![]() Gold is a precious and highly liquid instrument that has the attributes of both commodity and currency. It has been used throughout history as money and has been a most popular metal for investment purpose, storage of wealth and as a source of high-quality collateral.

Gold is a precious and highly liquid instrument that has the attributes of both commodity and currency. It has been used throughout history as money and has been a most popular metal for investment purpose, storage of wealth and as a source of high-quality collateral.

Gold has social and cultural significance. For us, gold means wealth and prosperity. Celebrations like weddings, Diwali and Dhanteras are considered to be incomplete without it.

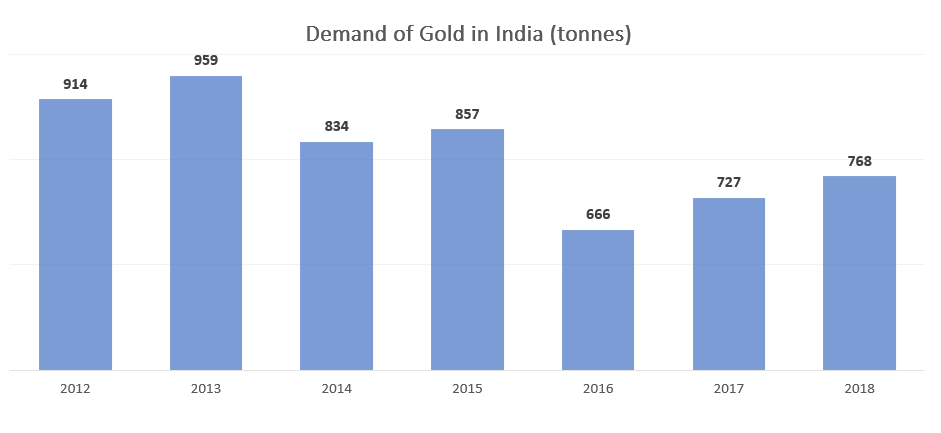

No wonder we, as Indians, account for almost one-fourth of all consumption of gold globally. Yes, really!

We love the yellow metal 🙂

The desire for gold is the most universal and deeply rooted commercial instinct of the human race.

While gold has ornamental and cultural significance for us, its investment properties are also equally good. Gold, as some form of currency or store of value, has been in circulation for centuries. As a long term store of value, it is an effective hedge against inflation while also exhibiting strong downside protection properties one would expect from an effective portfolio hedge.

Gold and silver are money. Everything else is credit.

: J.P. Morgan

Factors that affect the gold price

The gold price is affected by market supply and demand along with speculation. Gold price also relates to the USD exchange rate, oil and other commodities prices, economic instabilities and financial crises, and other world events such as wars, natural hazards and disasters. Abken (1980) and Salant & Henderson (1978) found inflation, gold demand and supply, world events, and gold auction as the determinant of gold price. More recently Tully and Lucey (2007) found that the US dollar is the main macroeconomic variable that affects gold returns. So, for Indian investors, investing in gold along with it being a macroeconomic hedge to crash in stock prices is also a currency hedge against rupee devaluation.

Enter digital gold

Digital gold is an investment option where you can buy 24K 99.9% pure gold online in denominations as low as Rs 100. It is a simple, straightforward and transparent way to buy and sell gold online.

Think of it as physical gold, except that you don’t have to worry about purity, making charges, safe storage or ease of selling.

How digital gold works?

The amount of digital gold you purchase online is backed by 24 K 99.9% pure gold which is placed in a secured vault. To buy, you place a buy order on Kuvera and we, with the help of our partners Augmont Gold, buy the gold at market price and keep it in a secure vault for you. Similarly, when you sell, we sell some of your gold at the then market price and deposit the cash into your bank account. Completely digital and completely secure.

How to buy digital gold on Kuvera?

It couldn’t be easier. Enter the amount or the gms you want to buy and pay by UPI, netbanking or card. Simple as that!

Why invest in digital gold (over physical gold)?

1/ Purity Certified 24K 99.9% pure gold. As good as it gets.

2/ Security – Stored in vaults by BRINKS, the global leader in asset security. No theft issues, no bank lockers, nada.

3/ Access – Sell it online at the prevailing gold price for immediate cash or request for home delivery. Your gold, your way.

4/ Quantity – Pay only for gold. No making charges, cuts or commissions. Get more gold.

Buy it when you want to invest in gold and sell it when you need money – all from the comfort of our app. Digital gold, thus, overcomes some of the traditional challenges of investing in gold.

