SPIVA (S&P Index vs Active) published the Year-End report for 2019 this week. SPIVA studies the outperformance of active managers vs benchmark Indices all over the world. Their India report includes a 10-year comparison of Index Vs Active funds in the Indian Mutual Fund landscape.

The scorecard reveals that over a five year period, 82.29% of Indian Equity Large-Cap funds, 78.38% of Indian ELSS Funds and 40.91% of Indian Mid-/Small-Cap Equity funds underperformed their respective benchmarks. The report shows that over the one year period ending December 2019, 40% of Indian Equity Large-Cap Funds and 70.73% of Indian ELSS Funds underperformed compared to their respective benchmarks. On the other hand, 72.09% of Indian Mid-/Small-Cap Equity funds overperformed the benchmark over the one year period ending 31 December 2019.

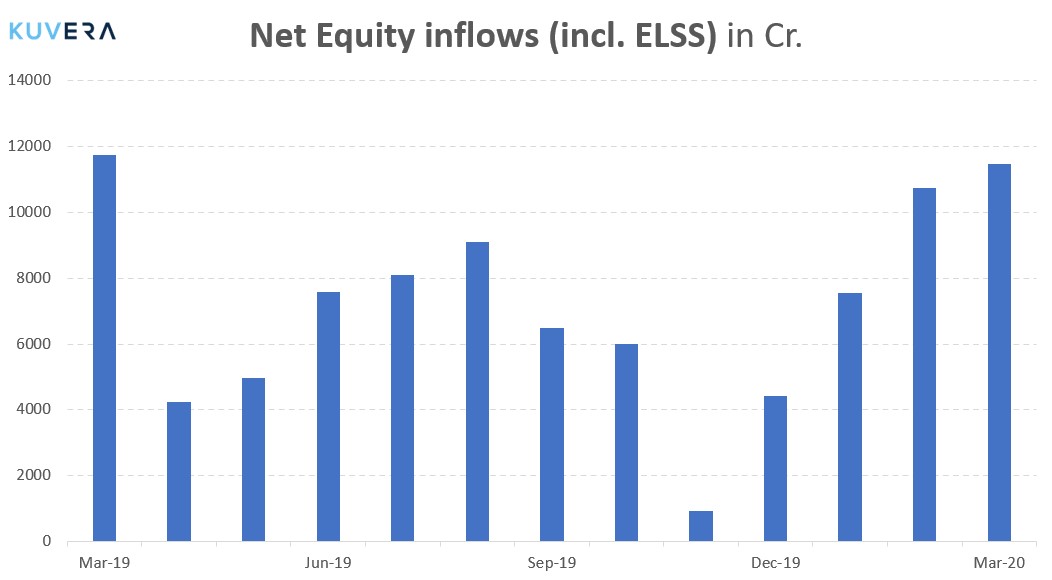

Inflows into Equity funds touched a one-year high in March, despite market volatility. Mutual fund industry witnessed inflows of Rs 11,485 crore in equity schemes for the month of March, up 7.04% from February where the inflows stood at Rs 10,730 crore. Equity Inflows were mainly supported by inflows into large-cap and multi-cap which saw inflows of Rs 2061 and Rs 2268 crore respectively. The assets under management (AUM) of the mutual fund industry dropped by 18% to Rs 22.26 lakh crore in March from Rs 27.23 lakh crore in the previous month.

SIP inflows reached a record high at Rs 8,641 crore in March, a rise of 7.3% from the same month last year. The total number of SIP folios in March jumped by 2.47 lakh to 3.12 crore. The total SIP contribution in the FY 19-20 rose to Rs 100,084 crore as compared with Rs 92,693 crore in 2018-19. AMFI data indicates that mutual funds added an average of 9.55 lakh SIPs per month during the financial year, with an average ticket size of Rs 2,800.

Switch to Direct plans. Think about this, you will pay more in commissions in your investing life than what you lost in the markets last month.

And the commission once paid, is not coming back. It is not a mark to market loss.

So stop paying commissions and use this opportunity to switch to Direct.

|

|

|

|

|

|

|

Movers & Shakers

1/ Mutual Fund houses have reopened lumpsum investments in certain small cap funds including DSP Small Cap Fund, SBI Small Cap Fund,and Nippon India Small Cap Fund.

2/ SEBI has temporarily revised the cut-off timings for mutual fund transactions between 7 April to 17 April. Refer the revised cut-off timings for mutual fund transactions on Kuvera here and here.

Quote of the week:

For the strength of the Pack is the Wolf, and the strength of the Wolf is the Pack.

:

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!