Top news

Securities and Exchange Board of India (SEBI) in its recent circular states that the use of UPI for individual investors applying for public issues of debt securities, non-convertible preference shares, municipal debt securities, and securitized debt instruments through intermediaries for amounts up to ₹5 lakh will be effective from November 1, 2024.

Western Carriers (India) got listed at a premium of 5.81% over the issue price of Rs.172/- per share. Arkade Developers got listed at a premium of 37% over the issue price of Rs.128/- per share. Northern Arc Capital got listed at a premium of 33.46% over the issue price of Rs.263/- per share. Manba Finance got oversubscribed by 224.05 times. KRN Heat Exchanger got oversubscribed by 212.93 times. Diffusion Engineers got oversubscribed by 27.47 times.

Whiteoak Capital AMC, Groww AMC and Baroda BNP Paribas AMC have launched the NFO for Whiteoak Capital Digital Bharat Fund, Groww Nifty India Defence ETF Fund, and Baroda BNP Paribas Nifty 200 Momentum 30 Fund respectively.

Index Returns

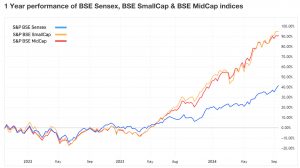

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | 1.5% | 32.8% | 13.6% | 24.3 | 4.0 |

| NIFTY NEXT 50 | 3.1% | 72.1% | 21.7% | 25.4 | 4.0 |

| S&P BSE SENSEX | 1.2% | 29.4% | 17.9% | 25.2 | 4.4 |

| S&P BSE SmallCap | 0.0% | 52.3% | 35.2% | 34.5 | 3.9 |

| S&P BSE MidCap | 0.7% | 53.2% | 26.9% | 43.2 | 7.1 |

| NASDAQ 100 | 1.1% | 36.0% | 12.7% | 41.7 | 3.8 |

| S&P 500 | 0.6% | 33.8% | 10.4% | 29.9 | 5.1 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Mirae Asset Hang Seng Tech ETF FoF | 24.3% | 22.2% | NA |

| Axis Greater China Equity | 11.3% | 9.4% | -4.2% |

| 10.8% | 13.8% | -7.1% | |

| DSP World Mining | 6.7% | 17.6% | 11.8% |

| 5.1% | -1.8% | NA |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Bank Of India ELSS Tax Saver | 1.3% | 48.9% | 21.4% |

| Quant ELSS Tax Saver | 1.1% | 52.8% | 26.4% |

| SBI Long Term Equity | 0.9% | 57.2% | 28.4% |

| 360 One ELSS Tax Saver Nifty 50 Index | 0.9% | 33.6% | NA |

| Navi ELSS Tax Saver Nifty 50 Index | 0.9% | 33.8% | NA |

| Stocks (Market cap > Rs 50k Cr) | 1W | 1Y | 5Y |

|---|---|---|---|

| Vedanta | 14.1% | 129.0% | 36.1% |

| Mahindra & Mahindra | 13.8% | 99.6% | 39.1% |

| Bharat Petroleum | 13.2% | 108.9% | 17.7% |

| GAIL (India) | 12.4% | 95.0% | 23.0% |

| Bharat Heavy Elect | 11.8% | 131.2% | 38.7% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| HSBC Consumption | -2.7% | 54.6% | NA |

| UTI Innovation | -2.2% | NA | NA |

| Motilal Oswal ELSS Tax Saver | -2.1% | 69.6% | 27.7% |

| Axis Nifty Smallcap 50 Index | -2.1% | 56.3% | NA |

| Invesco India Multicap | -2.0% | 50.9% | 21.7% |

| Stocks (Market cap > Rs 50k Cr) | 1W | 1Y | 5Y |

|---|---|---|---|

| PB Fintech | -12.6% | 118.8% | NA |

| Dabur India | -4.8% | 14.0% | 8.7% |

| Avenue Supermarts | -4.5% | 40.4% | 28.2% |

| Bharat Forge | -4.0% | 40.0% | 32.0% |

| Godrej Consumer | -3.9% | 41.9% | 19.6% |

| Most Bought MF | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Flexi Cap | 2.4% | 43.3% | 19.1% |

| Motilal Oswal Midcap | 0.2% | 73.3% | 38.6% |

| Kotak Equity Arbitrage | 0.0% | 8.4% | 6.9% |

| UTI Nifty 50 Index | 1.5% | 34.0% | 14.7% |

| Bandhan Small Cap | 1.7% | 78.0% | 30.9% |

| Most sold MF | 1W | 1Y | 3Y |

|---|---|---|---|

| Edelweiss Arbitrage | 0.0% | 8.2% | 6.8% |

| Sundaram Mid Cap | 0.5% | 57.1% | 27.7% |

| Quant Flexi Cap | 2.0% | 57.8% | 25.8% |

| SBI Magnum Midcap | -0.3% | 38.9% | 24.3% |

| Tata Arbitrage | 0.0% | 8.2% | 6.7% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| Axis Nifty 50 Index | 1.5% | 33.8% | NA |

| Axis Small Cap | -0.3% | 43.1% | 24.8% |

| UTI Nifty Next 50 Index | 1.5% | 72.4% | 22.4% |

| Motilal Oswal Midcap | 0.2% | 73.3% | 38.6% |

| Parag Parikh Flexi Cap | 2.4% | 43.3% | 19.1% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Suzlon Energy | 0.2% | 211.9% | 91.0% |

| 1.0% | 106.5% | NA | |

| Tata Motors | 2.7% | 60.2% | 54.2% |

| Bharat Heavy Electricals | 11.8% | 131.2% | 38.7% |

| Tata Power Co | 10.4% | 86.4% | 49.0% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| NVIDIA Corporation | 4.7% | 179.1% | 95.0% |

| Taiwan Semiconductor Manufact.. | 2.8% | 91.2% | 31.3% |

| Meta Platforms | 1.1% | 89.0% | 26.2% |

| Super Micro Computer | -8.2% | 53.1% | 85.4% |

| Amazon | -1.9% | 47.9% | 16.8% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.

Disclaimer: Mutual Fund investments are subject to market risks. Read all scheme related documents carefully.

Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Investment in the securities is subject to market risks. Read all the related documents carefully before investing.

The securities quoted are for illustration only and are not recommendatory.

This market update was initially published by Livemint.

#MutualFundSahiHai, #KuveraSabseSahiHai!