What is asset allocation and how does periodic rebalancing help your portfolio achieve better results? In this episode of #KuveraInsights, we speak with Aashish, MD & CEO – Motilal Oswal Asset Management and Alex, Anchor & Special Correspondent, Bloomberg Quint to discuss the importance of maintaining a multi-asset portfolio and periodic rebalancing.

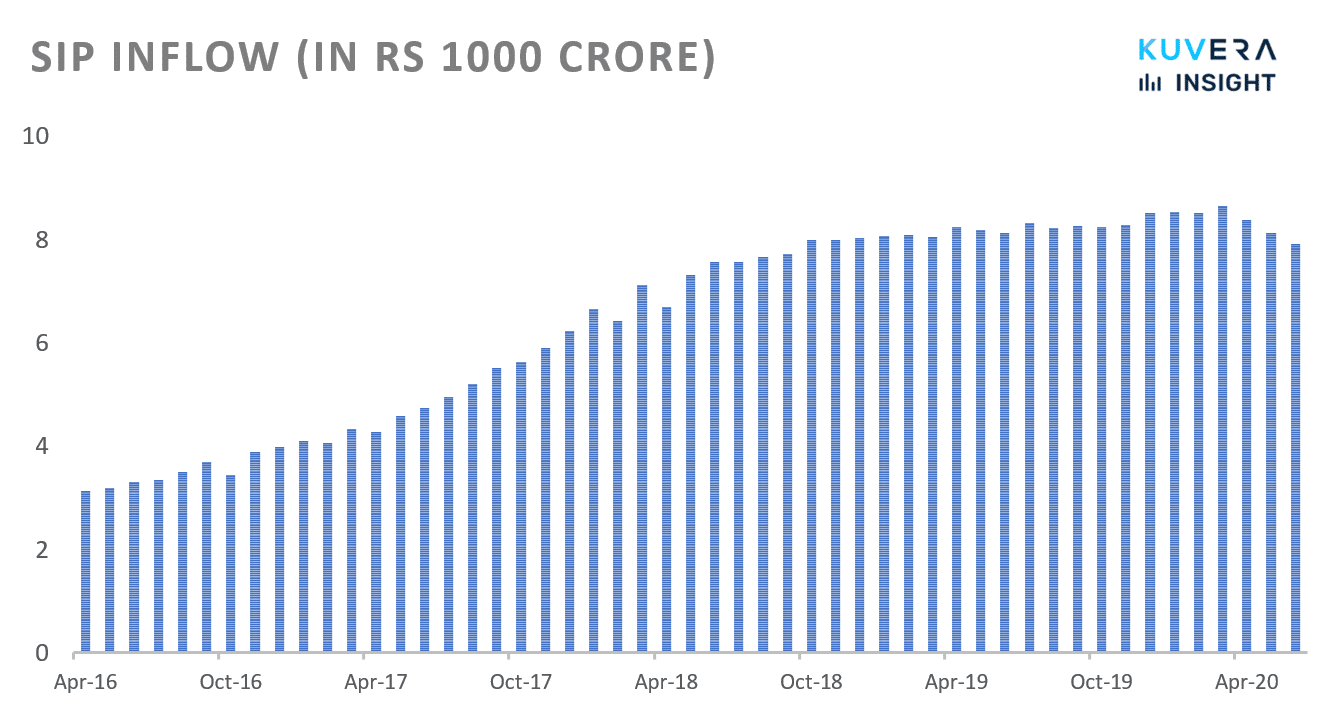

SIP inflows stood at Rs 7,917 crore in June, a dip of 2.53% from the same month last year while the total number of SIP folios in May jumped to 3.23 crore from 3.16 crore in April. Explaining the rationale behind the fall in SIP inflows, NS Venkatesh, CEO – Association of Mutual Funds in India (AMFI), said –

“The small dip in SIPs is largely because of the COVID impact as cash flows have been affected. Plus the (MF) industry has also provided a SIP pause facility, so a lot of people have opted for pause facility because of which inflows have fallen marginally.”

UTI Mutual Fund has received all its dues from Zee Learn Limited. UTI Credit Risk Fund had 9% (Rs 40.77 crore) exposure meanwhile UTI medium-term fund had exposure of 3.02% (Rs 3.4 crore). UTI AMC had side pocketed the schemes on 7 July following a rating downgrade of the Essel Group company by CARE Ratings. Investors holding units in the pertaining segregated portfolios will receive proportionate payments from the AMC.

|

|

|

|

|

|

|

|

Movers & Shakers

1/ Motilal Oswal Mutual Fund has launched the NFO for Motilal Oswal Multi Asset Growth Plan. The scheme would invest in Equity, International Equity Index Funds/Equity ETFs, Debt and Money Market Instruments and Gold ETFs. The NFO will be open for subscription until 27 July.

2/ HDFC Mutual Fund has appointed Gopal Agrawal as co-fund manager of HDFC Equity Saving Fund, HDFC Focused 30 Fund & HDFC Growth Opportunities Fund, with effect from 16 July 2020.

3/ Canara Robeco Mutual Fund has appointed Joseph Silvanus as Independent Trustee on the board of Canara Robeco Asset Management Company Ltd.

4/ SBI Mutual Fund has appointed Archana Hingorani as an Independent Director on the Board of SBI Mutual Fund Trustee Company Private Limited.

Quote of the week:

The difference between success and failure is not which stock you buy or which piece of real estate you buy, it’s asset allocation.

: Tony Robbins

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!

karan

July 21, 2020 AT 21:33

Hi i am an Indian living abroad. My question is that how can i use this app to invest in indian market without a PAN number.

Thankyou.

Gaurav Rastogi

July 27, 2020 AT 05:28

PAN is required for investing.

Shivram Manohar Revankar

July 24, 2020 AT 10:45

Why kubera not providing debit card facility on SaveSmart. Where as in some of apps providing debit card. Please think of it. It will be helpful.