First, for those who are new to Kuvera, a quick recap.

We have recommended a portfolio since Jan 2017. We updated our recommendation in Oct 2018. You can read about that here: Performance & Recommended Portfolio Update

We started out in Jan 2017, with this equity portfolio –

| Jan 2017 – Oct 2018 | Portfolio Weight |

| ICICI Prudential Nifty Next 50 | 45.7% |

| Motilal Oswal Focused 25 | 28.5% |

| IDFC Nifty | 12.9% |

| ICICI Prudential US Bluechip | 12.9% |

We updated it in Oct 2018, to our current equity portfolio recommendation –

| Oct 2018 – Till Now | Portfolio Weight |

| UTI Nifty Next 50 | 45.7% |

| Motilal Oswal Focused 25 | 28.5% |

| DSP Equal Nifty 50 | 12.9% |

| ICICI Prudential US Bluechip | 12.9% |

We recorded the rationale for portfolio recommendation changes here: Performance & Recommended Portfolio Update

Our portfolio has ~13% international exposure through ICICI Prudential US Bluechip fund. Has focused factor exposure through ~29% holding in Motilal Oswal Focused 25 fund. You will also note that with the exception of Motilal Oswal Focused 25, the remaining three funds have zero stock overlap.

Second, how do I see Kuvera’s recommended portfolio?

You can view our recommended portfolio and invest in it when you do goal planning on our platform. You can also just mimick the portfolio weights above. The difference is that when we know your goals and your investment horizon (5 yr, 10 yr etc) we can also advise you on how much of your portfolio should be in our recommended equity portfolio and how much should be in our debt portfolio. So, goal planning will not only show you our recommended portfolio but also asset allocation.

That out of the way, let’s look at the performance and risk review of our portfolio vs Nifty 50 and Nifty Next 50.

Performance overview – all time period.

| Jan ’17 – Oct ’19 | Nifty 50 | Nifty Next 50 | Kuvera |

| Annual Return | 14.3% | 10.5% | 13.3% |

| Std Dev | 13.5% | 15.7% | 12.2% |

| Drawdown | -10.7% | -17.1% | -11.0% |

| Max Monthly | 7.4% | 10.1% | 7.9% |

| Min Monthly | -7.5% | -12.0% | -8.0% |

| Return / Risk | 1.06 | 0.67 | 1.09 |

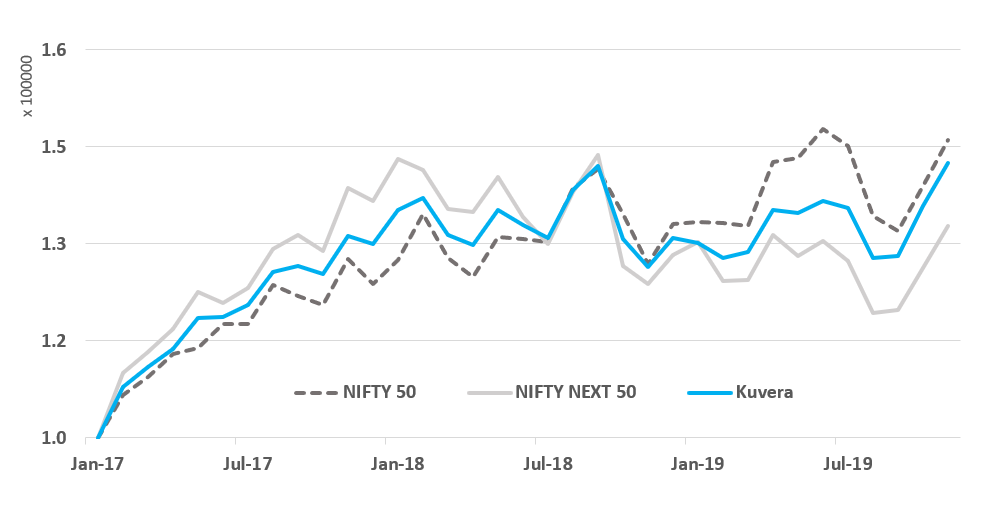

And the chart:

Some quick observations:

1/ Our rationale of the four selected funds was based on low historic covariance and low fund overlap. In the case of index funds, we used index returns to have long-run data available. Nifty Next 50 is the base of our recommendation with 46% of our equity portfolio recommended to this index. Our diversification through Nifty index, one international fund and one focused fund significantly improve on the return and risk of Nifty Next 50. Nifty Next 50 reward to risk ratio (Returns / Std Deviation) has been 0.67 in this time period while the Kuvera portfolio has a reward to risk ratio of 1.09. Since Jan 2017, while Nifty Next 50 has returned 10.5% annualized our diversified portfolio has returned 13.3% annualised. Similarly, while the volatility of Nifty Next 50 has been 15.7% our recommended portfolio has a volatility of 12.2%.

