Top news

The Dow Jones Industrial and the Nasdaq 100 touched all time highs of 31200 and 13200 respectively during this week.

SIP inflows surged to Rs 8,418 crore in December 2020, a rise of 15% from the previous month.

PGIM India Mutual Fund has revised the minimum purchase amount for all its schemes to Rs 5,000 with effect from January 08, 2021.

Kotak Mutual Fund and PGIM India Mutual Fund have launched NFOs for Kotak Nasdaq 100 Fund Of Fund and PGIM India Balanced Advantage Fund. The NFOs close on January 25 and January 29 respectively.

UTI Equity Fund has been re-classified as Flexi cap fund and renamed to UTI Flexi cap fund with effect from January 13, 2021.

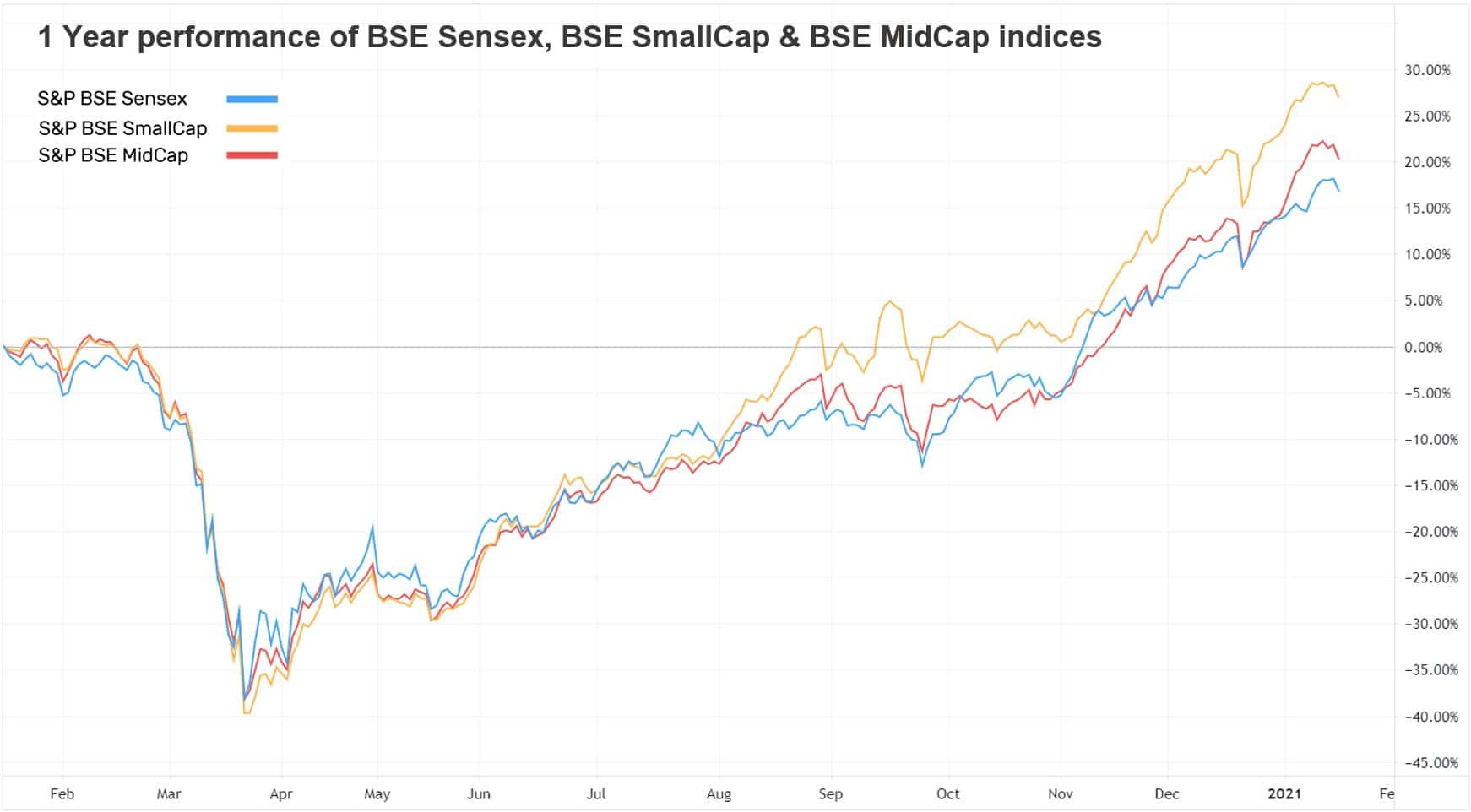

Index Returns

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | 0.6% | 16.8% | 10.3% | 39.3 | 4.1 |

