India’s financial world has seen tremendous changes in the recent year. As per AMFI, the AUM of the Indian MF Industry has grown from ₹7.66 trillion as on August 31, 2013 to ₹46.63 trillion as on August 31, 2023 more than 6 fold increase in a span of 10 years.

With the growth in mutual fund sector, various related sector are also growing. One of these is the loans on mutual funds. There is another similar sector which has been growing steadily. Annual financial liabilities of households rose by 5.8 per cent of GDP in FY23, compared with 3.8 per cent in FY22 as per RBI.

The need of convenient borrowing options has been on the rise. Taking loans against mutual funds has emerged as a viable option for individuals looking to meet their immediate financial needs.

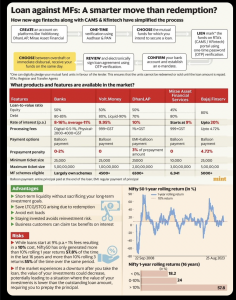

While this avenue has traditionally seen limited interest due to its lower profitability for banks, the game is changing. Fintech companies and Non-Banking Financial Corporations (NBFCs) are reshaping the landscape, making loans against mutual funds a compelling choice.

In this blog post, we will explore the ins and outs of taking a loan against your mutual funds and help you decide if it’s the right choice for you.

The Case For Loans Against Mutual Funds

Competitive Interest Rates: One of the most enticing aspects of opting for a loan against mutual funds is the attractive interest rates. Typically ranging between 9% to 11%, these rates are substantially lower than those of personal loans or credit cards. This translates into significant savings on interest payments over time.

Quick and Convenient Approval: Fintech companies have streamlined the loan approval process, making it swift and hassle-free. Integration with platforms like CAMS and Kfin allows for seamless online approval, reducing the waiting time associated with traditional loan applications.

Acts as an Overdraft (OD): Loans against mutual funds function like an overdraft facility. This means you can repay the loan amount at your convenience, without stringent repayment schedules. It offers flexibility to manage your finances efficiently.

Prevents Early Redemption: For those who rely on mutual funds for their financial goals, taking a loan against your investments can be a lifesaver. It prevents the need for early redemption of your mutual funds, allowing your investments to continue compounding over time.

Tax Efficiency: Loan against mutual funds can be tax-efficient. Since you are not selling your mutual fund units, you avoid capital gains tax. This strategy allows you to maximise your returns and reduce your overall tax liability.

The Case Against Loans Against Mutual Funds

While loans against mutual funds offer several benefits, it’s essential to consider the potential drawbacks:

Return Uncertainty: Mutual funds’ returns are subject to market volatility. Historically, only about 50% of the time have mutual fund returns exceeded 10% on a one-year basis. This means that during market downturns or periods of low returns, your loan may not be adequately covered by your mutual fund’s performance.

Rolling Forward the Loan: To mitigate market fluctuations, some borrowers choose to roll forward their loans until their mutual funds recover. However, this strategy can lead to extended periods of no returns, which may not align with your financial goals.

In conclusion, taking a loan against mutual funds can be a sensible option, offering competitive interest rates, flexibility, and tax advantages. However, it’s crucial to weigh the potential risks, particularly the uncertainty of mutual fund returns, before proceeding.

Before taking any financial decision, including loans against mutual funds, it’s advisable to consult with a financial advisor who can assess your unique circumstances and guide you towards the most suitable choice. Remember, your financial well-being is a journey, and each decision should align with your long-term goals and risk tolerance.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.