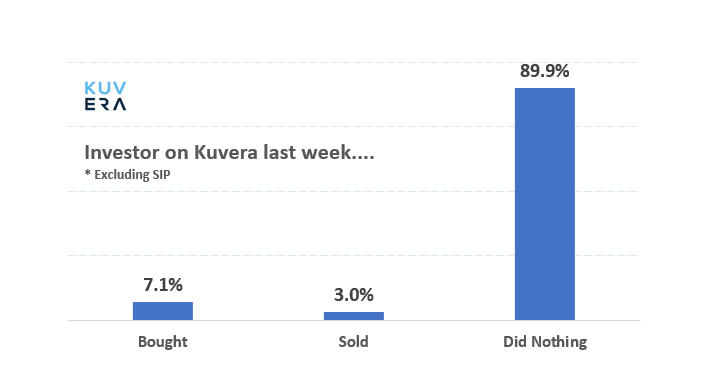

Investors on Kuvera continue to invest with discipline. In line with time tested financial advice to stick to their plans and ignore short term market movements, about 90% of investors on Kuvera did nothing amongst the market moves last week.

Kudos to investors to stay the path. So much of social media is about what you are doing wrong. It should be more about what you are doing right – and it is a lot!

The behaviour gap is the difference between:

“.. the rate of return an investment would earn in a fixed period, and the return an investor, in reality, earns from that very investment.” – Morningstar

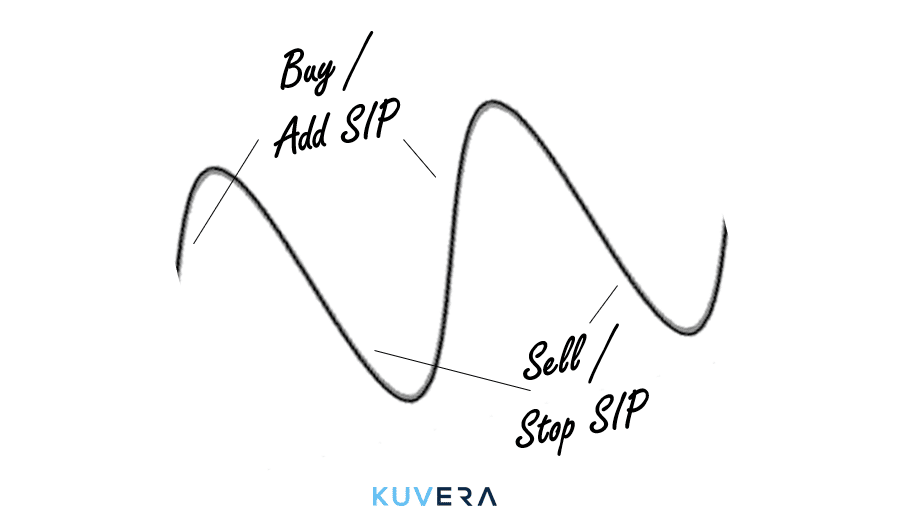

This is caused by the inability of the investor to time the market. Simply put, investors buy after good returns and sell after bad returns.

If the chart below looks familiar, then you know what we are talking about.

Research shows that the behaviour gap leads to a 1 – 2% reduction in annual returns achieved by an investor.

From the US,

Over 1991 – 2004, equity fund investor timing decisions reduce fund investor average returns by 1.56% annually. Underperformance due to poor timing is greater in load funds and funds with relatively large risk-adjusted returns.

Friesen and Sapp, 2007, Journal of Banking & Finance

And Norway,

We find evidence that equity fund investors between1996 – 2007 reduced their returns by 1.32% annually due to investor timing decisions. Investors in actively managed funds displayed the poorest performance, while investors in index funds actually showed the ability to time the market.

Erik Braenden and Hans Theodorsen

We have written more extensively on this here.

The bottom line is this if a SIP at 12,000 Nifty made sense to you, and you are thinking of stopping it now, you are falling into the behaviour gap.

Similarly, if a SIP at 20k BSE SmallCap made sense to you, and you are thinking of stopping now that BSE SmallCap is at ~13k, you are falling into the behaviour gap.