| NIFTY NEXT 50 | -1.6% | 16.6% | 2.2% | 43.1 | 4.5 |

| S&P BSE SENSEX | 0.5% | 17.0% | 12.0% | 34.1 | 3.4 |

| S&P BSE SmallCap | -1.2% | 28.4% | -2.3% | NA | 2.5 |

| S&P BSE MidCap | -1.2% | 21.8% | 1.4% | 69.7 | 2.8 |

| NASDAQ 100 | -2.3% | 41.5% | 23.7% | 39.4 | 8.5 |

| S&P 500 | -1.5% | 14.5% | 10.6% | 30.1 | 4.2 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Franklin India Technology | 4.9% | 64.3% | 28.1% |

| PGIM India Emerging Mark... | 4.7% | 30.6% | 12.3% |

| PGIM India Global Equity Opp... | 4.3% | 68.9% | 32.8% |

| Edelweiss Emerging Markets... | 4.1% | 28.9% | 14.5% |

| 3.8% | -19.6% | 0.9% |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Quant Tax | 2.0% | 58.0% | 16.4% |

| IDFC Tax Advantage | 1.4% | 23.7% | 5.3% |

| HDFC Tax Saver | 1.2% | 8.6% | 1.0% |

| Nippon India Tax Saver | 1.2% | 2.1% | -5.2% |

| 1.2% | 15.6% | 6.7% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Tata Motors | 32.4% | 33.0% | -5.3% |

| DLF | 13.8% | 9.8% | 23.8% |

| Vodafone Idea | 13.8% | 123.3% | -27.1% |

| MRF | 13.2% | 31.3% | 18.5% |

| 10.5% | 28.3% | 16.9% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| DSP World Gold | -6.0% | 36.0% | 17.0% |

| Invesco India Gold | -3.8% | 19.3% | 16.5% |

| Axis Focused 25 | -2.4% | 21.3% | 13.0% |

| Axis Long Term Equity | -2.4% | 20.7% | 13.0% |

| -2.3% | 20.4% | 5.5% |

Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Hindustan Zinc | -11.5% | 27.6% | 23.1% |

| Adani Green Energy | -10.9% | 376.9% | NA |

| Bandhan Bank | -9.1% | -29.0% | NA |

| InterGlobe Aviation | -7.6% | 14.4% | 7.5% |

| -7.2% | 42.4% | 24.6% |

Bought and Sold

| Bought on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| ABSL Digital India | 0.1% | 62.7% | 28.2% |

| Parag Parikh LTE | 0.3% | 32.4% | 15.20% |

| Axis Bluechip | -1.0% | 20.9% | 16.3% |

| UTI Nifty Index | 0.6% | 17.6% | 11.4% |

| -0.2% | 72.0% | 29.90% |

| Sold on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Kotak Standard Multicap | 0.0% | 14.9% | 9.6% |

| L&T Emerging Businesses | -1.2% | 15.2% | -1.9% |

| HDFC Hybrid Equity | 0.8% | 16.6% | 7.5% |

| IPRU Asset Allocator | 0.3% | 16.5% | 12.1% |

| -1.3% | 15.4% | 9.7% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| PGIM India Global Equity Opp... | 4.3% | 68.9% | 32.8% |

| Tata Digital India | 1.0% | 60.3% | 31.1% |

| Axis Bluechip | -1.0% | 20.9% | 16.3% |

| IPRU Technology | -0.2% | 72.0% | 29.9% |

| 0.3% | 32.4% | 15.2% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Reliance Industries | 1.4% | 27.9% | 29.9% |

| Adani Green Energy | -10.9% | 376.9% | NA |

| Infosys | 6.6% | 73.5% | 20.3% |

| Tata Consultancy Services | 6.6% | 46.5% | 24.8% |

| 3.6% | 13.8% | 23.4% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Tesla | -6.1% | 704.5% | 82.3% |

| Apple | -3.7% | 61.3% | 39.3% |

| NIO | -4.5% | 1184.7% | NA |

| Amazon | -2.5% | 65.3% | 40.4% |

| -3.2% | 27.9% | 33.1% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!

Prasad

January 21, 2021 AT 16:04

dear sir/mam

want to invest 10000 per month in mutual fund, guide me the best mutual fund.

need to invest in different funds to safe gurd

tks

prasad

Gaurav Rastogi

February 1, 2021 AT 02:54

You can see our recommended portfolio here https://kuvera.in/blog/nov-2019-kuvera-recommended-portfolio-update/