Why invest in digital gold (over Gold ETF and Gold Mutual Funds)?

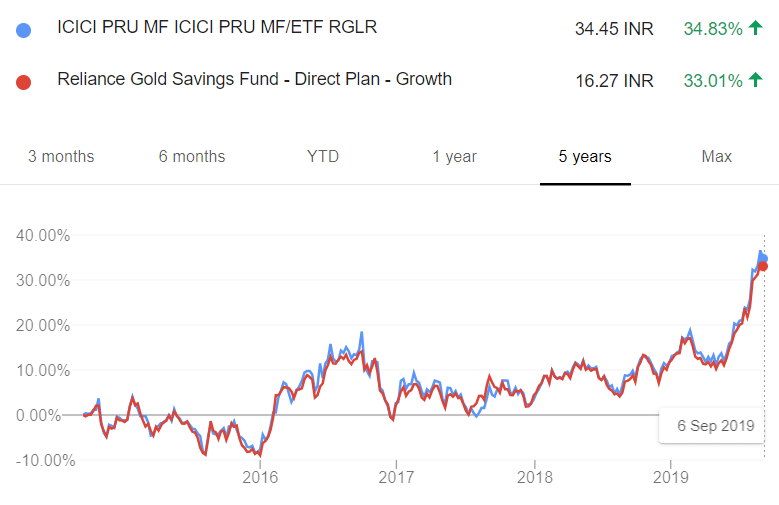

It is a known fact that Gold ETFs and Gold Mutual Funds do not track the price of physical gold closely. The culprit is fund expenses.

The NAV for Gold ETF or Mutual Funds is computed after deducting the fee of the asset management company plus storage and custodian charges, which can all add up. Over time this can create a significant mismatch in gold returns and that of the gold ETF or Mutual Fund.

In the chart below, we look at 5-year returns from one Gold ETF (ICICI) and one Gold MF (Reliance).

The ETF gained 34.83% while the MF gained 33.01%. Between the same time (19 Sep 2014 to 6 Sep 2019), the price of 22K gold went up by 51.3% (from Rs 2,525 / gm to Rs 3,820 / gm).

That’s a big performance drag for using ETF and MF for investing in gold.

Why invest in digital gold (along with equity MFs)?

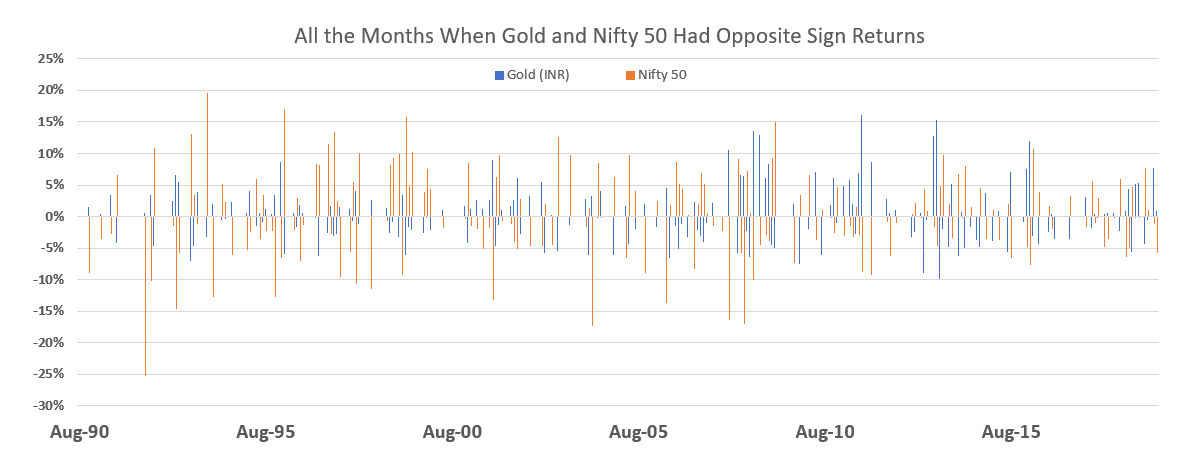

Going back to 1990 and looking at monthly data we can see that Nifty50 returned higher on average, but with higher standard deviation or risk. Risk-adjusted returns are still marginally better for gold but not by much.

