Sensex hit a record high last week as it rose 2.83% to close above the 40,000 mark while the Nifty 50 gained 2.72%. The secondary indices outperformed the key benchmark indices, with the BSE Mid-Cap and Small-Cap indices gaining 3.83% and 3.4% respectively.

When markets are close to new highs a lot of investors ask the question:

I have some money in my bank account, should I invest it as a lumpsum or buy a liquid fund and setup a Systematic Transfer Plan (STP) into an equity fund over a year. A 1 Year STP will move 1/12th of your liquid fund units to the equity fund every month.

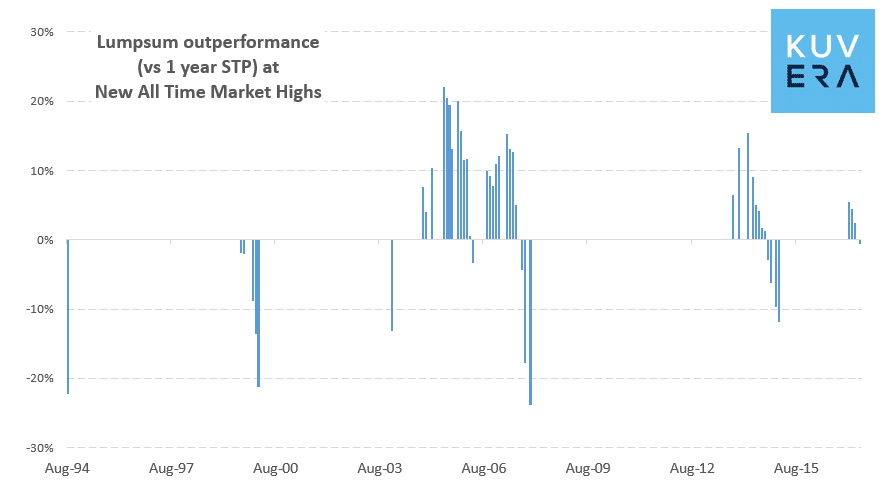

Historical data suggests lumpsum investing is the way to go. We start with NIFTY index (Sensex results are the same) data going back to 1994 and in every month the market has made a new all-time high we set up two investments:

1/ Invest in a liquid fund and then STP into NIFTY over 1 year

2/ Invest in NIFTY

Lumpsum investing has outperformed STP even when the market is making new highs. Lumpsum investments are likely to work out better 60% of times and with higher expected returns. The intuition here is simple.

The STP or lumpsum debate eventually is one of market timing. Doing an STP implicitly assumes that you can time a market high – it is the only scenario that justifies doing an STP over a lump sum. If you do not think you can time market highs, then don’t STP.

How is STP a claim of market timing ability? Well, think about it.

STP will work only when the average NAV over the next 12 months is lower than today’s NAV so that you can accumulate more units than you would by buying all of it today. So an STP investor is making a complex claim that NAV will be on average lower over the next 12 months while I am accumulating units and then it will go up after.

Lumpsum, on the other hand, makes no market timing assumptions – it is the simpler option. The international evidence also backs this up. For S&P 500 and Nasdaq, where we ran the same analysis, lumpsum outperforms STP 3 out of 5 times when either index is making a new high. As noted earlier, even for other Indian indices like Sensex etc the results remain the same.

Indian stock market entered Vikram Samvat 2076 on a positive note, with the barometer index, the S&P BSE Sensex, rising 0.49% and Nifty 50 rising 0.38% during the muhurat trading on Sunday. The BSE and NSE conducted a special one-hour muhurat trading session on 27th October between 6:15 pm and 7:15 pm to mark the beginning of the Hindu calendar year. Kuvera entered the new Samvat on a high note, as we were recognised by BSE for highest Fintech transactions in FY 2018-19.

Individual wealth in India grew by 9.62% to Rs 430 lakh crore in the fiscal year 2019, continuing the acceleration of wealth growth over the last few years, as per a report by Karvy Private Wealth. The India Wealth Report 2019 noted that a majority of this growth was achieved by 10.96% rise in wealth creation by financial assets as compared to physical assets which grew by 7.59%. Individual investors continued moving their wealth from physical assets to financial assets with the proportion of financial assets having inched up to 60.95% from 57.25% in the last 5 years, the report said.

Yes Bank Ltd. has received a binding offer for an investment worth $1.2 billion as part of the bank’s fund-raising efforts. The investment is subject to regulatory, board and shareholders’ approvals. The bank added it continues to be in advanced discussions with other global and domestic investors.

|

|

|

|

|

Movers & Shakers

1/ LIC Mutual Fund has announced that Ritu Modi is being designated as Fund Manager – Equity with effect from 01 November 2019. He will be taking on the fund management responsibility for few schemes.

2/ Principal Mutual Fund has announced that Ravi Gopalakrishnan will cease to be the fund manager of Principal Tax Savings Fund, Principal Personal Tax Saver Fund & Principal Equity Savings Fund. Sudhir Kedia will take on the managerial responsibility.

3/ Sundaram Mutual Fund has announced change in scheme name of Sundaram Global Advantage Fund to Sundaram Global Brand Fund, with effect from 21 November 2019. The benchmark index will be updated to Dow Jones Industrial Average.

Quote of the week:

It must be apparent to intelligent investors that if anyone possessed the ability to do so [forecast the immediate trend of stock prices] consistently and accurately he would become a billionaire so quickly he would not find it necessary to sell his stock market guesses to the general public.

: David L. Babson & Company

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!

Ramneek

November 8, 2019 AT 15:31

How did UTI Nifty Index fund outperformed the Nifty 50 by staggering 1.4% (15.7-14.3) as per the data above?

Gaurav Rastogi

November 11, 2019 AT 02:14

Point noted. Though, one is total return (growth plan) the other price return. We will make this clear.

Ramneek

November 12, 2019 AT 11:38

Oh, that makes sense… Thanks a lot!

Alok Dubey

November 8, 2019 AT 16:21

Alok