SIP Inflows stood at Rs 8,272 crore in November, an increase of Rs 26 crore from the previous month. AMFI data shows total SIP inflows so far in 2019 stood at Rs 65,880 crore. The asset under management (AUM) of the mutual fund industry reached Rs 27 lakh crore in November 2019, a 15% growth in AUM (YoY) from Rs 23.59 lakh crore in November of the previous year.

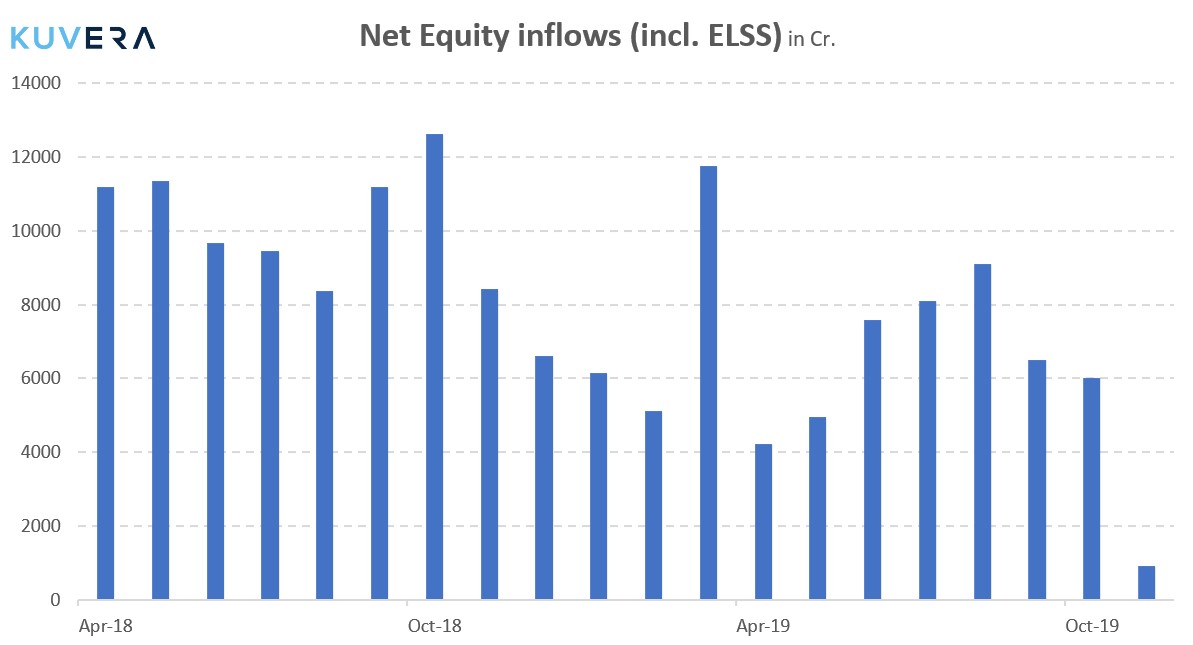

Net inflows into equity mutual funds, including closed-ended schemes, stood at Rs 933 crore against Rs 6,015 crore in the previous month, latest data released by the Association of Mutual Funds in India (AMFI) shows.

