Direct plans of Mutual Fund schemes give higher returns than regular plans because of lower expense ratio. Lower expense ratio is due to the fact that Direct Plans do not pay any commissions to the advisor (usually an RIA). The commission savings means that for the same scheme, Direct plan can have up to 1.5% / year higher returns than Regular plans.

Direct plans of Mutual Fund schemes give higher returns than regular plans because of lower expense ratio. Lower expense ratio is due to the fact that Direct Plans do not pay any commissions to the advisor (usually an RIA). The commission savings means that for the same scheme, Direct plan can have up to 1.5% / year higher returns than Regular plans.

Direct plans were mandated by Securities and Exchange Board of India (SEBI) in 2012 and implemented from January 2013. It has been 4 years and there are quite a few fee only advisors (both online and offline) in the market, but we still hear so many questions about commissions. This post is to help clarify the Top 4 myths that still persist about Mutual Fund commissions.

Commissions are small –

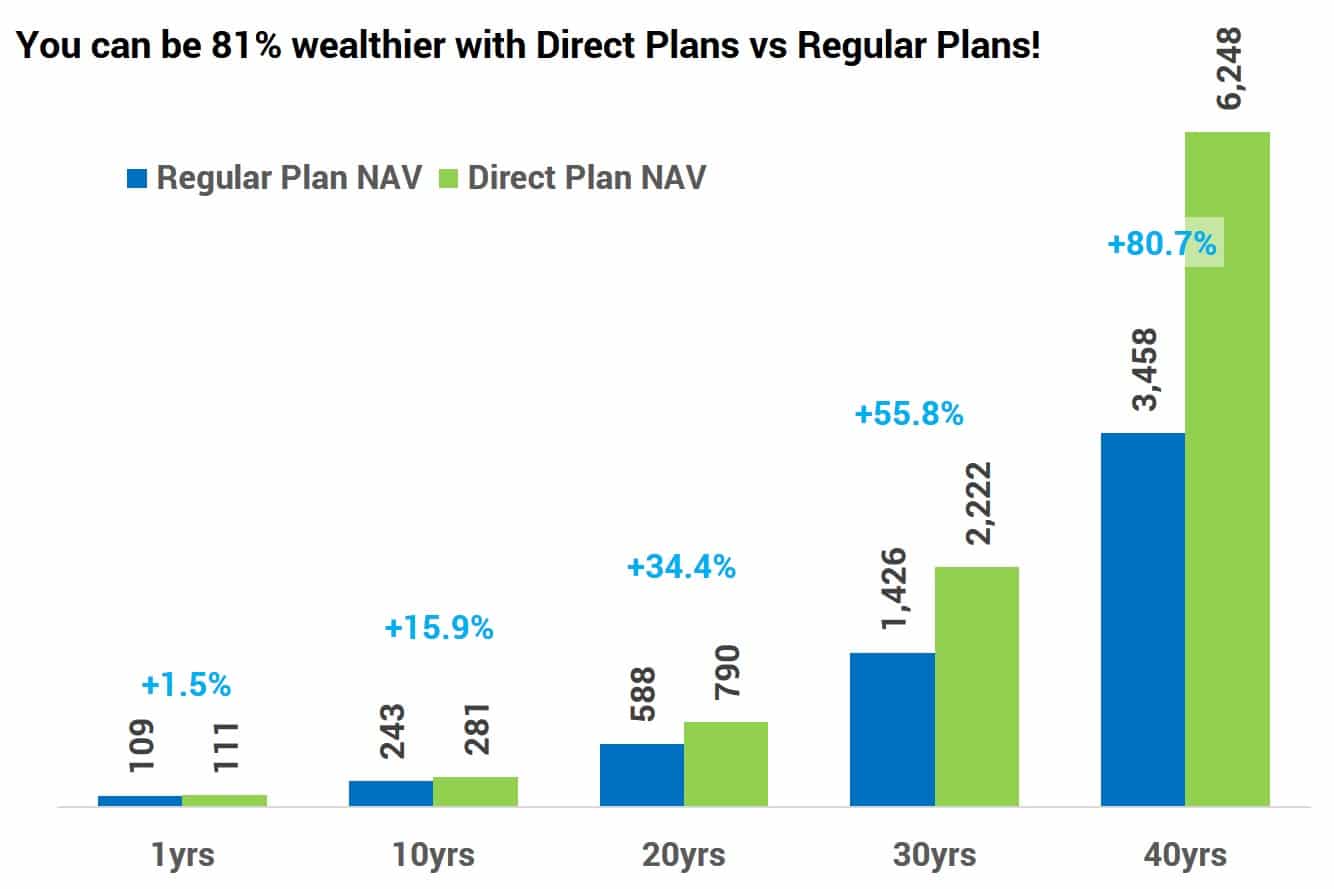

Anecdotal survey points to brokers always characterizing Mutual Fund commissions as small. Even online investment brokers use “small commission” extensively in their FAQ. Up to 1.5% annual commissions looks small – but its long term impact on your portfolio is very big. While brokers will be the first to highlight the compounding effect of long term Mutual Fund holdings they fail to highlight that commissions paid out annually also have a similar compounding effect. Saving 1.5% in commissions every year would mean a 45% larger portfolio in 25 years.

Commissions are paid only in the first year –

This we attribute to the practice of splitting the commission between the broker and the investor. Since the broker would only split the first year’s commission, it has led many to believe that Mutual Fund commissions are paid only in the first year. In reality if you buy a fund from a broker, they will continue to receive annual commissions as long as you are invested in that fund regardless of the level of service you receive. Commissions are buy once, pay forever (till you sell).

Commissions are paid only when I sell the fund –

A lot of people ask this question, in person and on email, and somehow we cant figure out why they think so. Brokers receive commissions on an annual basis as it is included in the expense ratio of the regular Mutual Fund scheme they offer.

Commissions can not be avoided –

With so many “Free for life” online investment brokers, investors end up believing that commissions are something you have to pay to invest in Mutual Funds. This is far from truth. Online Direct plan advisors like ours will help you invest in Direct plan of Mutual funds and help you save commissions. Remember an online “Free for life” account to invest in Regular funds is actually a very expensive way to invest in Mutual Funds. If you agree sign our petition here.

Mutual Fund commissions were necessary till 2013 as there was no way to invest in Mutual Funds without paying commission. Not anymore. Direct Mutual Fund plans are here to stay and help you avoid the overhead of Mutual Fund commissions to generate higher long term returns.

Still not sure. Learn more about saving Mutual Fund commissions here and here.

Pradipta Mahato

May 10, 2018 AT 10:35

How different are you from unovest, i guess they also sell direct plans. Hopefully we have now many players in selling direct plans. So how kuvera is different. If i become a kuverian, what extra advantages will get.

Karthik Kanniyappan

August 7, 2018 AT 14:13

It’s not a thousand feature which makes Kuvera great . So far with my experience, Kuvera is good and is a key influencer to choose due to these following reasons :

1. Ultra clean and slick interface with multi device support.

2. Manage family accounts , joint accounts under one umbrella making investments more interesting . With LTCGT limit with 1.1lax per year.. it’s good to invest with multiple family members which would equally empower.

3. Tax Gain reports precise with GrandFathered

4. GOAL based investments with recommendations. I do agree recommendations needs to get lot more better based on personalization which currently is not fully ready though.

Gabbar is back

January 11, 2020 AT 11:32

Thanks for your

Pradipta Mahato

May 11, 2018 AT 11:39

No need to revert back, l got my answer, just came through an article.

https://www.basunivesh.com/2017/10/06/best-direct-mutual-funds-platforms/