Top news

Net inflows into open-ended equity mutual fund schemes surged to a 14 month high of Rs 10,083 crore in May 2021, compared to inflows of Rs 3,437 crore in the previous month. The net AUM rose to an all-time high of Rs 33.06 lakh crore in May.

GST collections stood at Rs 1.02 lakh crore in May 2021, eight straight months where GST revenues have remained above Rs 1 lakh crore.

Axis MF, BOI AXA MF and HDFC MF have launched the NFO for Axis Quant Fund, BOI AXA Bluechip Fund and HDFC Banking and Financial Services Fund.

Index Returns

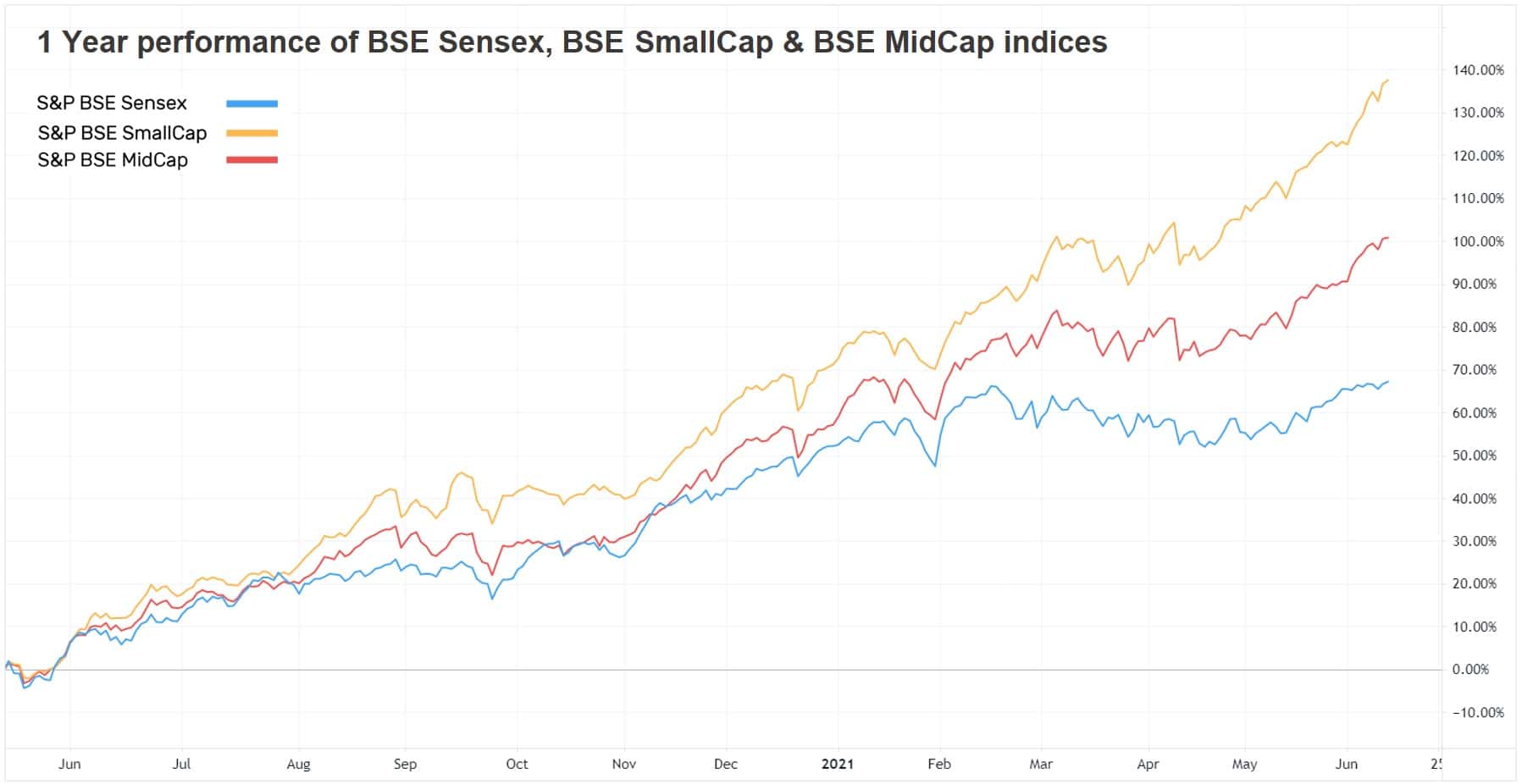

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | 0.8% | 59.4% | 13.6% | 29.3 | 4.5 |