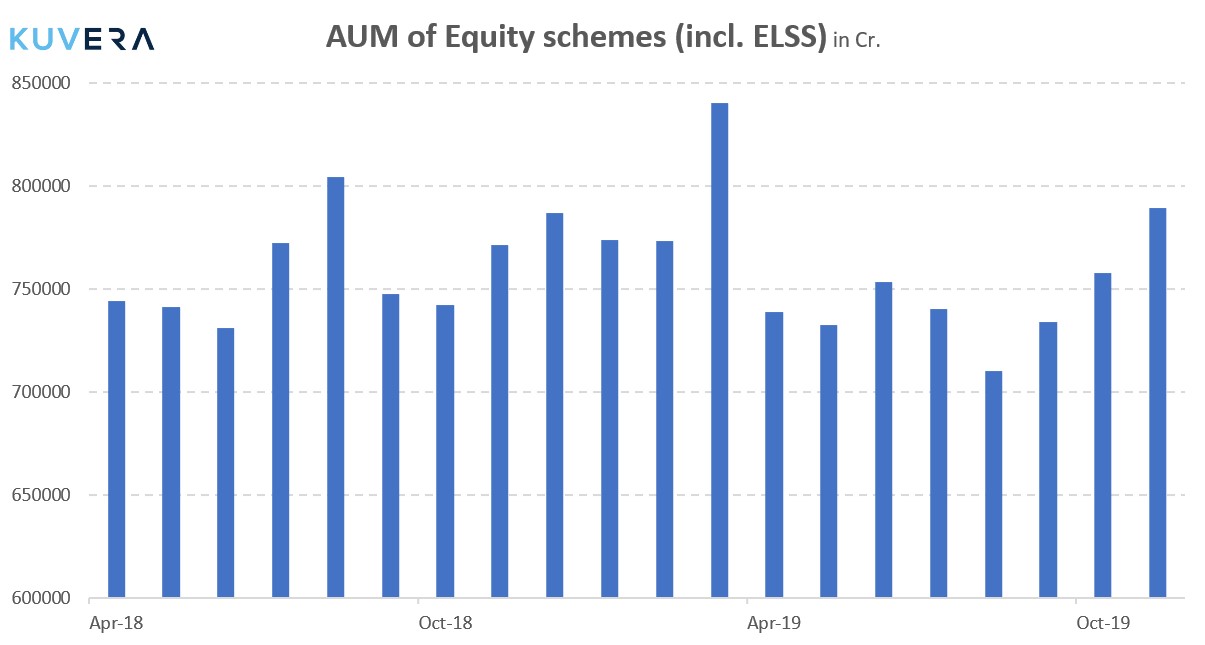

In comparison, The Assets under Management of Equity-oriented schemes stood at Rs 7,89,219 crores in November, up from Rs 7,57,687 crore in the previous month.

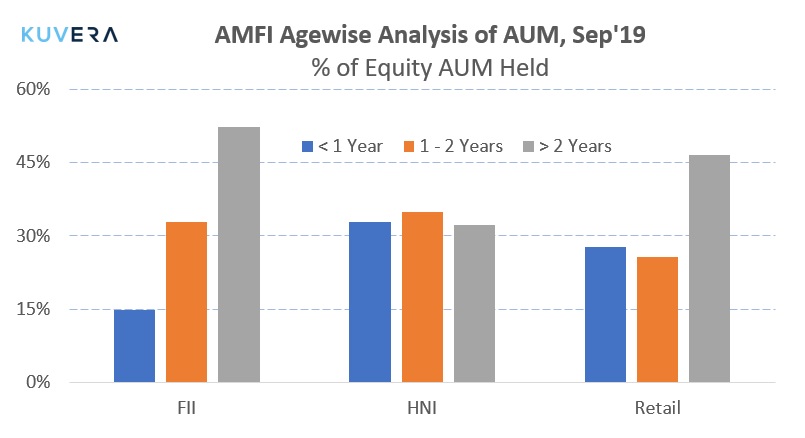

AMFI data also shows that retail investors are not churning their portfolios as much as HNIs. Retail investors held ~47% of equity assets for more than 2 years compared to ~31% of equity assets for HNIs. Percentage of equity AUM held over 2 years by retail investors has also increased marginally to 46.65% above the June 2019 figure of 45.51%. Research has shown that return chasing and high churn can lead to a return underperformance of up to 1.5% a year.

Gold has had a very impressive 2019 up close to ~25% YTD. Latest data from Bloomberg Intelligence reports that central banks have been buying nearly 20% of the world’s gold supply, approaching the highest levels since the Nixon era. Central banks were net sellers of Gold from 1971 through to 2010. Gold is an effective portfolio diversifier with low correlation to equity returns especially during wars, market crashes, and disasters. If you haven’t already, we recommend that you add some gold exposure to your portfolio.

Edelweiss Mutual Fund has launched the new fund offer of Bharat Bond ETF, India’s first corporate bond Exchange-traded fund. This fund is an initiative of the Government of India, from the Department of Investment and Public Asset Management (DIPAM). The NFO for Bharat Bond Fof April 2023 and Bharat Bond Fof April 2030, Fund of Funds investing primarily in Bharat Bond ETF, will remain open for subscription until December 20, 2019.

|

|

|

|

|

|

|

Movers & Shakers

1/Essel Mutual Fund has announced that Manav Vijay ceases to be the Fund Manager & Key Personnel of the AMC, with effect from 07 December 2019. Saravana Kumar will take over the fund managerial responsibilities.

2/ Principal Mutual Fund announced that Pedro Borda has vacated the office of Director of Principal Asset Management Private Limited with effect from 05 December 2019.

Quote of the week:

This is the moment when we must build on the wealth that open markets have created, and share its benefits more equitably. Trade has been a cornerstone of our growth and global development. But we will not be able to sustain this growth if it favors the few, and not the many.

: Barack Obama

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YoutTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!