Zen and the art of investing – simple stories to understand markets and our reaction to them!

Ch 1: The simplest things are the hardest

Ch 3: Do you have an information advantage to beat the markets?

Ram and Shyam enrolled for an experiment to make some extra money.

In the experiment, they were shown a series of pictures of a healthy or a sick cell and their job was to distinguish which is which. They were given no instructions on how to identify a healthy cell. After each answer either a light marked “right” or one marked “wrong” lit up.

Over time they were asked to come up with their own “strategy” to identify a healthy cell.

The catch was that only Ram received accurate feedback.

When Ram chose correctly, the “right” button lit up and if he was wrong, the “wrong” button lit up.

Shyam, on the other hand, got random feedback. There was no correlation between what he chose and the feedback he received. The feedback he received was garbage.

By the end of the experiment, Ram could identify a healthy cell at an 80% success rate while for Shyam it was 50%, the same as chance since the feedback he got was garbage. So far so good.

In the next step in the experiment, both Ram and Shaym were asked their “strategy” to identify a healthy or sick cell?

Ram, who got accurate feedback, had a simple strategy to identify healthy cells.

Shyam, who received garbage feedback, created a complicated strategy to identify healthy cells. Shyam’s complex strategy accounted for all the inconsistent feedback he had received. The feedback he received was wrong, but Shyam did not know that.

When Ram and Shaym discussed their theories with each other a weird thing happened.

Instead of Shyam applauding the beauty and simplicity of Ram’s approach, it was Ram who was impressed with the complicated and unreliable strategy Shyam had built.

Only a final step remained now to conclude the experiment.

Ram and Shyam were asked to identify a series of cells as healthy and sick again. This time both were given accurate feedback.

Shyam convinced that his complicated theories were correct, kept guessing at no better than 50%. Even accurate feedback could not change his mind to rethink his approach.

Worryingly Ram, enamoured by the “brilliant” complexity of Shyam’s theories, tried to use some of the same in his responses. As a result, his accuracy fell from 80% to a little over 50%.

While Ram and Shyam are fictional such a study was indeed conducted by Stanford psychologist Alex Bavelas who documented the same results as here.

Between simplicity and complexity, complexity won.

For all our craving for simplicity, we are intrigued by complexity. It draws us in, convinces us of the possibilities and sells us on something fantastic even if our rational minds would like us to believe that the complex is less probable than the simple.

Overtime we learn to identify greed and fear. We learn from the past.

It is complexity that always gets us.

With investing and investment advice the promise of false complexity is what the investor has to be most aware of and will find the hardest to avoid.

Say you have just come into a lot of money. A windfall of some kind, a big annual bonus, a lottery or an inheritance.

You would like to invest it in equity Mutual Funds. You are told by your advisor that there are two choices. First, is to invest all the money into equity Mutual Funds immediately. Second, is to invest first in a liquid money market fund and then systematically transfer into an equity Mutual Fund over one year. Let’s call this a 1-year Systematic Transfer Plan (STP).

Over time, the advisor community has built a narrative on why 1-year STP is a better option. The narrative is that averaging your buy price over one year improves returns and reduces price volatility. Choosing 1-year STP assumes that the average price over the next 1-year is going to be lower than the price today else you would be better off investing today. Investors generally believe that markets over time will go higher. So specifically, by choosing the 1-year STP route the investor is making a complex claim that the market on average will go lower in the next 1-year while they are investing in tranches and will then go up.

Occam’s razor is a principle from philosophy which is used widely in scientific enquiry. If there are multiple explanations for an event, then choose the one which requires the least number of assumptions.

Investors would benefit from running all advice from the same prism. If the advice requires a lot of assumptions to come true to be beneficial then it is unlikely to be of great value.

Investing as soon as you have the money is the simpler solution. It requires you to make no assumptions on the nature of future returns. Further, there is a lot of research that does show that timing the market is actually very hard supporting the case for investing now rather than doing a 1-year STP. Our own research shows that investing immediately works better about 60% of the time.

Thus, one would believe that when presented with the choice most investors would choose to invest now. But, that’s not true. Most investors believe that by investing systematically they can improve their returns.

Investing advice is filled with unnecessary complexity. It can be used to sell an investment as more sophisticated or to make the advisor sound more intelligent. Take the simple question, if you are running a Systematic Investment Plan (SIP), which day of the month should you choose for your investments? A SIP, for the uninitiated, is simply a way to invest a fixed amount of money into the markets on a fixed day of the month. By investing every month, the investor gains from rupee cost averaging over time.

Going back to first principles and recognizing that future returns are highly unpredictable, one would say it wouldn’t matter which day of the month you have your SIP on. You should just have your SIP the day after your paycheck so that you do not accidentally spend the money before you have the time to invest it. Research shows little correlation between the day of the SIP and the return of the SIP i.e any day is as good as the other to do your SIP.

Now, suppose you have an advisor who looks at one year of past data and tells you that in the past year a SIP on the 15th of the month had the highest return. Will that sway you to start your SIP on the 15th? In an informal survey, 70% of respondents said yes. The investor, trusting their advisor, will start on the 15th expecting a better outcome and will then be disappointed that the expectations were not met. Adding the complexity of finding the best SIP date creates an expectation which will not be met.