Gold also has a better max drawdown (a measure of maximum loss possible) of -25% (vs -55% for the Nifty 50). That is an investor in Nifty50 would have faced a maximum peak to trough decline in the portfolio value of -55%. In the same time, an investor in Gold would have a faced a maximum peak to trough decline of -25%.

| 1990 Onwards Monthly | Gold | Nifty50 |

| Return | 10.7% | 15.6% |

| StdDev | 15.9% | 27.2% |

| Return / StdDev | 0.67 | 0.57 |

| Max DrawDown | -25% | -55% |

What gold loses in return expectation it more than makes up for in correlation and thus diversification benefits. Gold, you see, is a team player. And at times when Nifty 50 is not performing due to crash fears, wars, natural hazards or disasters, gold does well.

It helps you tide over the bad times much better. Or you could say, when the going gets tough, gold gets going.

In the past 29 years of data, the correlation of monthly gold returns and monthly Nifty50 returns is just 0.3%!

Of the 348 monthly returns in our sample, there are 178 instances where the returns on gold and returns on Nifty 50 have opposite signs. That is if gold posted positive returns, Nifty 50 posted negative returns and vice versa. This is exactly what diversification is about – two assets, each with positive expected returns but no correlation in returns.

So, what does that mean at a portfolio level? Well, let’s look at a portfolio that is 50% gold and 50% nifty 50 at all times –

| From 1990 Monthly | Gold | Nifty50 | 50% Gold – 50% Nifty 50 |

| Return | 10.7% | 15.6% | 13.1% |

| StdDev | 15.9% | 27.2% | 15.8% |

| Return / StdDev | 0.67 | 0.57 | 0.83 |

| Max DrawDown | -25% | -55% | -27% |

The combined portfolio has highly superior risk-adjusted returns. And the drawdown number is as close as gold’s alone. Lawrence (2003) also concludes that the low correlation between gold and stock returns makes gold an efficient portfolio diversifier.

