Top news

India’s forex reserves stood at an all-time high of $592.89 billion this week boosted by gold and currency assets. The previous high was $590.18 billion in Jan 2021.

Gold rates this week surpassed the Rs 48,500 mark and were at a 4 month high. The rise in prices was supported by a slide in cryptocurrencies and a weaker US dollar.

ITI Mutual Fund has launched the NFO for ITI Value Fund. The NFO closes on June 8.

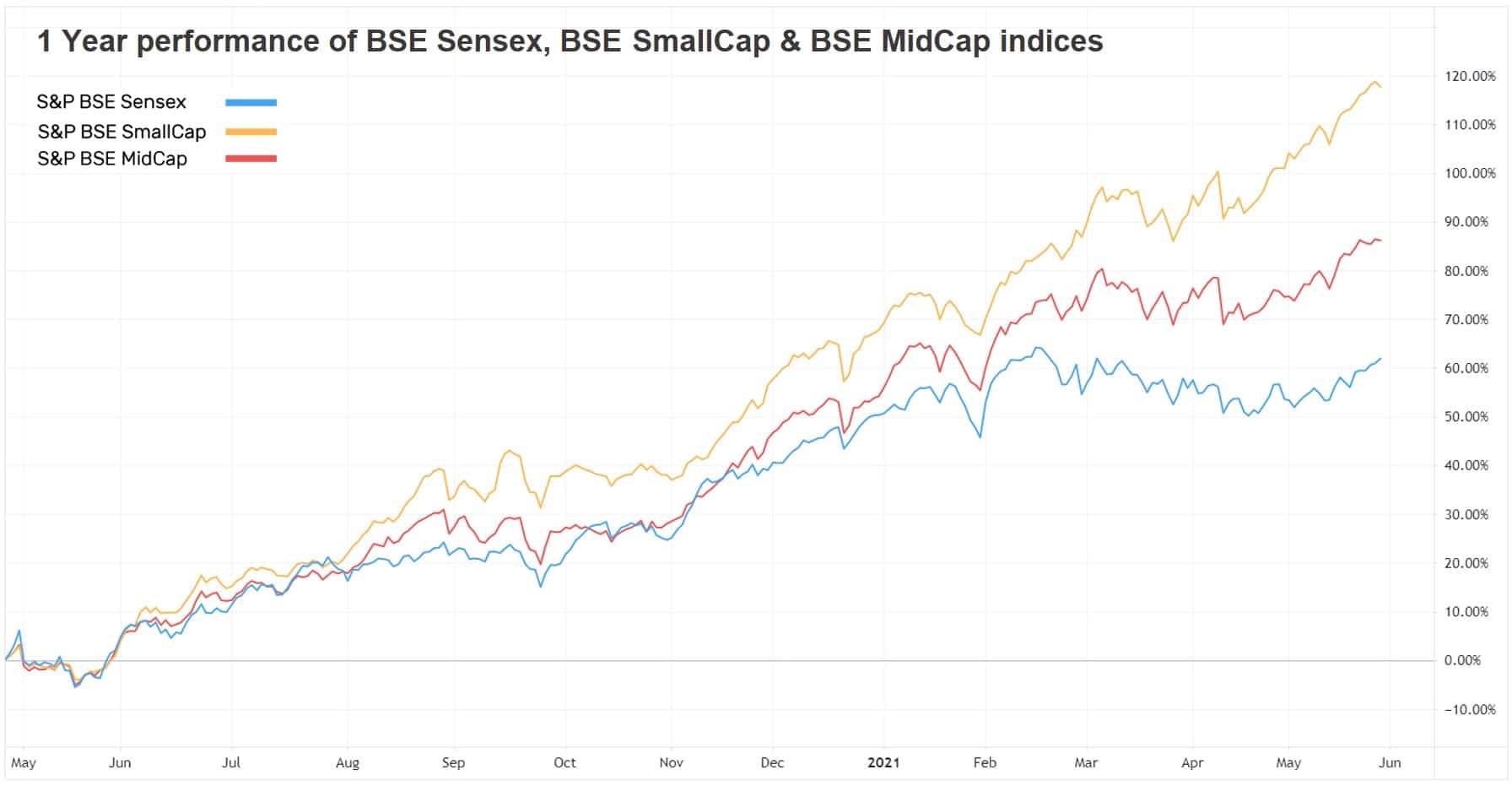

Index Returns

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | 1.7% | 62.5% | 13.1% | 29.0 | 4.4 |

