Top news

Franklin Mutual Fund has announced the payout of the next tranche of Rs 2489 crore to unitholders of the six wound-up schemes. Unitholders can check their payout status here .

RBI has announced measures under Resolution 2.0 framework including ‘Term liquidity’ of Rs 50,000 crore for emergency healthcare services, special long-term repo operations (SLTRO) of Rs 10,000 crore for small finance banks (SFBs) and MSMEs.

Tata Mutual Fund and Parag Parikh Mutual Fund have launched the NFOs -Tata Dividend Yield Fund and Parag Parikh Conservative Hybrid Fund. The NFOs close on 17 May and 21 May respectively.

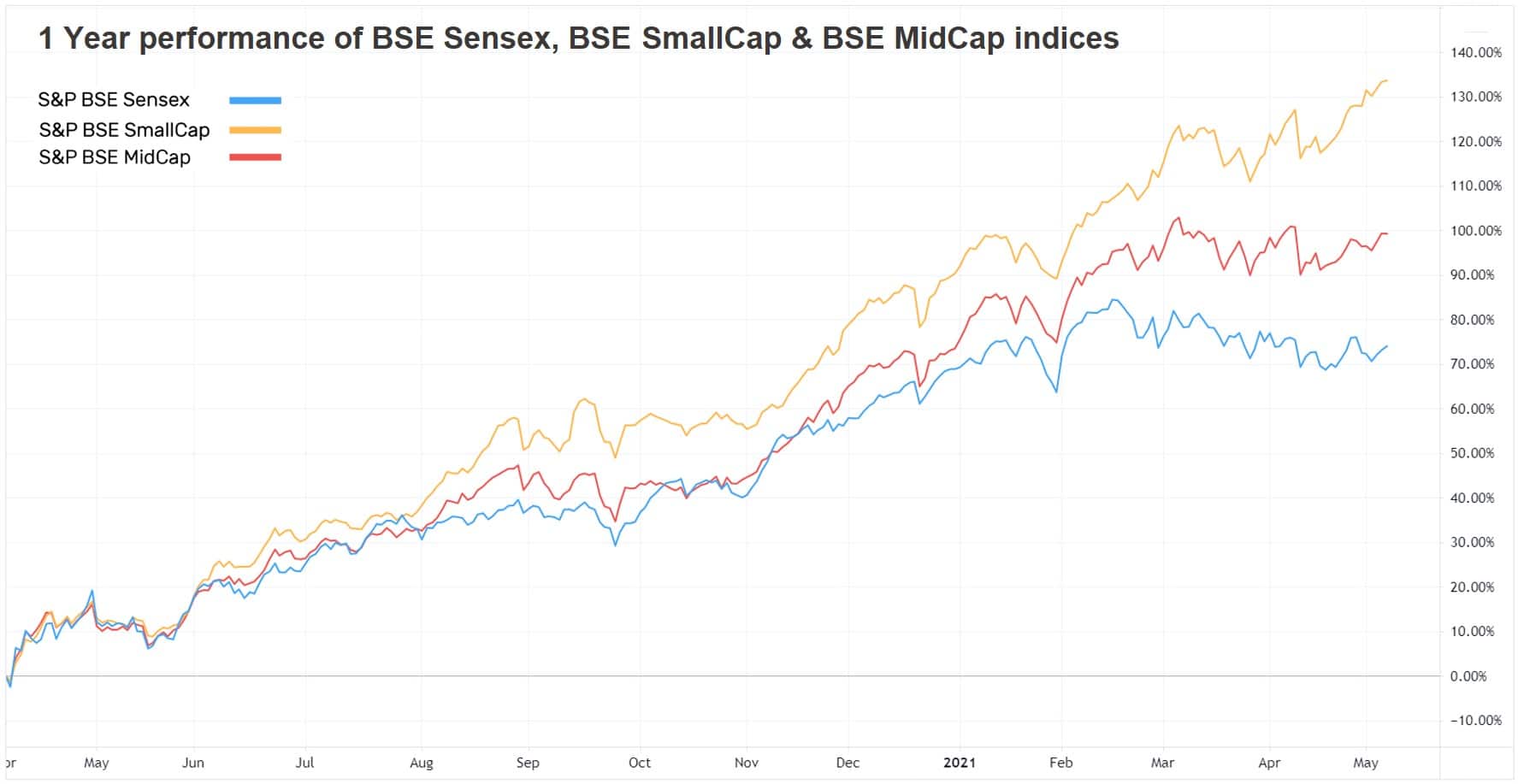

Index Returns

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | 1.3% | 61.0% | 11.4% | 30.2 | 4.2 |