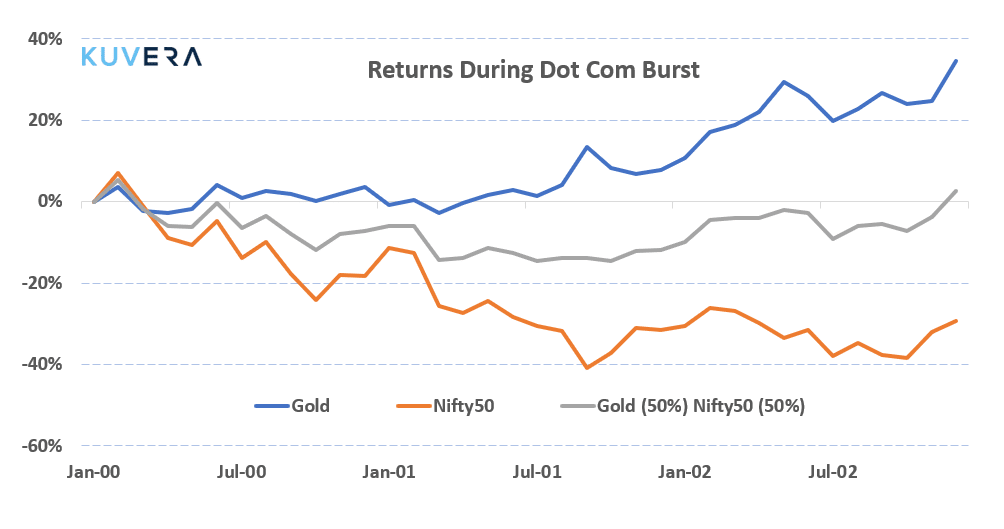

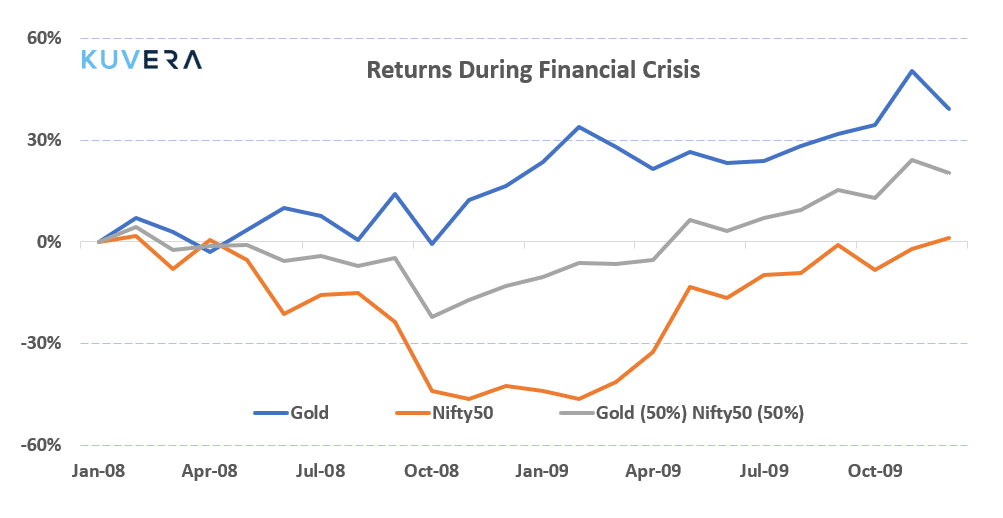

Let’s look at two such episodes in the past in a lot more details. The bursting of the dot com bubble of 2000 – 2002 and the great financial crisis of 2008-2009.

The dot com burst of 2000 – 2002: The dot com bubble burst in early 2000 bringing an end to excesses in dot com funding and valuations in the US. Even though the bubble was mostly localized to NASDAQ the bursting of the bubble had consequences for Indian markets too. Between 2000 to 2002 Nifty50 proceeded to fall 40%. As a flight to safety and crash hedge, Gold had outsized gains of ~30% during the same time period.

The Global Financial Crisis of 2008: As per Wikipedia, “the 2008 financial crisis, was a severe worldwide economic crisis considered by many economists to have been the most serious financial crisis since the Great Depression of the 1930s, to which it is often compared.” The crisis had a severe impact on global financial markets and Nifty50 saw a monthly drawdown of ~50% during that time. Gold again shone as the crisis hedge and rallied ~30% to protect from some of the impacts of the stock market meltdown.

Just based on the correlation data, it is clear that investors should take gold seriously and have exposure to it as a macro-economic hedge, as a currency hedge and a saviour in bad times.

That it also returned ~11% during the past 29 years is just icing on the cake.

Key Takeaways

1/ Gold has properties of both a commodity and a currency. Gold is unique among commodities due to gold’s traditional role as a safe-haven and store of value.

2/ Gold returns have a low correlation to equity returns especially during wars, market crashes, and disasters. This makes gold an effective portfolio diversifier.

3/ Digital Gold solves the issues of owning and safekeeping digital gold.

The desire of gold is not for gold. It is for the means of freedom and benefit.

:Ralph Waldo Emerson

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Digital Gold and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!

Harsh Pandey

September 24, 2019 AT 03:31

Nice feature, Kuvera!

Gold should be a part of a diversified portfolio. Digital gold is nice. So is Sovereign Gold Bond scheme of RBI.

Gaurav Rastogi

September 24, 2019 AT 04:25

Thanks, Harsh much appreciated.

Jagdish Mali

September 24, 2019 AT 06:52

How different is this digital gold from mutual fund or ETF in terms of expense charges

Gaurav Rastogi

September 28, 2019 AT 02:53

There are no expense charges in digital gold unlike gold mutual fund or gold ETF.

Bsp

February 22, 2020 AT 08:03

But the spread between buy and sell price of digital gold can be too high. We don’t have any regulation around the spread. I have almost saw around 2% spread between buy and sell price. Can we assume that etf expense ratio will almost be equal to spread charged by digital gold? It would have been better if vendor has some limitation on maximum spread between buy and sell price.

Gaurav Rastogi

February 23, 2020 AT 14:00

Even an ETF or MF will buy and sell gold with a similar spread. The spreads are dictated by the commodity markets.

Jaywant Takbhate

May 15, 2021 AT 13:08

But what about GST charges? Currently it is 18%.so if i invest 100 rupees, gold worth only 88 rupees is bought. Isn’t it?

Gaurav Rastogi

May 17, 2021 AT 01:19

GST is 3% for gold.

Vandhiadevan Varadharajan

September 24, 2019 AT 09:43

What is the % of exposure to have in Gold for an Retail investor portfolio. Consider how to include gold in Kuvera recommended portfolio which has Equity +Debt already. Is it only used as diversifier. What about the overall return of Digital gold say for 5/10 years. If its less than the traditional Fixed income products(after tax), then there is no necessity to include Gold

Gaurav Rastogi

September 28, 2019 AT 03:06

Most traditional all-weather portfolios will allocate 15 – 30% of your equity allocation to Gold. Note here that Gold allocation comes out of your equity allocation and not your debt allocation. For example if you are 80:20 in equity debt, then at 25% gold as part of the equity allocation, you should move to 60% equity, 20% gold and 20% debt. As your equity portion unwinds, so does your gold allocation.

