) and 31st December (in case of belated return filing) for various categories of taxpayers. To file a return, you must report your income, deductions, tax liability and other applicable supporting documents.

Let’s find out what income tax filing is, the different forms you can use to file ITRs and more on the income tax e-filing process.

What Is Income Tax Return Filing?

Income tax return filing is the process of submitting annual tax returns to the government, which simply translates to disclosing your income and claiming deductions and credits to calculate the taxes you owe to the government. In most countries, individuals and businesses are required by law to file tax returns, usually by a specific deadline. In India, the last date for filing your ITR is 31st July every financial year.

The filing process involves reporting income from various sources, such as employment and investments, and also claiming eligible deductions and credits.

Save up to ₹15,625 in LTCG taxes every financial year with Tax Harvesting.

What Are The Different Types Of ITR Forms?

There are different types of Income Tax Return (ITR) forms for your different sources of income. Here are all the ITR forms that you can use for filing:

ITR-1 (SAHAJ):

This form is meant for individuals with income from salary, pension, or income from one house property. This ITR form should be used by individuals whose annual income from these sources is less than ₹50 lakh. However, it is important to note that this is not suitable for individuals who have income from sources other than salary, pension, or income from more than one house property as well or if agricultural income exceeds ₹5000.

ITR-2:

It is used by individuals and Hindu Undivided Families (HUF) with income exceeding ₹50 lakhs, income from sources like salary, pensions, capital gains, foreign assets or agricultural income exceeding ₹5,000.

Start investing in Index Funds.

ITR-3:

This form is appropriate for individuals and HUFs with income from business or profession, profits from being a partner in a firm, investments in unlisted equity shares or holding the position of an individual director in a company.

ITR-4 (SUGAM):

This is meant for individuals, HUFs and firms with an income of up to ₹50 lakhs from businesses or professions, including those under the presumptive income scheme.

ITR-5:

The ITR form is designed for firms, body of individuals, cooperative societies, Limited Liability Partnerships (LLPs) and various other entities, excluding individual citizens.

ITR-6:

This is intended for companies to file electronically, except those claiming exemptions related to income from religious or charitable properties.

ITR-7:

This is the form that is used by companies falling under specific sections of the Income Tax Act, such as religious or charitable institutions, political parties, educational institutions and other similar organisations, for filing their returns.

Who Should File ITRs In FY 2024-25?

If your income is above ₹2.5 lakhs in FY 2023-24, you are required to file for income tax return in FY 2024-25. This income limit applies to individuals below 60 years of age filing under the old tax regime. While those above 60 years have to file if their income exceeds ₹3 lakhs.

Note- You pay taxes on the income that you have earned in the previous financial year. For instance, you file for income tax returns this year (i.e., by 31st July 2024) for the income that you earned during the FY 2023-24. In this case, FY 2024-25 is the assessment year for your income earned in FY 2023-24.

However, under the new regime, the basic exemption limit for individuals below 60 years is ₹3 lakhs. Additionally, there are various conditions such as bank deposits exceeding ₹50 lakhs, current account deposits exceeding ₹1 crore, annual sales turnover above ₹60 lakhs and professional income above ₹10 lakhs. Furthermore, if you have income from foreign assets, expenses on foreign travel or you are a resident taxpayer with overseas assets, you must file for ITR.

What Is The Process For ITR Filing?

The process of ITR filing involves the following steps:

Step 1- Calculating Income Tax Liability:

Calculate your total income earned during the financial year and determine your income tax liability.

Step 2- Choose Filing Mode:

You can file your ITR offline or online based on your preference and convenience.

Mode 1: Offline

You can visit the official portal of income tax e-filing and download the ITR form that match your income sources. Then, you fill in the necessary details on the downloaded form. After that, you have to generate a JavaScript Object Notation (JSON) file of the ITR form and save it on your computer. Finally, submit the ITR form by uploading the saved JSON file through the offline mode.

Mode 2: Online

You can file your income tax returns through the Income Tax Portal by the Government of India.

How Do I E-File ITR On The Income Tax Portal?