2/ That Nifty 50 and our returns are close is a co-incidence. Nifty 50 has returned a higher 14.3% during this time period at a marginally lower reward to risk ratio (1.06 vs 1.09). That our returns are close to Nifty 50 is a pure coincidence. We expect this to diverge in the future.

Performance overview – calendar year performance.

| Return | Nifty 50 | Nifty Next 50 | Kuvera |

| 2017 | 27.6% | 43.2% | 35.2% |

| 2018 | 4.5% | -9.0% | -3.7% |

| 2019 YTD | 9.5% | 1.9% | 9.5% |

| Volatility | Nifty 50 | Nifty Next 50 | Kuvera |

| 2017 | 11.1% | 13.1% | 9.3% |

| 2018 | 15.4% | 18.2% | 14.3% |

| 2019 YTD | 14.3% | 14.0% | 11.9% |

| Reward / Risk | Nifty 50 | Nifty Next 50 | Kuvera |

| 2017 | 2.5 | 3.3 | 3.8 |

| 2018 | 0.3 | -0.5 | -0.3 |

| 2019 YTD | 0.7 | 0.1 | 0.8 |

What next?

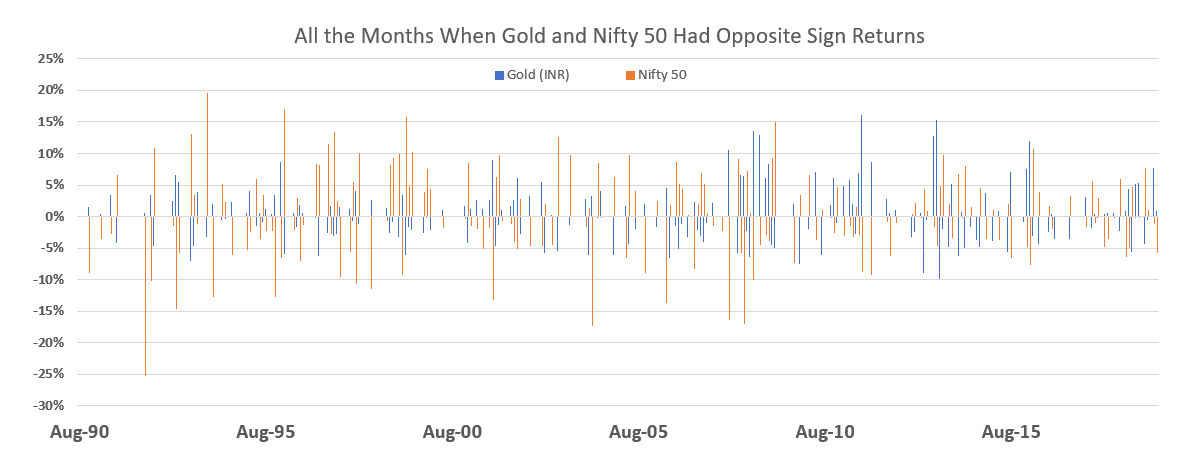

We have written on how gold can be a good downside hedge to equity exposure – even better than credit and bonds. In the past 29 years of data, the correlation of monthly gold returns and monthly Nifty50 returns is just 0.3%!

Of the 348 monthly returns in our sample, there are 178 instances where the returns on gold and returns on Nifty 50 have opposite signs. That is if gold posted positive returns, Nifty 50 posted negative returns and vice versa. This is exactly what diversification is about – two assets, each with positive expected returns but no correlation in returns.

Essentially, what gold loses in return expectation it more than makes up for in correlation and thus diversification benefits. Gold, you see, is a team player. And at times when Nifty 50 is not performing due to crash fears, wars, natural hazards or disasters, gold does well.

It helps you tide over the bad times much better. Or you could say, when the going gets tough, gold gets going.

