Zomato is a food delivery and restaurant discovery platform that operates in various countries around the world. It allows users to browse and order food from a variety of restaurants, as well as get information about menus, ratings, and reviews. Zomato also provides a platform for restaurants to manage their online presence, including taking online orders and reservations. The company was founded in 2008 and is headquartered in Gurgaon, India.

Growth of Zomato

Zomato grew through a combination of strategic partnerships, acquisitions, and expanding into new markets. The company began by focusing on the Indian market, where it quickly became a popular platform for finding and ordering food from local restaurants. As it gained traction, Zomato began expanding into other countries in the region, including the United Arab Emirates, Qatar, and Lebanon. In the years that followed, the company continued to expand globally, entering new markets in Europe, the Americas, and Asia.

One of the key ways Zomato grew was through acquisitions of other food delivery and restaurant discovery platforms. For example, in 2015, the company acquired UrbanSpoon, a popular restaurant discovery platform in the United States. This allowed Zomato to enter the US market and quickly establish a strong presence there. In the years that followed, the company made several more acquisitions, including Maple POS, a point-of-sale system provider, and Runnr, an Indian food delivery company.

In addition to acquisitions, Zomato also grew through strategic partnerships with restaurants and food delivery companies. By working closely with these partners, the company was able to expand its reach and offer a wider range of food and delivery options to its users.

Overall, Zomato’s growth can be attributed to a combination of factors, including a strong focus on the customer experience, a commitment to innovation, and a willingness to adapt and evolve as the market changed.

Zomato IPO

Zomato went public in April 2021 through an initial public offering (IPO) on the National Stock Exchange of India (NSE) and the Bombay Stock Exchange (BSE). The IPO was oversubscribed, with the company receiving strong demand from investors.

In the lead up to the IPO, Zomato raised approximately $250 million in a pre-IPO funding round, valuing the company at around $5.4 billion. The IPO was priced at INR 705 ($9.50) per share, and the company sold about 12.3 million shares, representing about 5.4% of its total equity.

After the IPO, Zomato’s shares began trading on the NSE and BSE, and the company’s valuation reached around $7.8 billion. The IPO was seen as a success, and Zomato’s shares have performed well in the months following the listing.

Check the latest Zomato share price here.

Zomato share price

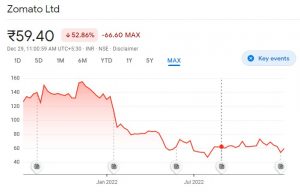

The share price of Zomato, a food delivery and restaurant discovery platform, has fluctuated since it went public in April 2021. The company’s shares began trading on the National Stock Exchange of India (NSE) and the Bombay Stock Exchange (BSE) at INR 705 ($9.50) per share, and the price has risen and fallen in the months since the IPO.

Zomato share price it the peak in November 18th 2021, it has fallen ever since and currently(29th Dec, 22) Zomato share price stands at INR 59.35.

Check the latest Zomato share price here.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch : Importance of Financial Planning

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today. #MutualFundSahiHai #KuveraSabseSahiHai