To e-file your ITR on the Income Tax Portal, you can follow these steps:

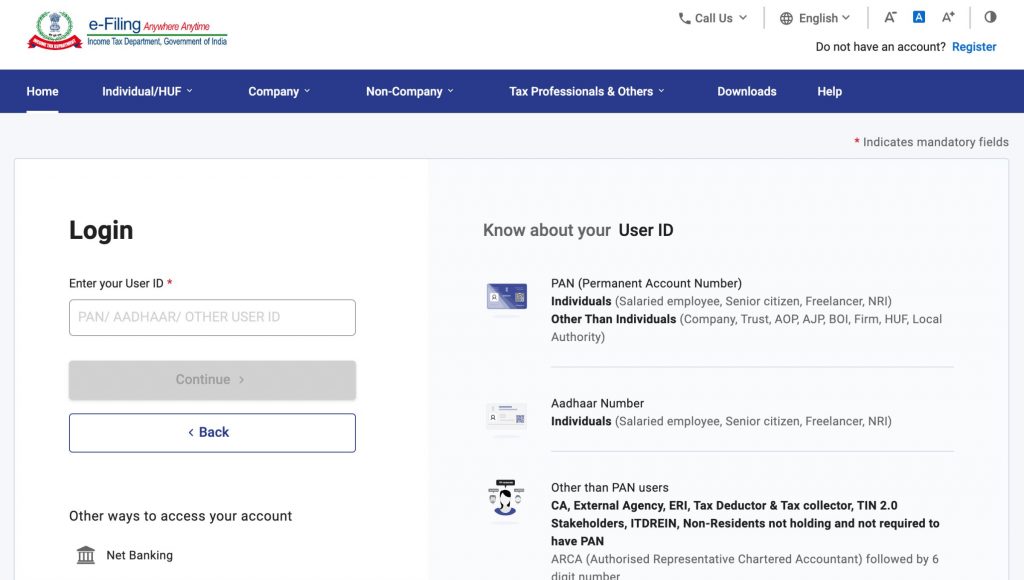

Step 1: Login

On the official Income Tax e-filing website, click on ‘Login’ and enter your PAN in the User ID section. Then, click on ‘Continue’ and enter your password.

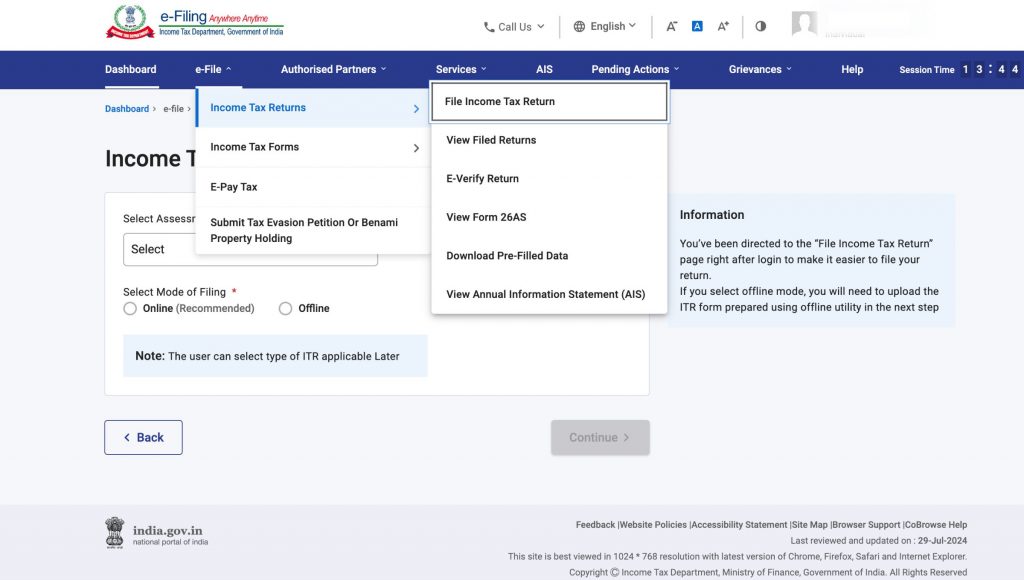

Step 2: Go To ‘File Income Tax Return’

Click on the ‘e-File’ tab > ‘Income Tax Returns’ > ‘File Income Tax Return’.