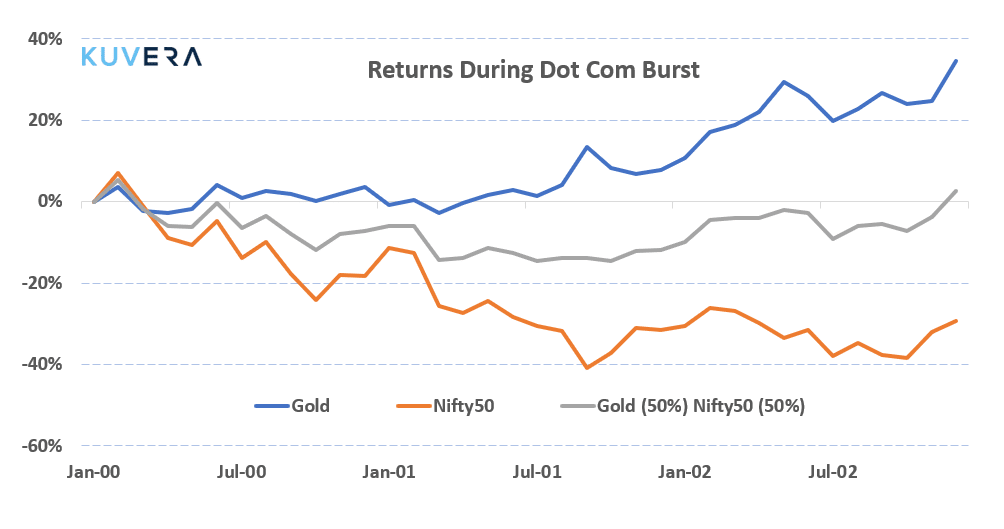

The dot com burst of 2000 – 2002: Between 2000 to 2002 Nifty50 proceeded to fall 40%. As a flight to safety and crash hedge, Gold had outsized gains of ~30% during the same time period.

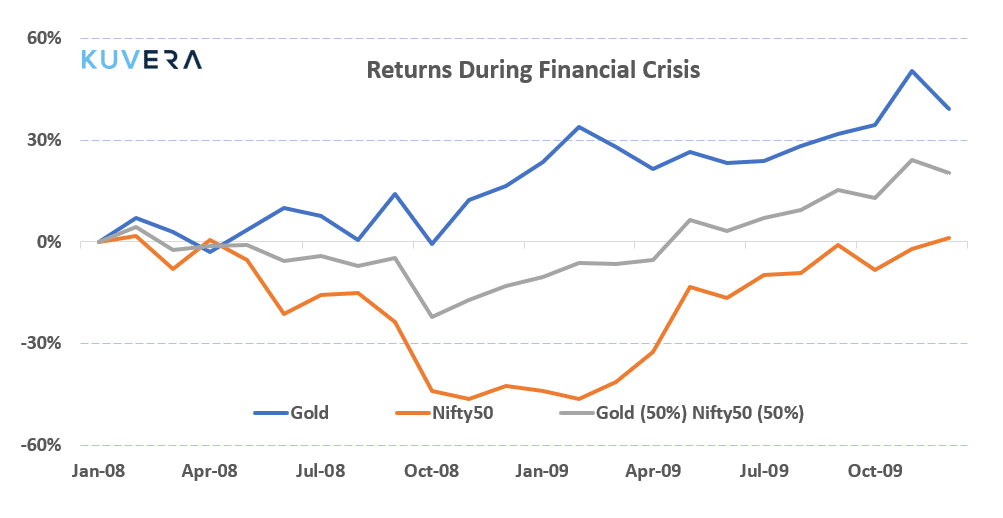

The Global Financial Crisis of 2008: Nifty50 saw a monthly drawdown of ~50% during that time. Gold again shone as the crisis hedge and rallied ~30% to protect from some of the impacts of the stock market meltdown.

We also note that digital gold is probably the best way to get exposure to the yellow metal, far better than gold ETF and Mutual Funds.

Frequently Asked Questions

1/ How often should I rebalance?

You can allow a 5% deviation to model allocation before thinking of rebalancing to original portfolio weights. Deviation based rebalancing is far superior to time-based rebalancing (every 3 months, or 6 months etc).

2/ When will you add small-cap exposure?

We are still tracking small-cap and mid-cap space with interest. This was our position in Oct 2018 as well when we did our last portfolio update. We are still not convinced this space offers value and we are comfortable to the possibility that we might miss the bus on a small-cap bull run. There is no FOMO. We will keep you informed as and when our opinions change.

3/International markets are doing well, should we increase our US exposure?