Why would an advisor promise something that they should very well know they can’t deliver on? One reason can be ignorance, the advisor themselves are fooled by complexity. The other could be to show themselves as more sophisticated, even though what they are advising is pointless.

SIP timing is a mini-industry. From people claiming SIPs in the early part of the month work better to complicated algorithms on how to invest monthly to eke out a gain over the simple and humble SIP. The question that we get by far from investors is “Is weekly or daily SIP better than monthly SIP?”

The origin of the question is equally interesting. Once an investor is convinced that rupee cost averaging is good the normal implication is that more rupee cost averaging is better. So, if monthly investments make sense, then weekly or daily should be even better. Except, that’s not how it works. Enough studies have found that daily or weekly SIP does not improve on monthly SIPs, either in increasing your returns or reducing your risk.

Einstein had famously said –

Everything should be made as simple as possible, but not simpler.

The famous Italian designer Bruno Munari commented –

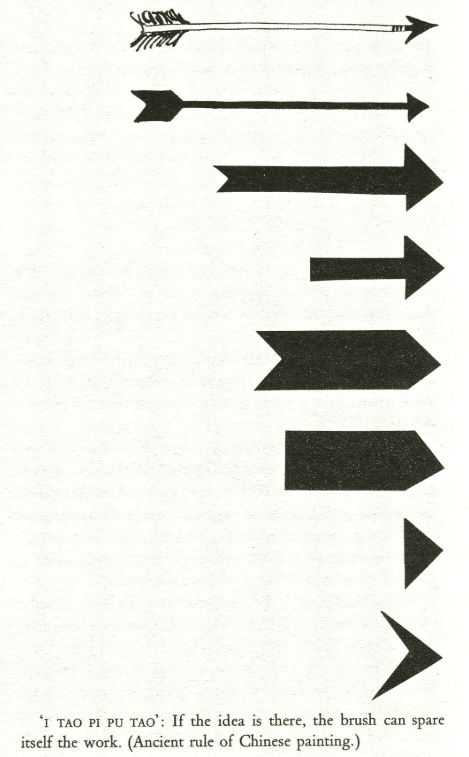

An arrow can lose it’s feathers, but not its point.

Investing monthly ties your monthly income or paycheck to your investment. It ensures you do not spend your paycheck on impulse buys but invest it periodically for a better future. A monthly SIP thus is a cash flow simplification. Extending it to weekly or daily is adding complexity with no clear benefits.

A similar example is the statement diversification is good. Does that mean more diversification is better? That is how investors interpret this statement – surely more of a good thing can only be better. So why not invest in 4 large-cap funds and 3 mid-cap funds and 4 small-cap funds.

The average investor on Kuvera has a whopping 13.4 funds in their portfolio. The most “diversified” investors have over 50 funds. A lot of online platforms fuel this fire by selling baskets of multiple funds perpetuating the “more is better” mantra for diversification. Similarly, every new advisor you hire adds “value” by adding their selection fo funds to your portfolio. The problem with this approach is that each Mutual Fund in itself is a very diversified investment vehicle. Proponents of passive investing will argue that just buying a Nifty 50 index fund and a risk-free instrument (liquid fund for e.g) is good enough and anything more is just complexity.

Academics have a term for this “more is better” approach to buying funds – naïve diversification. Academic studies in the US have shown that post 32 stocks the diversification achieved by adding one more stock to your portfolio is negligible. Since almost all Mutual Funds have at least 25 stocks, they are well diversified.

The only argument to add multiple funds can be if they have minimal overlap – so invest in a Nifty 50 fund, a Nifty Next 50 fund, a value biased fund, an international fund and one debt fund. Essentially the portfolio we recommend on Kuvera. A five-fund portfolio that takes care of all your needs. Minimum fuss and low complexity over time.

As computer scientist Edsger Dijkstra, who shaped the then-emerging field of computer science both as a practitioner and as a researcher, wrote –

Simplicity is the hallmark of truth— we should know better, but complexity continues to have a morbid attraction. When you give, for an academic audience, a lecture that is crystal clear from alpha to omega, your audience feels cheated and leaves the lecture hall commenting to each other: “That was rather trivial, wasn’t it? The sore truth is that complexity sells better.

That simplicity is preferred has support across multiple domains and branches of science. KISS, a backronym for “keep it simple, stupid“, is a design principle noted by the U.S. Navy in 1960. The KISS principle states that most systems work best if they are kept simple rather than made complicated; therefore, simplicity should be a key goal in design, and unnecessary complexity should be avoided.

Leonardo Da Vinci, the celebrated renaissance man, famously said

Simplicity is the ultimate sophistication

Our ideals for simplicity are high. A story about a zen master known for his simple living goes something like this –

Ryokan, a Zen master, lived the simplest kind of life in a little hut at the foot of a mountain. One evening a thief visited the hut only to discover there was nothing to steal.

