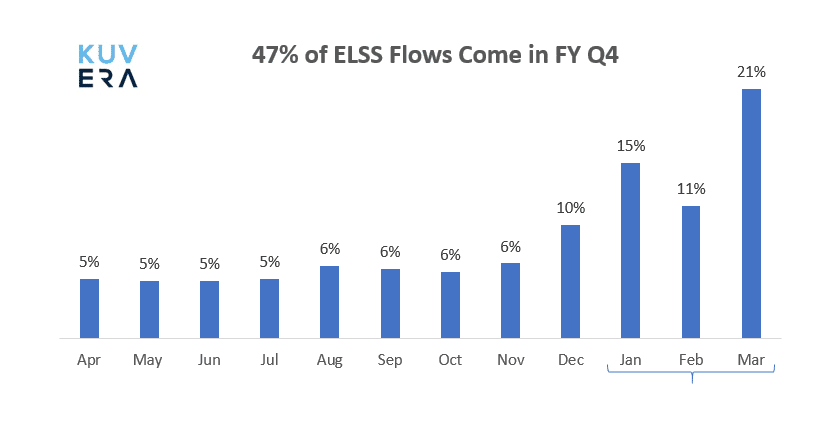

Kuvera Insights: Investors procrastinate their ELSS investments. They would be better off buying periodically with a SIP or if lock-in is a big concern then buying in the Q1 of a financial year. But the data suggests most wait till the last quarter of an FY and then invest as a lump sum.

Gold prices touched an all-time high in India this week, while global prices hover around a seven-year high. Three of the top five best performing funds this week were gold funds. The investment demand for gold continues to grow. We have written about investing in Gold as a macroeconomic hedge here.

Moody’s Investors Service cut India’s 2020 GDP growth forecast to 5.4% on 16th February. The credit rating agency also trimmed its 2021 GDP forecast to 5.8% from 6.7%. The cut in growth forecast comes amidst coronavirus outbreak which, according to Moody, could hurt India’s economic recovery. Meanwhile, in a review meeting of the Finance Ministry, Nirmala Sitharaman said that the government will soon announce measures to deal with the impact of the coronavirus outbreak on the domestic industry and the economy.

Discount broker Zerodha is looking to enter the Rs 27-trillion mutual fund industry, with the firm putting in its application for AMC license with the Securities and Exchange Board of India. AMC applications of other players like Srei Infrastructure Finance and Frontline Capital Services are under process. More recently, SEBI gave in-principle approval for MF license to broking player Samco Securities and NJ India.

|

|

|

|

|

|

|

Movers & Shakers

1/ Principal Mutual Fund has announced that Lalit Vij has ceased to be the Managing Director of the Company, with effect from 14 February 2020.

2/ Nippon India Mutual Fund has announced the creation of segregated portfolio of securities of Vodafone Idea Limited (VIL) held in three schemes with effect from 17 February 2020:

3/ UTI Mutual Fund has announced the creation of a segregated portfolio of securities of Vodafone Idea Limited (VIL) held in five schemes with effect from 17 February 2020:

- UTI Credit Risk Fund

- UTI Bond Fund

- UTI Regular Savings Fund

- UTI Dynamic Bond Fund

- UTI Medium Term Fund

Quote of the week:

A fine is a tax for doing something wrong. A tax is a fine for doing something right.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!