No. In 2017, the Indian market did very well and we were questioned on our US exposure. Then 2018 and 2019 happened. Diversification is not the same as chasing returns. If you do not have international exposure then it helps to add it to your portfolio. If you already do, then don’t increase it based on recent past returns. Chasing returns will only lead to the behaviour gap and lower future returns.

*** We will keep adding FAQ based on what we get asked the most 🙂

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YoutTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!

Vipul

December 1, 2019 AT 06:49

I love to have Kuvera, well designed web site and good articles through mail support, one who are investing in MF must have kuvera registration

Gaurav Rastogi

December 10, 2019 AT 04:19

Thanks Vipul

Venkata Ramakrishna

October 15, 2021 AT 04:12

Love Kuvera and have recommended to all my friends. You are doing amazing job.

TARAN

December 6, 2019 AT 12:33

Its a wonderful app. They keep on improving it regularly. Would love to have more assisting and guiding features in future that would help in making the right choices. Looking forward to it.

Gaurav Rastogi

December 10, 2019 AT 04:18

Thanks Taran.

Nilesh pandya

February 8, 2021 AT 05:01

Any up date for huf accunt

Sandeep Marthala

December 12, 2019 AT 03:57

I think you should be explicit of expense ratios of funds you selected and impact of exit ratios when you rebalance

Gaurav Rastogi

December 13, 2019 AT 06:40

Sure we will add this. Index funds generally have very low expense ratio and very short for exit load periods.

Gaurav Kumar

December 18, 2019 AT 09:39

It was nice reading this analysis. I have a question for you as a lay investor:

Suppose I rely upon your suggestion as described. What do I do if I wish to rebalance my future investment portfolio as and when your suggestion changes? Do I stop the ongoing investments, redeem them and reinvest them according to the fresh suggestions, OR do I simply stop any SIPs to the old bunch of MFs and redirect any future investment according to the new suggestions? What does the zen of investment say about this?

Gaurav Rastogi

December 30, 2019 AT 01:58

Stop the old SIPs

Start SIPs in the new fund.

Redeem and reinvest old funds in the new funds in a tax-efficient manner.

Singh

December 20, 2019 AT 04:32

I can invest ( Kuvera portfolio) for my child education for horizon 9 year .

Deepak

December 26, 2019 AT 00:05

Thanks Kuvera for the excellent work that you continue doing. On the Goals, please could you add a feature to add, modify a specific date so it can be more useful. Thanks.

Gaurav Rastogi

December 30, 2019 AT 01:57

On the dashboard when you click on the goal you can modify the duration of the goal. Currently in only yearly increment. We will add monthls soon.

Aditya

January 19, 2020 AT 17:16

Hi, this is excellent article and am planning to follow your portfolio and invest through SIP’s. What I want to understand is, why do you have ICICI US blue chip for international exposure and not some index fund like Motilaloswal Nasdaq 100 ETF FoF?? With your other recommendations you have gone the route of index funds, but here this seems to be different. Motilal fund seems to have lesser expense ratio too.

Gaurav Rastogi

January 20, 2020 AT 01:06

Thanks Aditya.

MOSL Nasdaq 100 is not a broad market index – it is a tech index. We have written elsewhere about sector timing and that applies to Nasdaq too. We prefer more broad market indices and since there is no S&P500 index, the ICICI US is a good proxy.

Further MOSL Nasdat ETF FOF is a fund of fund, so you have to add the expense ratio of the underlying ETF to the expense ratio of the fund itself. Hope this helps.

Aditya

January 27, 2020 AT 17:36

Oops! I seems to have replied to an already existing comment and didn’t see your response.

Thanks for the response Gaurav.

Now including ICICI US makes sense. I like the plan and reasoning. Have signed up for an SIP based on the recommendation with the suggested weights. Hopefully we get a proper S&P 500 fund and we can switch to it!

Apurva

January 19, 2020 AT 03:12

Hi Gaurav, I have been using Kuvera for sometime now and really happy with it. Request to add one more feature though- of being able to tag different folios to different goals in the same scheme as I wish to invest in separate SIPs in same scheme aligned to different goals. Please do let me know if this facility is already there and I may have missed it. Thanks!

Gaurav Rastogi

January 20, 2020 AT 01:59

Thanks for the feedback Apurva. We will look into this.

Vinay

January 21, 2020 AT 17:25

Good Job done Team Kuvera !

I am sure you have a list of features which are prioritized in your pursuit. If not done may be a poll could be a good idea. I would like to suggest some features suggestion namely, p2p lender account statement upload to measure debt component here, possible integration of NPS account mapped to retirement goal, Savings Bank Account Balance Update with FD feature, Stocks & REIT holdings.

