Here are some of the top most frequently asked questions on index funds.

1. What is a benchmark index?

A benchmark index is a standard against which the performance of a portfolio of investments is measured. It’s like a yardstick for investors to compare how well their investments are doing compared to a representative segment of the market.

For example, you might use the Nifty50 as a benchmark index to see if your investments are performing better or worse than this broad sample of 50 major Indian companies.

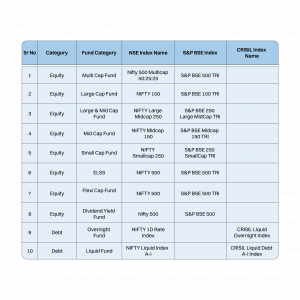

Here are few of the index funds in India and their corresponding benchmark indices as per AMFI;

It’s like a reference point that investors and financial professionals use to compare how well their investment portfolios are doing against a selected segment of the market. If your investments perform better than the benchmark, it means you’re doing well; if they perform worse, there’s room for improvement.

2. Who creates benchmark indices in India?

In India, benchmark indices are created and managed by stock exchanges and financial services companies. The two main stock exchanges in India, the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), each have their own set of benchmark indices. For example:

BSE (Bombay Stock Exchange): The BSE’s flagship index is the SENSEX, which includes 30 of the largest and most actively traded stocks on the BSE. It’s one of the oldest and most widely followed indices in India.

NSE (National Stock Exchange): The NSE’s main index is the NIFTY 50, which includes 50 of the largest stocks listed on the NSE, covering 13 sectors of the Indian economy. It’s widely used by investors both in India and internationally to gauge the performance of the Indian equity market.

Additionally, there are other indices managed by financial services firms that serve as benchmarks for specific sectors, market capitalizations, or investment strategies. These firms include CRISIL, a global analytical company providing ratings, research, and risk and policy advisory services, and India Index Services and Products Limited (IISL), a subsidiary of NSE Indices Limited, which specializes in index and index-based products and services.

3. How does index fund work?

Index funds are a type of mutual fund or exchange-traded fund (ETF) designed to track the performance of a specific market index, like the S&P 500, NIFTY 50, or any other benchmark index. Here’s how they work:

- Replicate the Index: An index fund aims to mirror the performance of its benchmark index by holding the same stocks or bonds in the same proportions as they appear in the index. By doing this, the fund’s performance closely matches that of the index itself.

- Passive Management: Unlike actively managed funds, where fund managers make decisions about which stocks to buy or sell, index funds are passively managed. This means the fund’s holdings only change to reflect changes in the index it tracks, such as when a company is added to or removed from the index.

- Lower Costs: Because index funds are passively managed, they often have lower expense ratios compared to actively managed funds. This means lower costs for investors, which can lead to better net returns over time.

- Diversification: Investing in an index fund provides instant diversification because the fund includes a wide range of securities. When you invest in an index fund, you’re essentially buying a small piece of all the assets that comprise the index. As the value of these assets rises or falls with the market (and therefore, the index it tracks), so does the value of your investment. Since these funds aim to replicate the performance of the index, the returns are typically similar to those of the index. This helps spread out risk, as the impact of any single security’s performance is diluted across the entire portfolio.

- Long-Term Investment: Index funds are often recommended for long-term investment strategies. They aim to match the market’s performance, which historically has trended upwards over the long term.

In summary, index funds offer an easy, cost-effective way to invest in a broad

4. How long should you hold index funds?

Index funds are not short duration investment instruments. They are best suited for long term investment such as 10Y or 20Y periods. This is because;

Historically, the markets tend to increase in value over the long term, despite short-term volatility. By holding index funds for a longer period, you’re more likely to avoid losing out to the market volatility.

Other factors such as the benefit of compounding and cost effectiveness due to less expense ratio also prove beneficial if you invest in index funds for a longer period.

5. Why are indices important?

Market indices help us answer several important questions: How is the stock market doing? Is it in good shape? What’s the current situation in the bond market? Are the prices of commodities rising?

Indices play a key role because they track and reflect the performance of markets. Take the Nifty 50 index, for instance; its daily closing level not only reveals the day’s activities in the Indian stock market but also provides insights into the broader economic outlook in the country at any moment.

Indices influence our financial lives in various ways. They offer up-to-the-minute insights on the vitality of financial markets and consistently updated views on market trends. Large investors, financial advisors, and individual investors alike use indices to compare their investments’ performance to the broader market, helping them determine if they are doing better or worse than the market.

