Sensex and NIFTY are the two most important stock market benchmarks in India. Sensex is a market-weighted stock index of 30 large, established companies on the Bombay Stock Exchange (BSE), while NIFTY is a similar index of 50 stocks on the National Stock Exchange (NSE). These indices serve as benchmarks to measure the performance of the overall stock market as well as an individual’s investments. Sensex and NIFTY are calculated based on the market capitalisation and financial performance of the considered companies. So, let’s find out how you can understand market trends and make informed investment decisions with the help of such financial benchmarks.

What Is A Financial Benchmark?

A financial benchmark is a standard used to compare the performance of investments or investment managers. It is usually a point of reference for evaluating whether an investment strategy has performed as expected or better. Financial benchmarks are carefully selected to categorise an investment style and may consist of one or more market indices.

What Are Market Indices?

Market indices serve as an indicator of trends in a market or economy. It is a collection of securities that represents a particular market or market segment. Indices are generally used as tools for benchmarks and as bases for investment products like Index funds.

Here are some major indices that are used to track different segments of the market.

BSE Sensex

BSE Sensex, or the Bombay Stock Exchange (BSE) Sensitive Index. It tracks the performance of 30 large, financially sound companies listed on the BSE. It is used as an indicator of the overall health and sentiment of the Indian economy.

NIFTY 50

Similar to Sensex is the NIFTY 50, which includes stocks listed on the National Stock Exchange (NSE) and shows a big picture of the market trends. It tracks the performance of the 50 largest and most liquid Indian companies across various sectors.

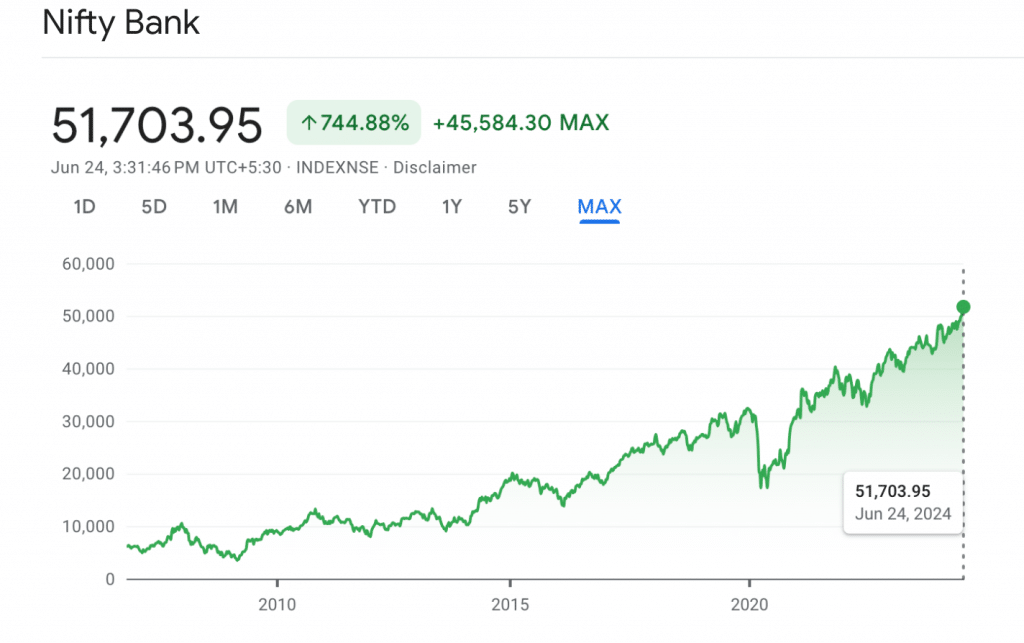

NIFTY Bank

The NIFTY Bank is an index that tracks the performance of the 12 most liquid and large capitalised Indian banking stocks traded on the National Stock Exchange (NSE). It serves as a benchmark for you, as an investor to analyse the banking sector and identify potential investment opportunities. NIFTY Bank index is mostly used for various purposes such as benchmarking fund portfolios and providing a reference point for market intermediaries to track the performance of the banking industry.

NIFTY IT

It is a sectoral index on the NSE that tracks the performance of the information technology (IT) sector in India. It comprises the top 10-15 IT companies listed on the NSE, providing a benchmark for the overall IT industry’s stock market performance.

S&P 500

This index tracks the performance of 500 of the largest publicly traded companies in the United States. It is a stock market index that is considered a barometer for the entire US equity market. The index is measured by weights as per the market capitalisation of its constituent companies, meaning larger companies have a greater influence on the index’s direction.