Gaurav Rastogi

January 26, 2020 AT 00:18

Thanks for the feedback Vinay, some of these are already in the pipeline

Ravi Prakash

March 3, 2021 AT 11:36

P2P Lending is becoming popular in India now, I too agree with your suggestion. It will help in tracking whole portfolio at one place.

sunil bhatia

January 30, 2020 AT 16:16

1.

kuvera is an excellent app.

2.

urgently needed uploading of huf as a family member.

Nikunj

February 3, 2020 AT 15:51

Hi

Why Nippon India Liquid Growth Direct Plan is getting added to every goal?

I don’t see it listed in the article.

Regards

Gaurav Rastogi

February 6, 2020 AT 01:04

This article lists our equity portfolio only. For any goal, we will recommend an equity basket and a debt fund for proper asset allocation based on your risk profile. Nippon liquid fund is our recommended fund on the debt side as we do not recommend taking credit risk.

Naveen

May 15, 2020 AT 11:30

Dear Gaurav , Could you ask your team this to update pls — Nov 2019: Kuvera recommended portfolio update. I have a question do your team rebalance an existing portfolio Due to Oil and Covid disaster.

Gaurav Rastogi

May 21, 2020 AT 08:17

We will publish an update soon.

Ananth

May 22, 2020 AT 09:46

Yes very much needed. I stopped my SIPs in my regular funds in DEMAT account and been waiting to start SIPs using goal based approach in Kuvera. Have been going through all the blog articles & defined my goals. Since the recommended portfolio update seems way back in Pre-Covid era whats your suggestion ? Should i start SIPs now & worry about shifting to new fund recommendations later or wait till new recommended portfolio update & start SIPs if its around the corner very soon ?

Rahul

May 25, 2020 AT 17:33

When can we expect an update for this?

Gaurav Rastogi

May 26, 2020 AT 02:26

Early next month (i.e June)

gayatri

June 20, 2020 AT 12:03

Gaurav we are waiting eagerly for the next investment strategy. kindly update

Raunak Kumar

January 5, 2022 AT 04:45

Hello!, it’s 2022 and theres still no update. When can we expect one? Thank you

Birendra Padhi

June 3, 2020 AT 12:18

Hello, Thank you for providing an excellent platform.

Is there any debt fund recommended portfolio as well?

Gaurav Rastogi

June 6, 2020 AT 03:50

On the debt side, our recommendation remains Nippon Liquid fund.

Manu

June 11, 2020 AT 09:58

Any update for this post?

Sivakumar Ayyadurai

June 27, 2020 AT 10:09

Suggestion: Is it possible for you to add FD’s into Add an Asset list

Gaurav Rastogi

June 29, 2020 AT 03:23

Yes pls, we will add soon.

Manish G Dave

June 29, 2020 AT 13:03

There is no performance update since 2019, you should bro it post 30th June 2020 which is day after tomorrow.

Ideally you should have done it post 31st March 2020 post break down and end of financial as it would have/had deviated more than 5% as compared to sensex and Nifty.

So I believe it gap in your service as during and after such massive events (pandemic and market crash) you should have advice your client or subscribers.

Hope you will take my feed back constructive way.

Awaiting for your revert.

Regards

Rahul

August 1, 2020 AT 20:00

Till now update. He mentioned they will update on early June. But no response yet.

Mayank

August 21, 2020 AT 04:23

Hi Gaurav, Thanks for this blog and the whole Kuvera experience. I am a beginner, it has been really helpful.

Instead of Liquid fund I have added to arbitrage fund (similar returns but tax benefit) do you think it’s a good/bad idea? Could it lead to some problem as I don’t have enough Debt exposure?

Shaz Kaleem

August 24, 2020 AT 10:20

Just a request, you can ignore also, everything is awesome and transparent here that’s the I love the platform. Please use simple english while discussing or publishing the blog/article or please have same article in regional language (example – hindi) so I can share it with other non english speakers. I want to spread the confidence of regular sip, of course with the help of articles/blogs.

Gaurav Rastogi

August 31, 2020 AT 01:09

Noted, and thanks for your honest feedback. We will make them simpler and will try to have hindi content too.

Kauser

August 25, 2020 AT 02:08

Hi Gaurav. I like Kuvera and reading informative posts on it. Can you also add buying/selling of stocks just like MFs. That would be great! Thanks…

Gaurav Rastogi

August 31, 2020 AT 01:08

We will have that shortly, enabled for multiple brokers.

