In recent years, credit cards are becoming more and more popular in the Indian market. While debit cards have always been India’s favorite, the newer generation has started favoring credit cards.

According to data released by the RBI, the value of credit card transactions in India was reported at 1,186,843.237 INR mn in Feb 2023.

This is a decrease from the previous 1,276,823.956 INR mn for Jan 2023. Credit card transactions reached an all-time high of 1,290,482.019 INR mn in Oct 2022 and a record low of 18,290.000 INR mn in Apr 2004.

The following graph shows the fluctuation in the value of credit card transactions in the past year from March 2022 to February 2023.

Here is the increase in volume of credit cards in the past year from March 2022 to April 2023.

Types of credit cards

Several types of credit cards are available in India, each tailored to meet consumers’ specific needs and preferences. Here are some of the most common types of credit cards in India:

- Rewards credit cards: These cards offer reward points for every purchase made using the card. These points can be redeemed for various rewards such as discounts on purchases, gift vouchers, and air miles.

- Cashback credit cards: These cards offer a certain percentage of cashback on every card purchase. This cashback is credited back to the cardholder’s account, thereby reducing the overall cost of the purchase.

- Travel credit cards: These cards are designed for frequent travelers and offer benefits such as air miles, airport lounge access, and travel insurance.

- Premium credit cards: These cards are targeted at high-net-worth individuals and offer exclusive benefits such as access to premium airport lounges, concierge services, and higher credit limits.

- Fuel credit cards: These cards offer discounts on fuel purchases made at select petrol pumps.

- Business credit cards: These cards are designed for business owners and offer benefits such as expense tracking, cashback on business expenses, and higher credit limits.

- Co-branded credit cards: These cards are offered in partnership with a particular brand or retailer and offer rewards and discounts when shopping at the partner brand’s stores or websites.

Top banks offering credit cards in India

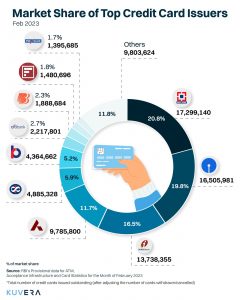

Before we go ahead and talk about the top banks offering credit cards in India and their types, let’s take a look at the market share of the total credit cards of various banks in India.

As you can see in the above graph, SBI credit cards and HDFC credit cards are the most commonly used credit cards in India. Now let us take a look at various types of credit cards offered by HDFC and SBI.

HDFC credit cards

With 20.8% of the market share, HDFC credit cards are the most popular among credit card users in India. Here are some of the most popular HDFC credit cards available and their features;

1) Platinum Times Credit Card

- zero joining fees

- Complimentary Times Prime annual Membership and E-Vouchers Worth Rs. 5000.

- 3 Reward Points on every spend of Rs 150

- 10 reward points on every weekday dining spent of Rs 150

2) HDFC Bank Regalia Credit Card

- 2,500 bonus Reward points

- 4 reward points every time one spends Rs. 150

- Rs. 2,500 + taxes

- Up to 6 complimentary lounge access every year to over 1,000 airport lounges all across the world

- Exclusive insurance benefits

3) Business MoneyBack

- 10X CashPoints on Amazon, BigBasket, Flipkart, Reliance Smart SuperStore & Swiggy

- 5X CashPoints on EMI spends at merchant locations

- 2 CashPoints on all other spends ( Excluding fuel, Wallets loads )

- Gift vouchers worth upto ₹2000 annually

Best SBI credit cards

There is no explicit parameter to decide whether a credit card is the best credit card of them all. The best SBI credit card will be the one that suits your needs and requirements specifically. Below are some of the most popular SBI credit cards and some of their attractive features:

1) SBI Elite card

- Welcome e-Gift Voucher worth Rs. 5,000 on joining

- Get free movie tickets worth Rs. 6,000 every year

- Earn upto 50,000 Bonus Reward Points worth Rs. 12,500/year

- Complimentary membership to Club Vistara and Trident Privilege program

2) SBI Card Prime

- Welcome e-Gift Voucher worth Rs. 3,000 on joining

- Spend linked Gift Vouchers worth Rs. 11,000

- 10 Reward Points per Rs. 100 spent on Dining, Groceries, Departmental stores and Movies

- Complimentary International and Domestic Airport Lounge access

3) BPCL SBI Credit card

- 2,000 Activation Bonus Reward Points worth Rs.500 as a welcome gift.

- 4.25% Value back – 13X Reward Points on every Rs.100 spent on fuel purchases.

- 5X Reward Points on every Rs.100 spent at Groceries, Departmental stores, Movies & Dining

4) SBI SimplyCLICK Credit Card

- Get Amazon gift card worth Rs.500* on payment of the Annual Fee of Rs. 499 +taxes.

- 5X Reward Points on online spends

- 10X Reward Points on online spending with exclusive partners

- E-vouchers worth Rs.2000 on annual online spends

5) SBI SimplySAVE Credit Card

- 2,000 bonus reward points on spends of Rs. 2,000 in first 60 days

- Enjoy 10 Reward Points per Rs.150 spent on Dining, Movies, Departmental Stores and Grocery Spends

- Annual fees reversal on spends of Rs. 1,00,000 and above

- 1% fuel surcharge waiver across all petrol pumps

Conclusion

Credit cards have become an essential financial tool for many consumers in India. With a variety of benefits and features, credit cards offer convenience, flexibility, and rewards to users. However, it is important to use credit cards responsibly, pay bills on time, and avoid excessive debt. By doing so, users can enjoy the benefits of credit cards while avoiding the risks and financial difficulties that can arise from misusing them. As with any financial tool, it is important to understand the terms and conditions of credit cards and to choose one that best fits your needs and financial situation.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube: Stocks vs. Mutual Funds

Start investing through a platform that brings goal planning and investing to your fingertips. Visit Kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.

#MutualFundSahiHai #KuveraSabseSahiHai!