VIX

The VIX, formally known as the Chicago Board Options Exchange (CBOE) Volatility Index tracks the expected volatility of the S&P 500 index over the next 30 days. It is a real-time market index that represents the market’s expectations for volatility based on S&P 500 index options.

Various other indices also measure different segments of the market. Such as mid cap index and small cap index track the performance of mid-sized and smaller companies. So, they offer insights into more volatile but potentially rewarding market segments.

While indices can be used as benchmarks, not all benchmarks are indices. Benchmarks can also be simple measurements such as the performance of a treasury bill or the average return of a sector.

What Is FBIL? What Role Does FBIL Play In The Financial Market?

Financial Benchmarks India Private Ltd. (FBIL) is an independent benchmark administrator for various financial instruments in India.

Here are the roles and responsibilities of FBIL:

1/ It is responsible for administering benchmarks related to money market interest rates, fixed income (government securities), foreign exchange and their derivatives in India. This involves creating, maintaining and reviewing these benchmarks from time to time to make sure they reflect the market accurately.

2/ FBIL manages benchmarks, including planning for the cessation of old benchmarks and transitioning to new ones. They also assess and introduce new benchmarks based on the emerging needs of end-users in the market.

3/ FBIL is authorised by the Reserve Bank of India (RBI) to operate as a benchmark administrator under Section 45W of the RBI Act, 1934. This authorisation includes the right to publish and manage significant financial benchmarks.

Which are the significant benchmarks that have been notified by the RBI?

A ‘Significant benchmark’ is any benchmark notified by Reserve Bank of India as important under the Financial Benchmark Administrators (Reserve Bank) Directions, 2019 considering its use, robustness and credibility in domestic and international markets. These benchmarks contribute significantly to the financial stability of the market.

Here are the benchmarks notified by RBI:

1/ Overnight Mumbai Interbank Outright Rate (MIBOR)

2/ Modified Mumbai Interbank Forward Outright Rate (MMIFOR)

3/ USD/INR Reference Rate

4/ Treasury Bill (T-Bill) Rates

5/ Valuation of Government Securities (G Sec)

6/ Valuation of State Development Loans (SDL)

Why Are Benchmarks Important In Investing?

Benchmarks are important for the following three reasons:

1/ Performance Measurement- They allow you, as an investor to measure the success of your investments against a relevant market.

2/ Risk Management- By comparing investments against benchmarks, you can estimate risk levels of your investments.

3/ Strategic Planning- Benchmarks help in understanding broader market trends, helping you plan your strategies.

Hence, you can start by tracking these indices through financial news or investment apps. Since index funds track the performance of these benchmarks, they are the best way to start your investments.

Start investing in Index Funds

How Is A Benchmark Calculated?

Benchmarks like the Sensex or Nifty are calculated based on the market capitalisation or price movements of their stocks. They combine the performance of selected stocks to provide a picture of market trends and the economic health of sectors or the entire market.

Simply speaking, they represent the performance of a set of securities meant to replicate a particular area of the market. Hence, indices can be calculated in many ways:

1/ Price-weighted index- Every stock influences the index in proportion to its price per share.

2/ Market cap-weighted index- Companies with higher market caps have a greater effect on the index’s performance.

3/ Equal-weighted index- All companies have the same influence on the index regardless of its size.

How Do Benchmarks Differ Across Asset Classes?

Benchmarks vary across asset classes. For equities, benchmarks like the Sensex or Nifty reflect stock market performance. On the other hand, for bonds, benchmarks might be based on interest rates or other debt instruments.

What Is Benchmark Rebalancing?

Benchmark rebalancing is the time-to-time adjustment of the constituents of a benchmark index. It makes sure the index accurately reflects the current market dynamics. Indices like NIFTY and Sensex regularly rebalance their indices by adding, removing or changing the weightage of stocks based on factors like market capitalisation, liquidity, and sector representation. This maintains the index’s relevance and ensures it continues to be an accurate benchmark for the broader market.

How Does Benchmark Rebalancing Help With Index Funds?

Passive funds, such as index funds, aim to replicate the performance of a specific benchmark. For these funds, rebalancing is important to ensure that the fund’s holdings mirror the changes in the benchmark index.

Here are the ways how benchmark rebalancing can help with index funds:

1/ Alignment With Index- Rebalancing ensures that the passive fund continues to accurately reflect the composition of the underlying index it tracks. This alignment is crucial for the fund’s performance to closely match the index.

2/ Risk Management- By regularly rebalancing, index funds maintain their risk profile according to the index. Without rebalancing, the fund could drift from its original risk exposure and it would be difficult to ascertain its risk.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch here: All About Sectoral & Thematic Funds

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.