| NIFTY NEXT 50 | 3.0% | 57.2% | 6.2% | 43.0 | 4.8 |

| S&P BSE SENSEX | 0.9% | 56.3% | 11.8% | 31.4 | 3.2 |

| S&P BSE SmallCap | 2.5% | 107.6% | 7.1% | 73.2 | 3.0 |

| S&P BSE MidCap | 1.5% | 80.2% | 7.4% | 56.9 | 3.0 |

| NASDAQ 100 | -1.0% | 50.6% | 26.2% | 36.6 | 8.5 |

| S&P 500 | 1.2% | 46.8% | 16.6% | 30.3 | 4.6 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| SBI Magnum Comma | 6.2% | 105.6% | 17.4% |

| Tata Resources & Energy | 5.0% | 97.2% | 21.1% |

| SBI PSU | 4.9% | 50.8% | 1.3% |

| DSP World Gold | 4.5% | 8.5% | 19.6% |

| 4.3% | 78.2% | 6.1% |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Quant Tax | 6.0% | 131.3% | 27.4% |

| Parag Parikh Tax Saver | 2.6% | 72.5% | NA |

| DSP Tax Saver | 2.2% | 71.5% | 14.50% |

| Quantum Tax Saving | 2.1% | 68.7% | 8.80% |

| 2.0% | 70.0% | 3.1% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Steel Authority Of India | 28.3% | 408.8% | 28.1% |

| NMDC | 20.1% | 152.8% | 17.9% |

| Marico | 15.3% | 55.7% | 15.2% |

| Tata Steel | 14.6% | 325.8% | 31.5% |

| 14.1% | 1213.1% | NA |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| PGIM India Global Equity Opp... | -6.2% | 55.4% | 31.3% |

| Franklin India Feeder US Opp... | -5.1% | 38.1% | 24.2% |

| PGIM India Emerging Markets | -4.8% | 45.8% | 10.0% |

| Edelweiss Greater China Equity | -3.7% | 58.7% | 26.5% |

| -2.9% | 47.1% | 12.5% |

Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| AU Small Finance Bank | -15.3% | 333.2% | NA |

| Bandhan Bank | -10.6% | 19.4% | NA |

| Info Edge (India) | -6.5% | 76.7% | 45.4% |

| Tata Consumer Products | -6.3% | 87.5% | 40.4% |

| -4.5% | 33.4% | 32.4% |

Bought and Sold

| Bought on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Flexi Cap | 1.2% | 73.9% | 21.1% |

| UTI Nifty Index | 1.3% | 62.5% | 12.5% |

| Axis Bluechip | 1.3% | 50.0% | 15.8% |

| IPRU Commodities | 9.0% | 189.1% | NA |

| -1.0% | 42.0% | NA |

| Sold on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| PGIM India Flexi Cap | 1.3% | 87.3% | 19.3% |

| Quant Active | 5.6% | 119.6% | 25.3% |

| IPRU Technology | 2.1% | 131.4% | 29.50% |

| Invesco India Opportunities | 0.3% | 54.5% | 10.5% |

| 0.0% | 3.8% | 5.8% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| Tata Digital India | 1.5% | 110.3% | 27.1% |

| Parag Parikh Flexi Cap | 1.2% | 73.9% | 21.1% |

| IPRU Technology | 2.1% | 131.4% | 29.50% |

| Mirae Asset Emerging Bluechip | 2.0% | 78.9% | 18.3% |

| -6.2% | 55.4% | 31.3% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Reliance Industries | -4.5% | 33.4% | 32.4% |

| Adani Green Energy | 4.4% | 421.9% | NA |

| Infosys | -0.2% | 103.0% | 19.60% |

| Tata Consultancy Services | 0.6% | 64.5% | 21.8% |

| -3.9% | 49.5% | 20.8% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Tesla | -5.2% | 310.5% | 73.3% |

| Apple | -1.0% | 67.9% | 41.2% |

| Amazon.com | -5.1% | 38.3% | 37.3% |

| Microsoft Corporation | 0.1% | 36.6% | 38.0% |

| -1.5% | 13087.9% | 54.6% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!