Himanshu Arora

August 26, 2020 AT 08:01

Gaurav Sir waiting for update to the portfolio list since so many months now.

What do you think of a portfolio having few index funds only, Indian or International, and sticking to them?

Now MO S&P fund is also there. In one of the comments you mentioned about NASDAQ FoF being limited to tech companies. Since this S&P fund is a fairly new one so should one wait for few years to see how it performs?

Gaurav Rastogi

August 31, 2020 AT 01:08

Hi Himanshu, these are long term portfolios, they don’t change often. Having said that we will do an update blog.

Dr Taranath Kamath

September 7, 2020 AT 02:07

When is the next update expected?

Gaurav Rastogi

September 24, 2020 AT 03:44

We update this on an as required basis, only when we make changes to this portfolio.

Anil Mehta

January 9, 2021 AT 16:48

Gaurav, Happy New Year. Do we expect any update on review / Update( if any) to Kuvera recommended portfolio/ funds soon? It’s been more than a year and an year full of events/ up and down..

Dr Vikesh Agrawal

January 28, 2021 AT 02:57

Hi, I’m a surgeon and I was introduced to Kuvera by one of my banker friend. I learned the basics of financial planning and investment using Kuvera. This app is very user friendly, informative, educative, unbiased, and keeps you motivated to invest in a more structured way. It should also incorporate government investments like PPF, NPS,Life Insurance etc to make it one place for everything.

Gaurav Rastogi

February 1, 2021 AT 02:50

We are building those other pieces as you mentioned. Thanks a lot for your kind words Dr Vikesh, means a lot to us.

Ashish Singh

January 30, 2021 AT 08:26

Hi Team,

I am using Kuvera since two years. This is very good platform. Everytime get to see new features and options which simplify the usage.. One suggestion, request you to please add more broker in Stock buying module.

Gaurav Rastogi

February 1, 2021 AT 02:47

Thanks, Ashish, we will add more brokers over time. Any particular broker you are looking for?

abhijit

February 13, 2021 AT 08:00

hello gaurav,

looking forward to the crypto launch.

i would also like to option to manually add details of FDs i have elsewhere, as you have for gold.

same for PPF and NPS. i read you are working on them.

i like the UI/UX of your product. managing investments of family through this.

thanks. cheers.

Rahul Parbhane

February 12, 2021 AT 09:15

With new change in NAV Kuvera can add field of payment done date to AMC in reports and we can be sure of we got fair NAV

Rahul Parbhane

February 12, 2021 AT 09:16

Imagine everyone starts selling all his portfolio and follow your it will be HAVOC. We have our goals with you and investment details. Why don’t you cant start service for portfolio screening and advisory.

Raghuram

March 4, 2021 AT 07:24

Hello Gaurav, hope you & Kuvera team are doing well and keeping safe.

A couple of questions about your index recommendation:

1/ now that MO S&P 500 index fund is available, would it replace the ICICI US fund?

2/ Can an update to the recommendation & its performance during covid recovery be made available to us?

I am very keen to see how index investing plays out in India and your inputs via this blog and elsewhere are helping immensely to enhance my understanding of this space. The behavioural thought pieces – Zen & The art of Investing – are brilliant! Thank you for everything you guys are doing. Cheers.

Sam Marshall

May 22, 2021 AT 07:11

Curious, it’s a great article and it should be permanent fixture every year . I couldn’t find any recommendation post 2019 . Wanted your take 8f anything has changed in above recommendation

Prabhat Arora

May 23, 2021 AT 06:04

Kuvera has become my one stop shop & is now my favorite app. Thanks!

Varun

June 8, 2021 AT 15:01

While I do understand that this is a long term portfolio but am concerned that there are no updates on this since 2019. Having recommended a lot of my friends and family to this platform, would feel better if there is at least an annual update on these funds even if there are no changes.

Subham Rakshit

December 8, 2021 AT 21:38

I fully enjoy Kuvera because of its simplicity in asset allocation. However there has been no update since 2019. Even if there is no actual update to the portfolio, I believe it would be good to have an article on the current asset allocation – how it behaved and why the asset allocation is still recommended. This would add a vote of confidence for all the investors.

Rupam

February 23, 2022 AT 14:11

10year ke liye 5000 ke sip/m karna hai , 10% se per year se increase karna hai koi aacha portfolios batye sir