All that you need to know about Mutual Funds this week

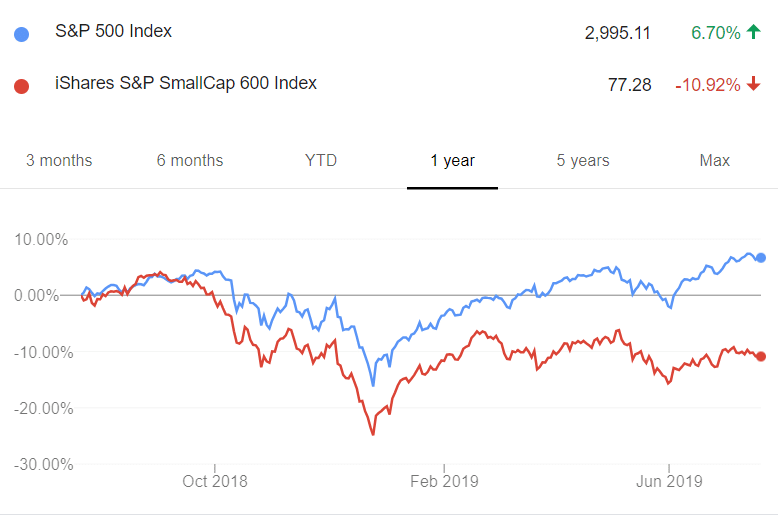

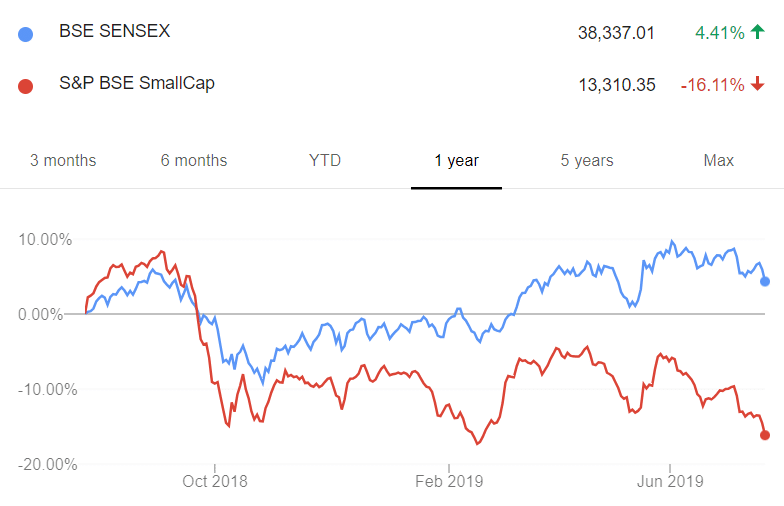

Small-cap and mid-cap underperformance continued this week. S&P BSE SmallCap Index was down 3.38% this week compared to a decline of 1.41% in the Nifty 50 Index. The small cap underperformance is a global phenomenon and the recent equity returns have been driven by large-caps in almost all markets. In the US the S&P SmallCap 600 Index has underperformed the S&P 500 Index by ~18% over the last year.

The small-cap underperformance in India has been slightly more extreme. The S&P BSE SmallCap Index has underperformed the SENSEX by ~20.5% over the last year. More aggressive small-cap portfolios have fared worse drawdowns of 30-40%. A more interesting phenomenon is also surfacing on social media – Portfolio Managers who claimed a lot of alpha due to process, stock selection and intelligence during the run-up in the small cap space are now running around looking for any and all external reasons on why their portfolio is underperforming. This indeed is a feature of the markets as well.

The upside is always presented as skill, while downside needs to be looked through the lens of bad luck or external dominating factors.

Since 2017, we have stayed away from recommending small-cap or mid-cap funds in our ideal portfolio. And even today, we are not convinced they deserve a place in your asset allocation.

So, what to do next? It reminds us of this quote –

The markets may be crazy, but that does not make you a psychiatrist.

: Meir Statman

The wrong thing to do now would be to stop investing or to sell your small-cap funds to buy the better performing large-cap funds. If your risk tolerance allows it, continue investing in small-cap via SIPs. Else, keep your small-cap investments as they are and make new investments in the large-cap space. Do not redeem unless you need money and this is the only source. Do take a good hard look at your asset allocation and ensure that you have the right equity/debt mix based on your goals.