Ryokan returned and caught him. “You may have come a long way to visit me,” he told the prowler, “and you should not return empty-handed. Please take my clothes as a gift.”

The thief was bewildered. He took the clothes and slunk away.

Ryokan sat naked, watching the moon. “Poor fellow,” he mused, “I wish I could give him this beautiful moon.”

Maybe this level of simplicity is impossible. But we have easy tools and rules available to keep our investing simple. Such as –

1/ SIP – keep it going through rain and shine

2/ Increase SIP amount to match the increase in your annual salary

3/ Always talk to 3 close aides before taking a transaction decision

4/ Only check your portfolio once a quarter

It is worth repeating here

Overtime we learn to identify greed and fear. We learn from the past.

It is complexity that always gets us.

With investing and investment advice the promise of false complexity is what the investor has to be most aware of and will find the hardest to avoid.

Read the other Chapters:

Ch 1: The simplest things are the hardest

Ch 3: Do you have an information advantage to beat the markets?

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!

sanjoy

September 14, 2019 AT 02:59

all your articles are excellent and thoughts to reflect upon… Thank you

Gaurav Rastogi

September 14, 2019 AT 10:48

Thanks Sanjoy. Much appreciated.

Gopalakrishna

December 24, 2019 AT 09:19

Thanks Kuvera. Your articles are an eye opener for me.

Keep it coming Gaurav and team. Happy new year to you all ?

Jyotirmoy

July 26, 2021 AT 20:05

I had a SIP long back. After 1 year, when i evaluated returns, i got nothing. I researched statements. I found that index was flat @5% odd. But it swang in between. And average unit cost was same as the highest NAV. Every month on my Sip date, market was on top. So i got no return. I invested lumpsum on lowest market. And then market got stuck, getting less return than FDs! Wherever i go, somebody always try to stop me from getting sonething better.

I researched more. And realised that investors have to fight market, fund managers, brokers, agents, etc all the time to get any good from market investments or insurance, FDs etc. If i close my eyes, i wud get swept away.

Siddhartha

September 14, 2019 AT 06:15

I absolutely love this series of yours! In the time when there are loads of “financial advisors” and a mountain of funds to choose from, this idea of keeping things simple is what we all need a reminder of from time to time. Kudos to your efforts!

Gaurav Rastogi

September 14, 2019 AT 10:47

Many thanks, Siddhartha. Appreciate your kind words.

Jinal

September 14, 2019 AT 07:29

Very well written .. Much appreciated!

Gaurav Rastogi

September 14, 2019 AT 10:42

Many thanks.

ASHISH MALVIYA

September 14, 2019 AT 09:44

good one sir..

can u share ur portfolio??

Gaurav Rastogi

September 14, 2019 AT 10:45

Thanks Ashish, my portfolio is Nifty Next 50 Index and an EW index. Same as our recommended index portfolio.

Anand Bhaskaran

September 17, 2019 AT 10:26

All the articles are very well written! Loved it.

Gaurav Rastogi

September 18, 2019 AT 00:56

Thanks Anand, much appreciated.

Karthik

June 15, 2020 AT 04:28

Unfortunately, Complexity is sold so easily to anyone than simplicity. Watch CNBC experts , They just rely on complex terminology and make a stock go around and around and around with just so much terminology… Another bluffing factor sold is NFO where NAV is lowest !!! Don’t know how many have fallen prey to it..

Gautam Wadhwani

November 5, 2019 AT 11:15

Fantastic and well summarized. I am myself guilty of both the points highlighted in your article – STP from liquid funds to equity over a period of time, as well as having a large set of funds (outside Kuvera) which are a drag on my portfolio.

I have simplified my investments and restricted to 6 funds max.

Gaurav Rastogi

November 6, 2019 AT 01:56

Great to hear this Gautam.

Prasanth Prabhu

November 7, 2019 AT 03:38

Another excellent article. Thank you for this

Gaurav Rastogi

November 12, 2019 AT 08:28

Thanks Prasanth.

Kannan

February 7, 2020 AT 18:32

Excellent advice, and an enjoyable read. Thank you for everything you do.

Gaurav Rastogi

February 8, 2020 AT 02:04

Thanks Kannan.

Y Ravi

September 30, 2020 AT 17:14

Gaurav, please write a book. Your clarity of thought and the way you present it with appropriate quotations is outstanding.

Gaurav Rastogi

October 5, 2020 AT 03:41

Thanks, buddy.

Tulasa

May 11, 2021 AT 01:02

Excellent article Gaurav!! Relates really well to the investment advices I have received so far!

Sapna

October 9, 2021 AT 09:51

Excellent article Gaurav… It’s always insightful to read such articles written by you… Superb ??

Piyush Gulhane

December 23, 2021 AT 03:28

Thank you so much Gourav for your Invaluable knowledge. I myself had my SIP’s spread over different dates of the month. All because my friend told me that it helps you take advantage of market ups and downs. Something I did not understand but truly complexity sells and I bought that Idea. Thanks to you now I know that this doesn’t really matter. Simplicity is the best.