6. Is investing in index funds tax free in India?

For tax purposes, index funds are classified as equity funds. The taxation on earnings from index funds is divided into short-term and long-term capital gains taxes, detailed as follows:

- Short-term Capital Gains: If you sell your index fund shares within 12 months of purchasing them, any profit is considered a short-term capital gain and is taxed at a rate of 15%.

- Long-term Capital Gains: Profits from selling index fund shares after holding them for more than 12 months fall into the long-term capital gains category, which is taxed at 10%. It’s important to note that long-term gains up to Rs 1 lakh per annum are not taxed.

Additionally, any dividends you receive from index funds are taxable as income. These dividends are added to your total income for the year and taxed according to the income tax bracket you are in.

7. Are index funds 100% safe?

While no investment is entirely without risk, index funds are often seen as a relatively safer investment option compared to many others. This is because they track a benchmark index, which historically has shown a tendency to increase in value over the long term. As such, index funds offer a way to invest in a broad segment of the market, capturing this upward trend while spreading out risk across multiple securities.

8. How do I buy index funds?

To invest in Index Funds on Kuvera:

Step 1: Download the Kuvera app

Step 2: Complete you KYC

Step 3: Go to “Invest” and select “Mutual Funds”

Step 4: Tap on “Start a SIP” and select Index Funds, or Go to Low cost Index Funds

Step 5: Choose the index fund you want to invest in, select Monthly SIP or Lumpsum

Step 6: Enter amount / SIP date (if applicable) and complete your transaction.

9. Do billionaires invest in index funds?

Many pro investors such as Ray Dalio, Kenneth Griffin, Warren Buffett, John Bogle and many more invest significantly in index funds.

Once at a Berkshire shareholder meeting in 1993, Buffett said: “By periodically investing in an index fund, for example, the know-nothing investor can actually outperform most investment professionals. Paradoxically, when ‘dumb’ money acknowledges its limitations, it ceases to be dumb.”

“The market portfolio is always efficient…For most people, the market portfolio is the most sensible decision.”

Eugene Fama, Prof. of Finance, Univ. of Chicago, Nobel Prize in Economics winner

10. Is index fund good for beginners?

Index funds are one of most popular investments amongst beginners as they are straightforward to understand. They aim to mimic the performance of a specific index, like the Nifty50, making it easy for beginners to know what they are investing in.

By investing in an index fund, beginners can instantly own a wide range of stocks or bonds, reducing the risk compared to investing in a few individual securities.

Over time, index funds have often outperformed actively managed funds, making them a solid choice for long-term investment goals.

Index funds encourage a buy-and-hold strategy, helping beginners resist the urge to make impulsive trading decisions based on short term market fluctuations.

Overall, index funds can be a great starting point for beginners looking to enter the world of investing without needing to become experts overnight.

11. Are index funds a good investment?

Index funds are very popular with newbie and seasoned investors alike.Here are some of the reasons that make them a reliable investment.

- Cost-Effective: Index funds typically have lower expense ratios than actively managed funds because they are designed to track the performance of a specific market index, reducing the need for costly portfolio management and research.

- Diversification: Investing in an index fund provides instant diversification across a wide range of securities within an index. This spread of investments can help reduce risk compared to investing in individual stocks.

- Simplicity: Index funds offer a straightforward approach to investing. Investors don’t need to pick individual stocks or time the market; they can simply invest in a broad market segment and benefit from the overall market performance.

- Performance: Over time, index funds have often outperformed a large portion of actively managed funds. While individual stocks or actively managed funds may outperform index funds over short periods, it’s challenging to consistently beat the market in the long run.

- Passive Management: Because index funds are passively managed to mirror the performance of an index, they require less buying and selling. This typically results in lower transaction costs and capital gains taxes, making them more tax-efficient.

- Transparency: The holdings of an index fund mirror those of its benchmark index, making it easy for investors to know exactly where their money is invested.

12. What is the difference between index funds and ETFs?

Click here to know the difference between index funds and ETFs and which is better for you?

13. Do index funds have a high return?

These type of funds track their corresponding benchmark indexes. They aim to mirror the performance of these indexes by holding the same stocks or bonds in the same proportions. This approach ensures the fund’s performance closely aligns with that of the index itself.

Despite market volatility, markets generally tend to rise over the long term. For instance, consider the performance of the Nifty50 since 2000. As seen below, the Nifty50 has steadily increased. If you had invested in the Nifty50 index in 2000, your returns would be more or less similar to the index itself.

Do you have any more queries on index funds? Comment with your questions and we’ll answer them!

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit Kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.