Yes Bank Limited is a private sector bank in India. It was founded in 2004 by Rana Kapoor and Ashok Kapoor. The bank offers a wide range of banking and financial services, including retail banking, corporate banking, and investment banking. The bank’s retail banking services include a variety of deposit and loan products for individuals and small businesses, such as savings accounts, current accounts, fixed deposits, personal loans, and home loans. The bank also offers wealth management, credit cards, and insurance products. Corporate banking services include corporate lending, working capital financing, trade finance, and cash management services.

Yes Bank is headquartered in Mumbai and has a significant presence across India, with over 1,000 branches and 14,000 ATMs across the country. The bank has also been expanding overseas, with representative offices in Dubai, Abu Dhabi, and Singapore.

Yes Bank was considered one of the fastest-growing private sector bank in India and a darling of India’s investors for many years. However, recently in 2020, the bank faced some severe financial crisis, caused by a combination of factors, including inadequate risk management, poor corporate governance, and a sudden withdrawal of deposits. The Reserve Bank of India (RBI) and the government of India intervened to stabilize the bank and this led to the government-approved rescue plan for the bank. Since then, new management took over and the bank is now under the process of restructuring and recapitalization.

History of Yes bank

The bank was set up as a private sector alternative to state-run banks, with the goal of providing efficient, customer-centric banking services.

In its early years, the bank focused on building a strong retail banking franchise and expanding its branch network across India. The bank also diversified into other businesses, such as investment banking, wealth management, and insurance.

In the 2010s, Yes Bank rapidly expanded its business and became one of the fastest-growing private sector banks in India. The bank also expanded its international presence, opening representative offices in Dubai, Abu Dhabi, and Singapore. During this time, Yes Bank also raised capital through several equity offerings, which helped to support its growth.

However, in 2019, there were concerns over the bank’s governance and regulatory compliance practices, which led to the resignation of its founder and Managing Director Rana Kapoor and a new management took over.

In 2020, the bank faced a severe financial crisis due to a combination of factors, including inadequate risk management, poor corporate governance, and a sudden withdrawal of deposits. This led to a severe liquidity crisis and the bank was unable to meet its financial obligations. In March 2020, the Reserve Bank of India (RBI) and the government of India intervened and announced a rescue plan for the bank. Under the plan, a new board of directors was appointed and SBI (State Bank of India) was given the task of finding a suitable investor for the bank. Since then the bank has undergone a significant restructuring and recapitalization process and is now under the new management and has been working on to improve its operations and financial position.

Yes Bank share price

Yes bank has expanded its branch network across the country and also increased its assets and customer base. However, in recent years, the bank has faced financial difficulties, leading to a government-led bailout and a change in leadership. It’s facing a lot of crisis and currently the government of India has taken control of the bank operations which has reflected in it’s share price.

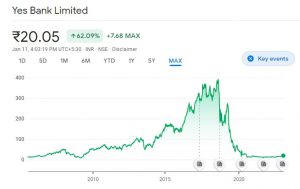

As shown in the above graph Yes Bank share prices have fallen in the recent years. Yes Bank share price reached it’s peak in August, 2018 when the value touched INR 382.85. Currently, Yes bank share price is at INR 20.05 ( as of 11th Jan, 2023).

To check the Yes bank share price today, click here.

Should you invest in Yes Bank shares?

Investing in any particular company requires a lot of research and it’s always recommended to do your own research, consult with a financial advisor and consider your own risk tolerance and investment goals before making any investment decisions. You should also consider that the bank has been facing financial difficulties in recent years, which have led to a government-led bailout and a change in leadership. The government has taken control of the bank operations and trying to revive it. The future performance of the bank is uncertain.

Any investment decision should be taken at investor’s own discretion after considering all the various factors involved. It is always recommended to consult with a financial advisor before making any investment decisions.

Check the latest development related to Yes Bank share price, here.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

5 practical tips to start your retirement planning

Start investing through a platform that brings goal planning and investing to your fingertips. Visit Kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.