Income tax is applicable on any income earned in India. The taxation rules applicable for different...

Tax

Lo & behold, Taxpayers! The tax-saving season is upon us– count your blessings and...

International investing is a great way to provide much-needed portfolio diversification to your...

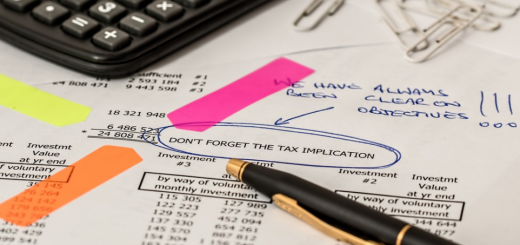

Investments and tax planning go hand in hand. When you invest in a scheme, you usually look for two...

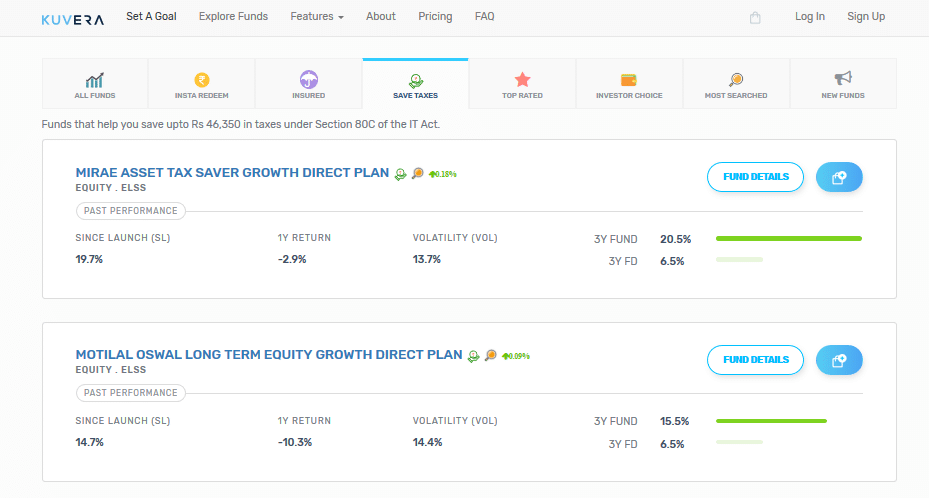

Equity Linked Saving Schemes (ELSS) are a category of Mutual Funds that get special tax treatment...

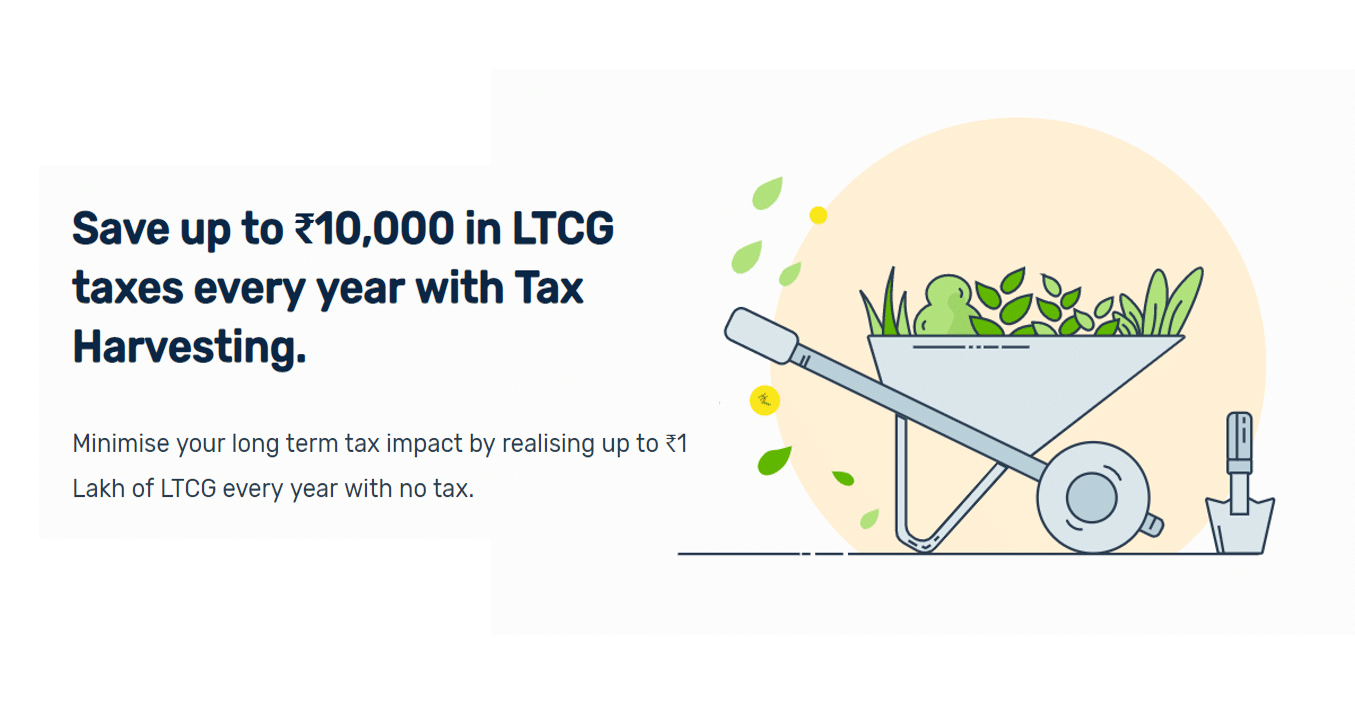

Tax Harvesting - Reduce your LTCG taxes for higher returns Last year a 10% Long Term Capital Gains...

Tushar is a personal finance enthusiast who loves to write on money, savings, investments and...

Tushar is a personal finance enthusiast who loves to write on money, savings, investments and...

About the author: Chirag Bogra, 29 Years, is a Sr. Big Data Architect at American Express and an...

Tushar is a personal finance enthusiast who loves to write on money, savings, investments and...