| NIFTY NEXT 50 | 0.8% | 59.0% | 8.3% | 31.6 | 5.1 |

| S&P BSE SENSEX | 1.7% | 59.5% | 13.5% | 31.9 | 3.3 |

| S&P BSE SmallCap | 1.5% | 117.7% | 10.5% | 55.1 | 3.1 |

| S&P BSE MidCap | 0.8% | 86.1% | 10.4% | 49.3 | 3.1 |

| NASDAQ 100 | 2.0% | 45.2% | 25.2% | 36.1 | 8.4 |

| S&P 500 | 1.2% | 38.7% | 15.6% | 29.8 | 4.5 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| PGIM India Global Equity Opp... | 4.8% | 40.7% | 28.5% |

| ABSL Digital India | 4.1% | 113.9% | 29.7% |

| Tata Digital India | 3.9% | 110.9% | 28.4% |

| IPRU Technology | 3.7% | 129.4% | 31.3% |

| 3.6% | 40.5% | 10.5% |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Principal Tax Saving | 1.9% | 67.9% | 10.2% |

| JM Tax Gain | 1.9% | 73.8% | 14.6% |

| BOI AXA Tax Advantage | 1.9% | 78.2% | 15.7% |

| ITI Long Term Equity | 1.8% | 73.2% | NA |

| 1.7% | 48.7% | 8.1% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Natco Pharma | 13.8% | 82.9% | 18.0% |

| Punjab National Bank | 12.7% | 53.5% | -11.3% |

| State Bank of India | 9.8% | 166.1% | 16.9% |

| Bank of Baroda | 9.6% | 118.1% | -9.3% |

| 7.2% | 119.7% | NA |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| DSP World Gold | -1.0% | 14.9% | 21.2% |

| UTI Healthcare | -0.7% | 59.0% | 26.5% |

| -0.6% | 11.5% | 4.1% | |

| ABSL Gold | -0.5% | 1.9% | 14.2% |

| -0.4% | 10.0% | 4.5% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Ipca Laboratories | -8.2% | 31.0% | 35.9% |

| Hindustan Zinc | -5.2% | 98.2% | 20.1% |

| Havells India | -5.1% | 116.3% | 22.6% |

| Bosch | -4.7% | 60.2% | -6.5% |

| -4.6% | 302.1% | 25.4% |

Bought and Sold

| Bought on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Flexi Cap | 1.2% | 67.9% | 21.5% |

| Edelweiss Balanced Advantage | 0.9% | 41.7% | 14.4% |

| Kotak Balanced Advantage | 0.7% | 35.9% | NA |

| UTI Nifty Index | 1.7% | 64.0% | 14.1% |

| 0.6% | 31.8% | NA |

| Sold on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| ABSL Tax Relief96 | 1.7% | 46.6% | 8.7% |

| Motilal Oswal Flexi Cap | 1.1% | 55.1% | 7.6% |

| HDFC Mid Cap Opportunities | 0.4% | 87.5% | 12.2% |

| Sundaram Select Focus | 1.6% | 52.4% | 13.4% |

| 0.7% | 63.6% | 9.9% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Flexi Cap | 1.2% | 67.9% | 21.5% |

| Quant Small Cap | 0.5% | 205.3% | 28.3% |

| Mirae Asset Emerging Bluechip | 1.2% | 81.9% | 20.6% |

| IPRU Technology | 3.7% | 129.4% | 31.3% |

| 3.9% | 110.9% | 28.4% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Reliance Industries | 5.5% | 44.8% | 34.5% |

| Adani Green Energy | -2.3% | 412.0% | NA |

| Infosys | 4.9% | 99.2% | 19.2% |

| Tata Consultancy Services | 2.7% | 56.8% | 21.1% |

| 3.6% | 277.0% | -4.6% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Tesla | 7.6% | 274.8% | 69.6% |

| Apple | -0.7% | 56.8% | 37.8% |

| Amazon.com | 0.6% | 32.3% | 35.3% |

| Microsoft Corporation | 1.8% | 36.3% | 36.7% |

| 4.0% | 46.6% | 22.5% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!

Sajan

June 3, 2021 AT 17:47

I am a nri.is it possible to create Nre and Nro in same time in kuvera app for mutal founds