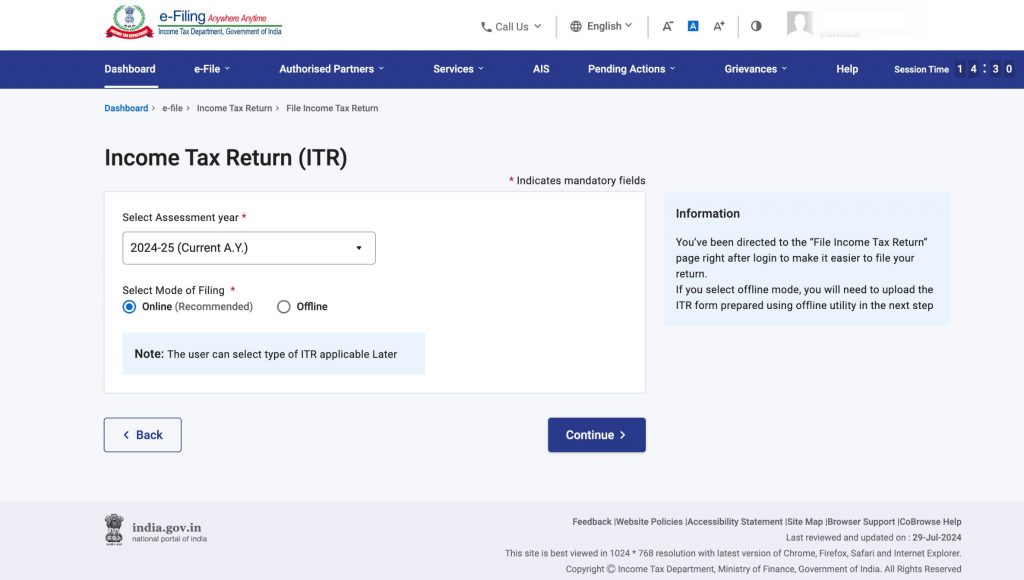

Step 3: Select The Right ‘Assessment Year’

Choose the ‘Assessment Year’ as per the financial year for which you are filing the return.

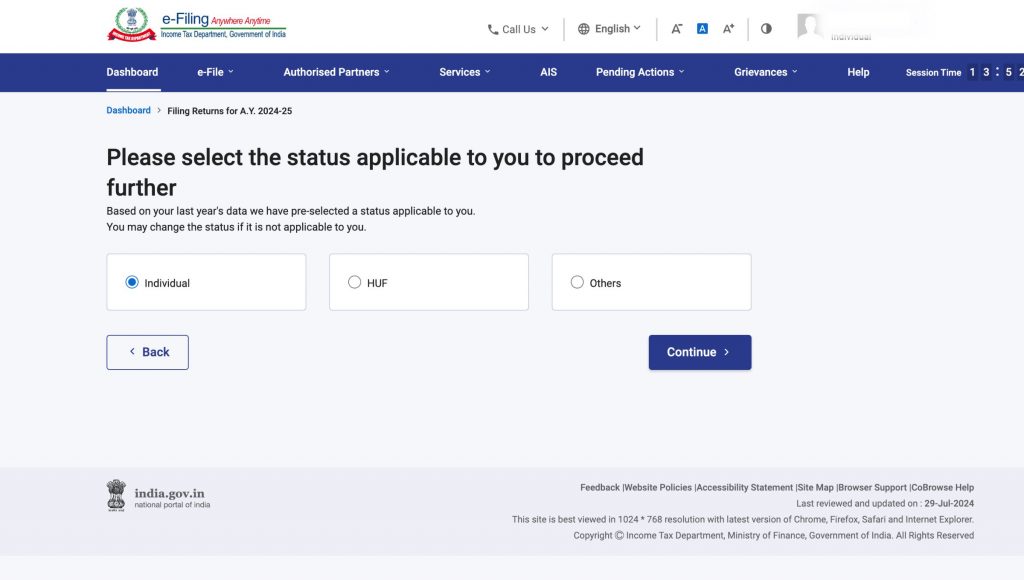

Step 4: Select The Status

Select your filing status as applicable – Individual, HUF or Others.

