Top news

The Securities and Exchange Board of India (SEBI) has announced that, effective June 1, 2025, the cut-off time for redemption and related transactions in Overnight Mutual Fund schemes will be extended from 3:00 PM to 7:00 PM for same-day NAV applicability, while purchase cut-off timings will remain unchanged.

SIP contributions hit a record ₹26,632 crore in April, reflecting rising investor confidence and steady economic momentum despite short-term geopolitical uncertainties.

Tata AMC, ICICI AMC, Baroda BNP AMC and SBI AMC have launched the NFO for Tata Income Plus Arbitrage Active FoF Growth Direct Plan , ICICI Prudential Quality Growth Direct Plan , Baroda BNP Paribas Income Plus Arbitrage Active FoF Growth Direct Plan , Baroda BNP Paribas Multi Asset Active FoF Growth Direct Plan , and SBI Nifty200 Quality 30 Index Growth Direct Plan

Index Returns

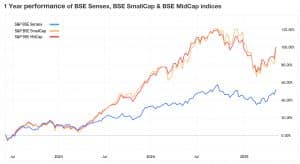

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | -0.7% | 8.2% | 15.1% | 22.4 | 3.7 |

| NIFTY NEXT 50 | 0.0% | -2.5% | 20.2% | 22.0 | 4.2 |

| S&P BSE SENSEX | -0.7% | 8.4% | 8.9% | 22.8 | 4.2 |

| S&P BSE SMALLCAP | 0.9% | 7.1% | 21.8% | 31.9 | 3.7 |

| S&P BSE MIDCAP | -0.3% | 3.3% | 21.7% | 36.3 | 4.6 |

| NASDAQ 100 | -2.4% | 11.2% | 12.7% | 37.2 | 4.1 |

| S&P 500 | -2.6% | 9.4% | 10.4% | 27.6 | 4.4 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Groww Nifty India Defence ETF FoF | 17.7% | NA | NA |

| ABSL Nifty India Defence Index | 17.9% | NA | NA |

| Motilal Oswal Nifty India Defence Index | 17.2% | NA | NA |

| Groww Nifty India Railways PSU Index | 16.4% | NA | NA |

| HDFC Defence Growth Direct Plan | 12.2% | 22.7% | NA |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Motilal Oswal ELSS Tax Saver | 11.5% | 16.2% | 30.9% |

| ITI ELSS Tax Saver | 9.0% | 8.1% | 27.2% |

| Samco ELSS Tax Saver | 8.8% | -2.8% | NA |

| Bank of India ELSS Tax Saver Fund Dir | 7.4% | 1.0% | 23.3% |

| HSBC ELSS Tax Saver | 7.2% | 12.8% | 24.7% |

| Stocks (Market cap > Rs 50k Cr) | 1W | 1Y | 5Y |

|---|---|---|---|

| Mazagon Dock Shipbuilders | 24.9% | 194.5% | NA |

| Rail Vikas Nigam | 23.6% | 48.6% | 87.7% |

| Linde India | 19.1% | -18.2% | 69.6% |

| Bharat Electronics | 18.5% | 56.3% | 74.4% |

| Yes Bank | 18.2% | -4.7% | -5.6% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| DSP World Gold FoF | -7.0% | 39.0% | 19.9% |

| ICICI Pru Strategic Metal and Energy Equity FoF | -4.6% | 9.4% | 9.8% |

| Aditya Birla Sun Life Gold Growth Direct Plan | -4.2% | 25.2% | 21.2% |

| ICICI Pru Regular Gold Savings (FOF) | -4.0% | 24.7% | 21.3% |

| SBI Gold Growth Direct Plan | -4.0% | 25.0% | 21.6% |

| Stocks (Market cap > Rs 50k Cr) | 1W | 1Y | 5Y |

|---|---|---|---|

| IndusInd Bank | -5.6% | -44.9% | 13.3% |

| United Breweries | -5.5% | 8.7% | 17.5% |

| Muthoot Finance | -5.3% | 25.9% | 20.8% |

| Bharti Hexacom | -3.5% | 74.9% | NA |

| Bharti Airtel | -3.3% | 38.5% | 27.3% |

Bought and Sold

| Most Bought MF | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Flexi Cap | 1.3% | 15.4% | 23.7% |

| Kotak Equity Arbitrage | 0.0% | 8.0% | 7.6% |

| Motilal Oswal Midcap | 3.8% | 21.0% | 33.8% |

| UTI Nifty 50 Index | 3.2% | 13.8% | 17.7% |

| Quant Small Cap | 5.1% | 1.4% | 30.2% |

| Most sold MF | 1W | 1Y | 3Y |

|---|---|---|---|

| Invesco India Arbitrage | 0.0% | 7.9% | 7.7% |

| Quant Flexi Cap | 4.2% | 0.5% | 24.9% |

| Quant Large Cap | 5.5% | 0.9% | NA |

| Quant Bfsi | 5.3% | 1.6% | NA |

| UTI Gold ETF FoF | -4.3% | 25.5% | NA |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| Axis Nifty 50 Index Growth Direct Plan | 4.3% | 13.8% | 17.7% |

| Axis Small Cap Growth Direct Plan | 6.7% | 13.7% | 23.6% |

| 7.3% | 1.3% | 21.3% | |

| Motilal Oswal Midcap Growth Direct Plan | 4.5% | 21.0% | 33.9% |

| Parag Parikh Flexi Cap Growth Direct Plan | 2.5% | 15.5% | 23.7% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Suzlon Energy | 20.9% | 44.8% | 90.1% |

| Tata Motors Ltd | 3.6% | -22.9% | 53.2% |

| Reliance Industries Ltd | 5.1% | 2.9% | 15.6% |

| Tata Power Company | 4.8% | -6.0% | 67.3% |

| Reliance Power Ltd | 14.5% | 74.7% | 90.0% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Palantir Technologies | 10.4% | 495.2% | NA |

| Tesla, Inc. | 17.3% | 97.2% | 45.6% |

| NVIDIA | 16.1% | 46.4% | 73.9% |

| S&P 500 Growth Vanguard | 7.1% | 20.3% | 16.9% |

| Microsoft Corporation | 3.5% | 8.1% | 19.9% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.

Disclaimer: Mutual Fund investments are subject to market risks. Read all scheme related documents carefully.

Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Investment in the securities is subject to market risks. Read all the related documents carefully before investing.

The securities quoted are for illustration only and are not recommendatory.

This market update was initially published by Livemint.

#MutualFundSahiHai, #KuveraSabseSahiHai!