Financial needs can arise unexpectedly for anyone, whether it’s for a medical emergency, home renovation, a sudden job loss, car repairs etc. This is where personal loans come into play.

Personal loan offer a quick and convenient solution to meet urgent financial requirements. In India, the demand for personal loans is very high, informal personal loans with high interest rates have caused concerns for the government and RBI in the past. However, with India’s shift towards a digital economy and a stronger financial sector, personal loans have become more secure and dependable. Obtaining funds through personal loans is easier than ever before.

As India moved towards a digital economy and a robust financial sector, now personal loans are much more secure and reliable. It has become an easy and convenient way to obtain funds with personal loans due to their unsecured nature.

Let us understand all about personal loans in India;

But before we start it is important to understand the need for long term wealth building. One simple way to achieve this is through SIP (Systematic Investment Plan). SIP offers a simple and low-effort method to build wealth gradually over time. So, while personal loans may address immediate needs, don’t forget to lay a strong foundation for your financial future with SIP.

What are Personal Loans?

Personal loans are unsecured loans offered by banks, financial institutions, or online lenders, allowing borrowers to access funds without providing any collateral. Unlike home or auto loans, personal loans can be used for various purposes, including debt consolidation, travel expenses, or even funding a wedding.

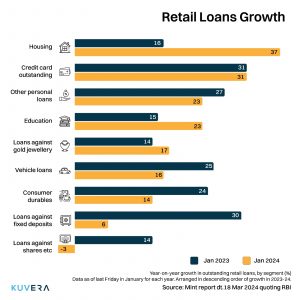

Growth in Personal Loans in India

In recent years, India has witnessed a significant surge in the demand for personal loans. RBI said that the personal loan segment grew 21 per cent year-on-year (Y-o-Y) in January, compared to the 22.3 per cent Y-o-Y growth registered in October 2023.

The latest CRIF-FIDC data reveals that non-banking finance companies (NBFCs) in India disbursed a substantial amount of personal loans in the last quarter of 2023-24 amounting to ₹64,778.27 crores, surpassing auto, education, gold, and healthcare loans in volume, as reported by Mint.

With the rise of digital lending and convenient application processes, accessing personal loans has become easier than ever before.

Pros and Cons of Personal Loans

Pros

- Quick Access to Funds: Personal loans offer immediate access to funds, making them ideal for addressing urgent financial needs. With digital lending, it has become a matter of few clicks to avail the funds.

- No Collateral Required: Unlike secured loans, personal loans do not require collateral, minimizing the risk for borrowers.

- Flexible Usage: Borrowers have the flexibility to use personal loan funds for any purpose, giving them freedom in financial decision-making.

Cons

- Higher Interest Rates: Personal loans typically come with higher interest rates compared to secured loans, resulting in higher overall borrowing costs.

- Risk of Overborrowing: Easy access to funds also puts a threat of taking excessive loans to fund an unaffordable lifestyle. Taking too many personal loans develops a dependance on loans.

- Impact on Credit Score: Defaulting on personal loan payments can negatively impact the borrower’s credit score, affecting future borrowing capabilities.

How to Avail Personal Loans Online?

With the advent of digitalization, applying for personal loans has become more convenient than ever. Online platforms and mobile apps such as Cred allow borrowers to compare loan offers, submit applications, and receive approval within minutes. To avail personal loans online, borrowers need to follow a few simple steps:

- Research and Compare: Explore various lenders and loan products to find the best fit for your financial needs.

- Check Eligibility: Review the eligibility criteria set by lenders to ensure you meet the requirements.

- Submit Application: Complete the online application form with accurate personal and financial information.

- Provide Documentation: Upload necessary documents, such as identity proof, address proof, and income documents, as per the lender’s requirements.

- Await Approval: Once the application is submitted, lenders will review the information and provide approval within a short timeframe.

5 Things to Remember Before Availing Personal Loans

Before jumping into the world of personal loans, it’s very important to consider the following factors:

- Assess Financial Health: Evaluate your current financial situation, including income, expenses, and existing debts, to determine your repayment capacity. Like any other loan, personal loans also affect your credit score. Repaying them in time is imperative to maintain a good credit score.

- Compare Interest Rates: Compare interest rates and loan terms offered by different lenders to find the most competitive option.

- Read the terms and conditions thoroughly: Thoroughly review the loan agreement, including terms and conditions, fees, and charges, to avoid any surprises later on.

- Plan for Repayment: Create a repayment plan that aligns with your budget and financial goals to ensure timely repayment of the loan.

- Beware of Scams: Personal lending scams have increased in recent years. Be cautious of fraudulent lenders or phishing scams when applying for personal loans online, and only trust reputable financial institutions.

Conclusion

Personal loans can be valuable financial tools when used wisely, providing quick access to funds for various needs. However, it’s essential to understand the pros and cons, conduct thorough research, and make informed decisions before availing personal loans. By following the tips mentioned above and staying vigilant throughout the process, borrowers can navigate the world of personal loans with confidence and financial prudence.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch here: Index funds explained

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.