Nippon Life Insurance has received approval from the Competition Commission of India for the acquisition of up to 75% stake in Reliance Nippon Asset Management. Additionally, the Japanese insurer is set to acquire 100% stake in Reliance Capital Trustee Company and Reliance Capital AIF Trustee Company, both wholly-owned subsidiaries of Reliance Capital.

Index Returns

| Index | Weekly open | Weekly close | Change |

| BSE Sensex | 38,736.23 | 38,337.01 | -1.03% |

| Nifty | 11,582.90 | 11,419.25 | -1.41% |

| S&P BSE SmallCap | 13,776.58 | 13,310.35 | -3.38% |

| S&P BSE MidCap | 14,553.88 | 14,078.34 | -3.27% |

Source- BSE/NSE

Top 5 best performing funds

| Name | Week | 3Y | Category |

| Kotak World Gold | 7.0% | -8.4% | Fund of Funds |

| DSP World Gold | 3.4% | -7.0% | Fund of Funds |

| IPRU Technology | 2.5% | 15.4% | Sectoral |

| Franklin India Technology | 1.8% | 13.6% | Sectoral |

| Franklin Asian Equity | 1.7% | 10.6% | Sectoral |

Source – Kuvera.in

Top 5 worst performing funds

| Name | Week | 3Y | Category |

| Sundaram Small Cap | -5.3% | 1.3% | Small |

| UTI Transportation & Logistics | -4.4% | -1.0% | Sectoral |

| IDFC Sterling Value | -4.1% | 10.9% | Value |

| Reliance Banking | -4.0% | 16.3% | Sectoral |

| Invesco India Small-Cap | -3.9% | NA | Small |

Source – Kuvera.in

What investors bought

We saw the most inflows in these 5 Funds –

| Name | 1Y | 3Y | Category |

| Mirae Asset Large Cap | 10.4% | 14.7% | Large Cap |

| Parag Parikh Long Term Equity | 2.9% | 13.5% | Multi-Cap |

| Kotak Standard Multicap | 7.1% | 13.6% | Multi-Cap |

| HDFC Small Cap | -3.7% | 14.0% | Small |

| Mirae Asset Tax Saver | 12.2% | 18.7% | ELSS |

Source – Kuvera.in

What investors sold

We saw the most outflows in these 5 Funds –

| Name | 1Y | 3Y | Category |

| Franklin India Equity | 1.3% | 7.7% | Multi-Cap |

| ABSL Equity Hybrid 95 | 2.3% | 8.3% | Hybrid |

| Franklin Smaller Companies | -7.3% | 13.3% | Small |

| Sundaram Large & Mid Cap | 4.5% | 13.5% | Large & Mid Cap |

| IPRU Value Discovery | 1.4% | 6.6% | Value |

Source – Kuvera.in

Movers & Shakers

1/ YES Mutual Fund has announced that Amit Deshmukh has been designated as Chief Financial Officer (CFO) for YES Asset Management.

2/ IDFC Mutual Fund has appointed Pradeep Kumar and Jaimini Bhagwati as Independent Directors on the board of IDFC AMC Trustee Company.

3/ Mirae Asset Mutual Fund has announced that Puneet Bhatia ceased to be the Head – Real Estate and Key Personnel of the AMC Trustee Company.

4/ Reports suggest that Sachin Bansal, the former co-Founder of Flipkart, is in talks with Essel Finance for acquiring Essel Mutual Fund.

Quote of the week:

जितना कम सामान रहेगा उतना सफ़र आसान रहेगा

जितनी भारी गठरी होगी उतना तू हैरान रहेगा: गोपालदास नीरज

Feature Showcase: Tax Harvesting

Tax Harvesting is a technique that utilises the ₹1 Lakh annual LTCG exemption by selling and buying back part of your investment such that you “realise” gains and not pay taxes on them. At a 10% LTCG tax rate, you could save up to Rs 10,000 in LTCG taxes every year by doing this diligently.

Do not wait for February / March to harvest taxes. Do it as early in the financial year as possible – you may not have gains later to harvest!

Like all our features, Tax Harvesting optimizes on your entire portfolio – bought on Kuvera or imported from elsewhere.

Start harvesting today.

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!