Avoid the gap, like the majority of investors on Kuvera!

In other news of interest, credit rating agency – ICRA has downgraded Yes Bank’s bonds worth Rs 32,911 crore, citing an increase in stressed assets and lack of debt resolutions. Bonds worth Rs 10,800 crore received a rating cut by two notches, and bonds worth Rs 22,112 crore received a single point downgrade.

Index Returns

| Index | Weekly open | Weekly close | Change |

| BSE Sensex | 38,337.01 | 37,882.79 | -1.18% |

| Nifty | 11,419.25 | 11,284.30 | -1.18% |

| S&P BSE SmallCap | 13,310.35 | 13,060.34 | -1.88% |

| S&P BSE MidCap | 14,078.34 | 13,856.19 | -1.58% |

Source- BSE/NSE

Top 5 best performing funds

| Name | Week | 3Y | Category |

| Tata India Pharma & Healthcare | 2.3% | -1.8% | Sectoral |

| IPRU Pharma Healthcare & … | 2.2% | NA | Sectoral |

| UTI Healthcare | 2.1% | -4.8% | Sectoral |

| ABSL Pharma & Healthcare | 2.0% | NA | Sectoral |

| DSP Healthcare | 1.9% | NA | Sectoral |

Source – Kuvera.in

Top 5 worst performing funds

| Name | Week | 3Y | Category |

| Edelweiss Small Cap | -3.0% | NA | Small Cap |

| DSP Small Cap | -2.8% | 1.2% | Small Cap |

| HDFC Small Cap | -2.7% | 11.6% | Small Cap |

| Franklin India Smaller Comp.. | -2.6% | 3.7% | Small Cap |

| Reliance Banking | -2.5% | 13.4% | Sectoral |

Source – Kuvera.in

What investors bought

We saw the most inflows in these 5 Funds –

| Name | 1Y | 3Y | Category |

| Parag Parikh Long Term Equity | -0.4% | 12.2% | Multi Cap |

| Mirae Asset Large Cap | 5.6% | 12.8% | Large Cap |

| UTI Nifty Index | 2.2% | 10.2% | Index Fund |

| Kotak Standard Multicap | 1.6% | 12.0% | Multi Cap |

| HDFC Small Cap | -9.4% | 11.6% | Small Cap |

Source – Kuvera.in

What investors sold

We saw the most outflows in these 5 Funds –

| Name | 1Y | 3Y | Category |

| ABSL Frontline Equity | 0.0% | 8.2% | Large Cap |

| Invesco India Equity Saving | NA | NA | Hybrid |

| HDFC Hybrid Equity | 4.1% | 7.0% | Hybrid |

| DSP Equity Opp | -0.8% | 9.1% | Large & Mid Cap |

| IPRU Balanced Advantage | 6.2% | 9.1% | Hybrid |

Source – Kuvera.in

Movers & Shakers

1/ Principal Mutual Fund has announced that P V K Mohan has resigned from his role as Head – Equity and Key personnel of the AMC. Ravi Gopalakrishnan has been appointed as Head – Equity of the Company. Gopalakrishnan will be the designated fund manager for all schemes previously managed by P.V.K. Mohan

2/ Union Mutual Fund has announced the change in scheme name of Union Tax Saver Fund to Union Long Term Equity Fund, with effect from 29 July 2019.

3/ DSP Mutual Fund has announced that the Funds categorized under Passive funds managed by Gauri Sekaria will henceforth be managed by Anil Ghelani, viz. DSP Equal Nifty 50 Fund, DSP Nifty 50 Index Fund, DSP Nifty Next 50 Index Fund and DSP Liquid ETF.

4/ IDFC Mutual Fund has announced that Pradeep Kumar and Jaimini Bhagwati have been appointed as Independent Directors on the board of IDFC AMC Trustee Company Limited.

Quote of the week:

You don’t have to choose the perfect investment or save exactly the right amount or predict your rate of return or spend hours watching television shows about the stock market or surfing the Internet for stock picks. You don’t need a plan for every contingency.

: Carl Richards, The Behavior Gap

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!