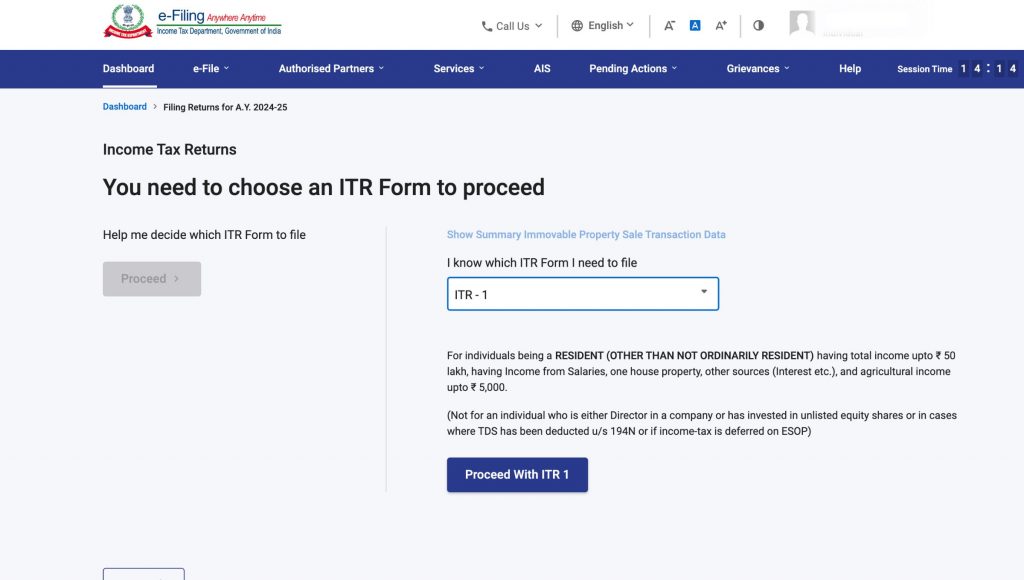

Step 5: Select ITR Form

Choose the correct ITR form based on your income sources.

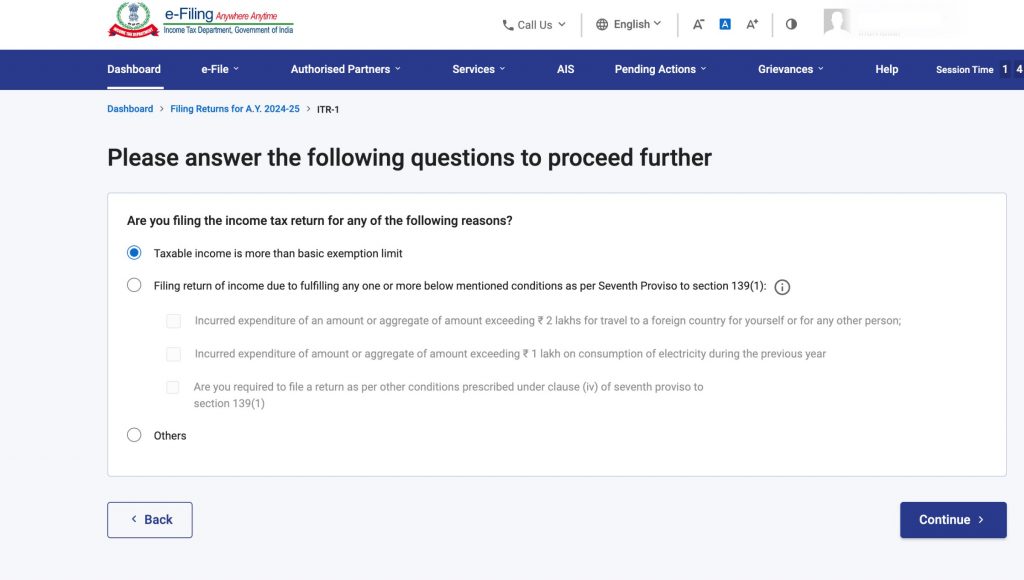

Step 6: Choose The Reason For Filing ITR

Specify the reason for filing your returns based on your situation, such as taxable income exceeding the basic exemption limit or meeting specific criteria requiring mandatory filing.

