Tata Consultancy Services (TCS) is an Indian multinational corporation that provides a wide range of information technology (IT) services, including consulting, software development, and business process outsourcing. TCS is headquartered in Mumbai, India and has offices in more than 50 countries around the world. It is a subsidiary of Tata Sons, one of India’s largest conglomerates. TCS is one of the largest IT services companies in the world and is listed on the Bombay Stock Exchange and the National Stock Exchange of India.

History of TCS

Tata Consultancy Services (TCS) was founded in 1968 as a division of Tata Sons, one of India’s largest conglomerates. The company was established to provide computer services to the Tata Group, which was one of the first Indian conglomerates to recognize the potential of information technology.

In the early years, TCS focused on providing a wide range of IT services, including software development, systems integration, and consulting. In the 1980s, the company started to expand its operations beyond India and opened offices in various countries around the world.

In the 1990s, TCS continued to expand its services and became one of the largest IT services companies in India. In recent years, the company has focused on digital transformation and has made several acquisitions to expand its capabilities in areas such as artificial intelligence, cloud computing, and data analytics. Today, TCS is a global company with clients in more than 50 countries and a presence in more than 20 countries around the world.

Growth of TCS

Tata Consultancy Services (TCS) has experienced significant growth since its founding in 1968. The company has consistently been one of the fastest-growing IT services companies in India and has also expanded its operations globally.

One of the key factors in TCS’ growth has been its ability to adapt to changing market conditions and to provide a wide range of services to its clients. The company has a diverse client base and has a strong track record of delivering high-quality services, which has helped it to win new business and maintain long-term relationships with its clients.

TCS has also been successful in building strong relationships with its clients and in delivering high-quality services. The company has a strong track record of completing projects on time and within budget, which has helped it to win new business and maintain long-term relationships with its clients.

In recent years, TCS has focused on digital transformation and has made several acquisitions to expand its capabilities in areas such as artificial intelligence, cloud computing, and data analytics. These are expected to be major drivers of growth in the technology industry in the coming years, and TCS is well positioned to take advantage of these trends.

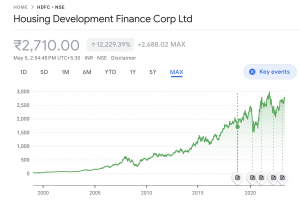

Growth of TCS share price

Tata Consultancy Services (TCS) is a publicly traded company listed on the Bombay Stock Exchange and the National Stock Exchange of India. Its share price has fluctuated over time, reflecting the company’s financial performance, market conditions, and investor sentiment.

In the early years of the company, TCS’ share price was relatively stable, but it started to rise significantly in the late 1990s as the company experienced rapid growth and increasing investor interest. In the 2000s, the company’s share price continued to rise, reaching a peak in 2007.

Since then, the share price has fluctuated somewhat, reflecting changes in the global economy and the technology industry. In general, the share price has trended upwards over the long term, reflecting the company’s strong financial performance and growth. TCS share price peaked on 7th Jan 2022 when the price touched INR 3853.50. Currently ( as of 5th May 2023) TCS share price sits at INR 3254.90.

Check out the latest TCS share price here.

It is important to note that the share price of a publicly traded company can be influenced by a wide range of factors, and past performance is not necessarily indicative of future results. It is always important for investors to carefully consider their own investment objectives and to consult with a financial professional before making any investment decisions.

Should you invest in TCS shares?

There are several factors that you may want to consider when evaluating whether to invest in TCS’ shares, including the company’s financial performance, market conditions, and potential risks. Some other things to consider may include:

The company’s business model and growth prospects: TCS is a leading provider of information technology services, including consulting, software development, and business process outsourcing. It has a diverse client base and a strong track record of growth, which could make it an attractive investment opportunity.

Market conditions: The technology industry is subject to rapid change, and the demand for TCS’ services may be affected by trends in the market. It is important to consider how the company is positioned relative to its competitors and how it is likely to be impacted by changes in the market.

Potential risks: Investing in any company carries some level of risk. It is important to consider the potential risks associated with investing in TCS’ shares, such as market, credit, and liquidity risks, as well as the company’s ability to manage these risks.

Again, it is important to carefully consider your own investment objectives and to consult with a financial professional before making any investment decisions.

Be updated with the latest development on TCS share prices here, before you start investing.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch here: ELSS: Saving tax through mutual funds

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today. #MutualFundSahiHai #KuveraSabseSahiHai