| NIFTY NEXT 50 | 1.0% | 58.5% | 10.2% | 33.1 | 5.3 |

| S&P BSE SENSEX | 0.7% | 56.3% | 14.0% | 32.2 | 3.3 |

| S&P BSE SmallCap | 3.5% | 112.0% | 14.0% | 53.1 | 3.2 |

| S&P BSE MidCap | 1.8% | 83.5% | 12.7% | 48.3 | 3.2 |

| NASDAQ 100 | 1.7% | 45.9% | 25.0% | 36.8 | 8.6 |

| S&P 500 | 0.4% | 41.4% | 15.1% | 30.0 | 4.6 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| IPRU Technology | 5.2% | 133.2% | 32.7% |

| Tata Digital India | 4.9% | 113.0% | 30.2% |

| SBI Technology Opportunities | 4.1% | 88.8% | 27.60% |

| ABSL Digital India | 4.1% | 114.1% | 31.5% |

| 3.8% | 28.4% | 23.4% |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| BOI AXA Tax Advantage | 2.6% | 79.0% | 18.0% |

| Baroda Elss 96 B | 2.4% | 67.6% | 11.1% |

| ITI Long Term Equity | 2.1% | 69.6% | NA |

| Union Long Term Equity | 2.1% | 65.2% | 15.90% |

| 2.0% | 70.2% | 14.5% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Adani Power | 47.1% | 282.2% | 37.9% |

| Piramal Enterprises | 22.5% | 115.9% | 12.4% |

| Steel Authority Of India | 10.4% | 327.4% | 24.80% |

| Coal India | 9.1% | 15.6% | -5.1% |

| 9.0% | 121.3% | NA |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| DSP World Gold | -1.1% | 10.6% | 20.9% |

| PGIM India Emerging Markets... | -1.1% | 28.4% | 11.7% |

| Principal Global Opportunities | -0.7% | 49.0% | 14.20% |

| -0.7% | 62.4% | 12.6% | |

| -0.6% | 62.5% | 19.8% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Petronet LNG | -6.2% | -8.4% | 14.4% |

| Havells India | -5.0% | 82.5% | 24.0% |

| Adani Green Energy | -4.4% | 274.6% | NA |

| Punjab National Bank | -3.9% | 24.2% | -12.9% |

| -2.7% | 146.2% | 19.8% |

Bought and Sold

| Bought on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Flexi Cap | 2.0% | 62.6% | 21.8% |

| UTI Nifty Index | 0.9% | 61.2% | 14.7% |

| Axis Bluechip | 0.9% | 52.2% | 17.2% |

| Axis Mid Cap | 1.7% | 65.8% | 21.4% |

| 1.2% | 61.1% | 15.6% |

| Sold on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| ABSL Digital India | 4.1% | 114.1% | 31.5% |

| Franklin India Prima | 1.3% | 74.2% | 13.2% |

| IPRU Value Discovery | 1.8% | 66.6% | 15.1% |

| L&T Emerging Businesses | 2.6% | 110.1% | 12.0% |

| 1.9% | 62.5% | NA |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| Quant Small Cap | 2.4% | 194.6% | 30.4% |

| Parag Parikh Flexi Cap | 2.0% | 62.6% | 21.8% |

| Mirae Asset Emerging Bluechip | 1.4% | 78.7% | 22.0% |

| IPRU Technology | 5.2% | 133.2% | 32.7% |

| 4.9% | 113.0% | 30.2% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Reliance Industries | 0.2% | 40.8% | 35.9% |

| Adani Green Energy | -4.4% | 274.6% | NA |

| Infosys | 4.0% | 101.9% | 21.2% |

| Tata Consultancy Services | 4.1% | 55.2% | 22.0% |

| 7.8% | 214.6% | -5.2% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Tesla | 1.8% | 226.1% | 69.4% |

| Apple | 1.2% | 50.5% | 38.8% |

| Microsoft Corporation | 2.8% | 37.3% | 38.0% |

| Amazon.com | 4.4% | 31.6% | 36.0% |

| 0.3% | 44.9% | 23.2% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!