About the author: Chirag Bogra, 29 Years, is a Sr. Big Data Architect at American Express and an Investment Blogger at www.mutualfundswiki.com. At MutualFundsWiki, he aims to empower investors with good strategies for long term wealth creation.

With the cost of living going up, savings play a very important role for individuals and families. It is very important that people save and invest more for their future considering average inflation of ~4% in last 10 years.

Most of the people make rush investments in last few months of financial year inorder to save taxes. They fail to evaluate the impact of investment decisions on their long term goals. The most popular investment mechanisms are tax efficient instruments like Fixed Deposits, Public Provident Fund, ELSS etc. Section 80c of Indian Income Tax act allows individuals to claim tax deductions upto 1.5 lakh annually on such investments.

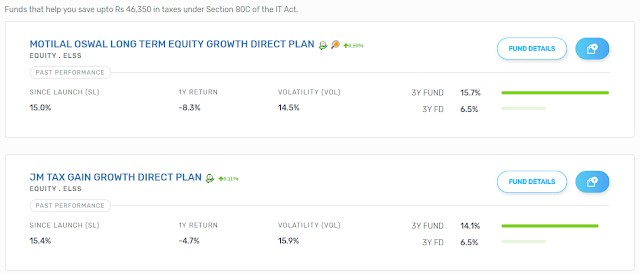

You can explore best ELSS funds on KUVERA & compare against variety of parameters like yearly returns, volatility, Expense ratio etc. Here are couple of best performing funds – do ensure you’re not only choosing funds based on past returns, but also on the basis of your risk profile and goals.

Benefits of investing in Equity Linked Savings Scheme (ELSS)

Historically, investors have swayed away from ELSS primarily because of equity risks associated with it. However, recently ELSS or Equity Linked Saving Scheme has become a popular investment instrument, primarily because of investor education initiatives by AMFI. There are many positives that ELSS offers over other investment products.

Ride the long term growth

The lock-in period for ELSS investments is 3 years. This is lower than any other tax saving instrument like PPF which has 15 years of lock in whereas Fixed Deposits have a 5 year lock in period.

Taxation benefits on the Income earned

Starting Apr’ 2018, LTCG has been imposed on income from equity & equity mutual fund schemes – which is 10% on income above 1 lakh annually.

Ensures Disciplined Investing

The lock in period of 3 years also ensures that investors don’t make hush-hush decisions & redeem their investments in quick time. It is also encouraged to invest through the SIP or Systematic Investment Plan mode & not make rush investments at the end of the year to meet Section 80c limits.

Compounding Benefits

Although no mutual fund including ELSS ensures guaranteed returns, the history suggests holding equity for longer term is the best possible investment in order to beat inflation. Equity or Equity investments like mutual funds do have risks associated with them in the shorter term, the only way out to mitigate the risk is to have a long term investment horizon to achieve compounding benefits.

Transparent

All Mutual Fund houses come under the purview of SEBI & hence, the invested Mutual Fund Units are safe. Also, ensure you have KYC completed to receive regular updates on your investments.

Equity Linked Savings Scheme (ELSS) Investment Tips

Just investing into mutual fund doesn’t ensure magical returns, there are multiple mistakes many investors make when they handle their ELSS investments. Here are few investment tips –

Start Early

Many ELSS investors jump to make their investments at the end of the year in order to achieve the 80c limits. If you’re investing lump sum into any equity fund, you might be at risk of investing right at the top & accumulating lesser units. It is always a good & sensible strategy to invest through SIP route to make investments every month & not just at the end of the year.

Don’t Switch Funds Regularly

While ELSS has a lock in period of 3 years, that doesn’t mean you need to redeem or switch your investments to other funds as soon as lock in period ends. If at the end of 3 years you’re not satisfied with the returns, don’t make a rush decision to redeem. You need to provide enough time for your investments to grow, just 3 years might not be good enough.

Growth vs Dividend

Just like any other mutual fund, ELSS also provides both Growth & Dividend options. Many investors go with Dividend option since they cannot wait till the lock in period & want to ensure some liquidity is available regularly, which might not be a good idea at all. Dividend is paid from the invested amount & NAV is adjusted accordingly. Also, it attracts Dividend Distribution Tax of 11.648% (10% + 12% surcharge + 4% cess). Smart investors would only choose growth option.

Don’t invest into too many schemes

Diversifying your investments is a smart decision, but over diversifying can degrade the returns. ELSS Mutual funds schemes invest into equity markets & hence, the underlying portfolio for similar schemes will overlap.

Investing more than 80c limits

Section 80c includes other investment instruments as well like PPF, PF, FD etc. For most investors it is not required to pump in entire 1.5 Lakh into ELSS considering investments in other 80c instruments. We can also choose to invest into ELSS above this limit, but should refrain as it will not add any value to your portfolio. If you wish to invest in to equity schemes above this limit – invest into non ELSS category, which will give you more liquidity & flexibility. Also, look at exit load before redeeming non ELSS equity funds.

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!