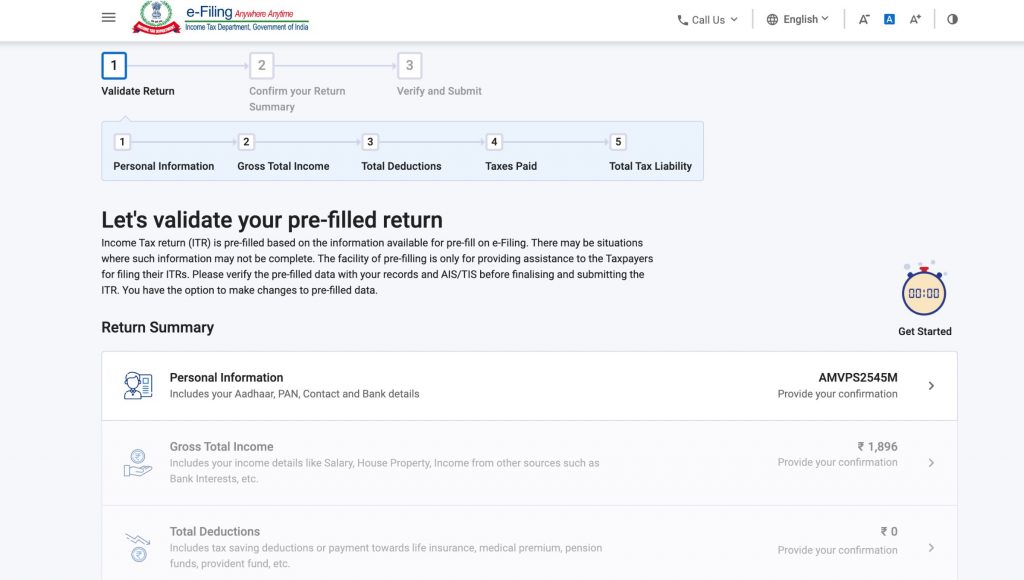

Step 7: Validate Pre-filled Information

Make sure that all pre-filled details, such as PAN, Aadhaar, contact information and bank details are accurate. On top of that, provide and validate any additional information if required.

Step 8: E-Verify ITR

Verify your return by 31st July using methods such as Aadhaar OTP, electronic verification code (EVC), Net Banking or sending a physical copy of the ITR form to the income tax department.

Save up to ₹46,800 in taxes annually with ELSS Funds.

How Can I Save Income Tax Before Filing For ITR?

To save income tax, you can invest in eligible Equity-Linked Savings Scheme (ELSS) funds before the due date of ITR filing. ELSS funds offer tax benefits under section 80C of the Income Tax Act, allowing deductions up to ₹1.5 lakh.

Start investing in ELSS Funds.

Wrapping Up

Nowadays, ITR filing can be filed through the offline process or online mode through the Income Tax India e-filing portal. However, penalties may apply if your amount of tax filed does not match your actual tax liability (as per AIS- Annual Information Statement provided by the Income Tax Portal). Some people also prefer to file income taxes through tax consultants as well. Either way, it is essential to file returns on time and accurately.

FAQs

What Is Income Tax?

Income tax is imposed by governments on the income or profits earned by individuals, businesses and corporations. It is an important source of revenue for the government to fund public goods and services.

How Do I Pay Income Tax Online?

To pay your income tax online, you can follow these steps:

- Step 1: Go to the e-Filing portal of the Income Tax Department at www.incometax.gov.in and click on ‘e-Pay Tax’.

- Step 2: On the ‘e-Pay Tax page’, fill in details such as your PAN, assessment year and tax amount, then click ‘Continue’.

- Step 3: You can then select any payment method, such as net banking, debit/credit card or UPI, and complete the transaction.

Why Is Income Tax Return Filing Important?

Filing for ITR serves as a legal document showing your accountability to the government. This allows you to claim eligible deductions and tax refunds, and provides a proof of income for various financial transactions. And filing them on time can also help you avoid penalties and interest charges.

What Is The Due Date To File My ITR?

The due date to file your ITR for the financial year 2023-24 (whose assessment year is FY 2024-25) is 31st July 2024. This is the standard deadline for salaried individuals and HUFs to file their ITR.

How Can I File My Income Tax Return After The Due Date?

You can file for a belated income tax return after the due date online through the Income Tax Department’s portal. For that, you will need to submit a belated income tax return with a late fee by 31st December of the financial year. In this case, the late fee is ₹5000 as per section 234F of the Income Tax Act. The belated return can be filed up to three years from the end of the relevant assessment year.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch here: How To Save Income Tax On Your Mutual Fund Investments

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans of Mutual Funds and Fixed Deposits and start investing today.

AREVUK Advisory Services Pvt Ltd | SEBI Registration No. INA200005166

DISCLAIMER: Mutual Fund investments are subject to market risks. Read all scheme related documents carefully. Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Investments in securities market are subject to market risks. Read all the related documents carefully before investing. The securities quoted are for illustration only and are not recommendatory.