Top news

GST collections stood at Rs 1.72 lakh crore for October 2023, a jump of 11% compared to the same month last year

UPI recorded an all-time high of 11.41 billion transactions amounting Rs 17.16 trillion in October 2023 reporting an 8% jump in volume from the previous month

India’s foreign exchange reserves (Forex) increased by $2.58 billion to touch $586.11 Billion for the week ending October 27, 2023

Shares of Blue Jet Healthcare got listed at a premium of 9.83% over issue prices of Rs 346 while IPOs of Honasa Consumer and Cello World got oversubscribed by 7.61 and 41.69 times respectively

Quant MF and DSP MF have launched the NFOs for Quant Momentum Growth Fund and DSP Gold ETF FoF. The NFOs closes on 13th November and 10th November Respectively

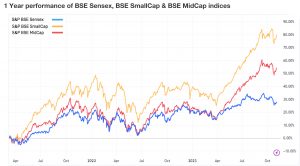

Index Returns

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | 1.0% | 6.5% | 18.1% | 20.9 | 3.4 |

| NIFTY NEXT 50 | 2.4% | 4.3% | 17.8% | 22.0 | 3.6 |

| S&P BSE SENSEX | 0.9% | 5.8% | 17.9% | 22.5 | 3.3 |

| S&P BSE SmallCap | 1.1% | 16.1% | 35.2% | 28.6 | 3.0 |

| S&P BSE MidCap | 2.0% | 23.7% | 26.9% | 24.3 | 3.0 |

| NASDAQ 100 | 6.5% | 39.1% | 10.8% | 22.5 | 3.8 |

| S&P 500 | 5.9% | 15.6% | 9.6% | 24.1 | 4.1 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| 7.0% | 3.8% | NA | |

| PGIM India Global Equity Opportunities | 6.3% | 28.3% | 3.2% |

| PGIM India Global Select Real Estate.. | 6.1% | 4.9% | NA |

| Bandhan US Equity FoF | 6.0% | 22.6% | NA |

| Mirae Asset Global X Artificial.. | 5.8% | 42.9% | NA |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| BOI Tax Advantage | 2.8% | 15.9% | 25.0% |

| ITI ELSS Tax Saver | 2.7% | 19.1% | 20.8% |

| Quant Tax | 2.5% | 10.8% | 35.1% |

| JM Tax Gain | 2.1% | 17.6% | 23.9% |

| Groww ELSS Tax Saver | 2.1% | 10.7% | 18.7% |

| Stocks (Market cap > Rs 50k Cr) | 1W | 1Y | 5Y |

|---|---|---|---|

| Vodafone Idea | 27.9% | 60.8% | -11.4% |

| Adani Power | 17.5% | 12.1% | 48.7% |

| Macrotech Developers | 17.0% | 72.4% | NA |

| REC | 14.3% | 193.9% | 30.5% |

| DLF | 13.7% | 54.7% | 28.3% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| HSBC Brazil | -2.8% | -6.0% | 6.0% |

| DSP World Gold | -1.9% | 17.7% | -6.7% |

| IPRU Nifty Auto Index | -0.8% | 20.9% | NA |

| Kotak Silver ETF FoF | -0.5% | NA | NA |

| Nippon India Silver ETF FoF | -0.5% | 22.4% | NA |

| Stocks (Market cap > Rs 50k Cr) | 1W | 1Y | 5Y |

|---|---|---|---|

| Supreme Industries | -5.9% | 76.9% | 33.6% |

| Samvardhana Motherson International | -3.9% | 29.4% | -2.78 |

| Muthoot FInance | -3.0% | 13.9% | 22.5% |

| One97 Communications | -2.9% | 38.9% | NA |

| JSW Energy | -2.9% | 16.9% | 39.5% |

Bought and Sold

| Most Bought MF | 1W | 1Y | 3Y |

|---|---|---|---|

| UTI Nifty 50 Index | 1.0% | 7.4% | 18.8% |

| Parag Parikh Flexi Cap | 2.5% | 22.0% | 24.8% |

| Quant Small Cap | 1.5% | 33.3% | 45.6% |

| IPRU Equity & Debt | 1.0% | 17.0% | 30.7% |

| UTI Nifty Next 50 Index | 2.4% | 4.5% | 18.1% |

| Most sold MF | 1W | 1Y | 3Y |

|---|---|---|---|

| IPRU Equity Saving Cumula... | 0.5% | 9.6% | 11.0% |

| IPRU Equity Arbitrage | 0.1% | 7.9% | 5.5% |

| UTI Flexi Cap | 0.8% | 4.5% | 15.8% |

| DSP Nifty 50 Equal Weight Index | 1.0% | 13.0% | 25.8% |

| Edelweiss Arbitrage | 0.1% | 8.1% | 5.7% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| JM Value Growth | 1.8% | 34.2% | 30.9% |

| Nippon India Small Cap | 2.0% | 33.7% | 45.2% |

| Quant Small Cap | 1.5% | 33.3% | 45.6% |

| HSBC Small Cap | 1.3% | 31.3% | 42.5% |

| Union Small Cap | 1.0% | 31.3% | 31.6% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| REC | 14.3% | 193.9% | 27.8% |

| Power Finance Corp | 13.6% | 181.8% | 28.4% |

| Indian Overseas Bank | 3.8% | 112.5% | 22.2% |

| Union Bank of India | 10.3% | 101.4% | 6.7% |

| Supreme Industries | 4.8% | 91.7% | 34.5% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| EHang Holdings | 13.3% | 268.0% | NA |

| Abercrombie & Fitch Co. | 11.6% | 281.9% | 28.2% |

| Meta Platforms | 6.0% | 246.5% | 15.9% |

| NVIDIA Corporation | 11.1% | 217.9% | 53.2% |

| Gaotu Techedu | 0.0% | 206.3% | NA |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.

Disclaimer: Mutual Fund investments are subject to market risks. Read all scheme related documents carefully.

Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Investment in the securities is subject to market risks. Read all the related documents carefully before investing.

The securities quoted are for illustration only and are not recommendatory.

This market update was initially published by Livemint.

#MutualFundSahiHai, #KuveraSabseSahiHai!