Vandhiadevan Varadharajan

October 1, 2019 AT 17:13

Currently i am holding 60:40 Equity and Debt funds in my overall portfolio, Based on your allocation recommendation, should i redeem equity portion and invest in Gold. Am i correct

Kalpnath Singh

September 25, 2019 AT 02:31

Very Nice option…..Pls add on one more feature on KUVERA with ur gold partner that he may deliver physical form or redemption on his partner showroom in the form of jewellery if someone like otherwise redemption both. Hopes KUVERA platform will rock in the form of gold investment also.

Regards.

Gaurav Rastogi

September 28, 2019 AT 02:51

Yes Kalpnath, the home delivery feature will be live soon making gold gifting and succession planning even easier.

Equebal Ahmad

September 26, 2019 AT 19:32

How long I can hold the gold in my portfolio when bought at Kuvera? Other platforms mentioned that digital gold bought on their platforms can be kept for 5 years. A fee will be applicable after that it not sold our converted to physical gold. Does Kuvera partner have similar policies?

Gaurav Rastogi

September 28, 2019 AT 03:51

The current policy for Augmont is that there is no limit on how long the customer can hold the gold in their portfolio in Augmont. The customers do not have to pay for storage or insurance.

Atit

May 2, 2020 AT 09:59

Can i buy sovereign gold bonds through kuvera ?

Gaurav Rastogi

May 21, 2020 AT 08:48

Not yet

Animesh Dutta

September 27, 2019 AT 00:31

Great feature! Appreciate the efforts on this. Introduction of digital silver would also be greatly appreciated. 🙂

Gaurav Rastogi

September 28, 2019 AT 02:50

Thanks, Animesh. Could you elaborate on reasons to own digital Silver please?

Aaron Abraham

October 16, 2019 AT 16:07

Hi Gaurav, I’m very interested in purchasing digital silver as well, because silver has outperformed gold in the past year and is still very much undervalued. Any chance we could see a similar option for Silver on Kuvera in the near future?

Gaurav Rastogi

October 18, 2019 AT 02:32

Thanks Aaron, give us some time to think through adding silver.

Phani

October 24, 2019 AT 21:43

Looking forward to buy silver along with gold

Bhushan

April 18, 2020 AT 04:08

Like said always Gold is for rich and for poor Silver is gold and always gave good returns. So digital silver option is better way to invest than physically.

Kyachinu

November 24, 2019 AT 05:52

Yes I am also looking for investing digital silver because gold is for king and silver is for rich . Now I am saving silver as god money . Please consider add digital silver please .

Kamesh

September 27, 2019 AT 09:40

Hi Kuvera Team,

I am a big fan of Kuvera platform, as the platform serves a comprehensive database of all my MF investments and is very intuitive. This new feature to buy GOLD is a fantastic idea. Can we expect to buy e-SILVER on Kuvera soon? Is investing (buy/sell) in e-GOLD still better than GOLD ETFs after taxation? Please do explain these concerns. Looking forward to your reply. Thank you.

Gaurav Rastogi

September 28, 2019 AT 02:45

Hello Kamesh, you hold Gold for the really long term – as we say it is a multi-generational asset. The yearly tracking error on Gold ETFs, which we write about in the note above , is so big that it trumps any tax benefits and we do not see this tracking error for gold ETFs or gold MFs coming down anytime soon.

Between Silver and Gold, we would recommend Gold, especially if you can buy it in any denomination.

Giri

September 28, 2019 AT 02:32

Thanks for bringing this feature and investment opportunity to our notice. I would like to know what is the processing charged by kuvera including the third party tie up to buy the asset ? Thanks

Gaurav Rastogi

September 28, 2019 AT 02:37

We do not charge any processing fee. We show you the same buy and sell rate as shown on Augmont site.

Vishal

April 20, 2020 AT 18:15

Hi if the rates same as Augmont site, what’s the advantage of investing/buying on Kuvera? Thanks

Gaurav Rastogi

April 24, 2020 AT 06:07

So you can see your entire portfolio and do effective asset allocation from one place.

Avishek Singh

September 28, 2019 AT 06:00

Hi Gaurav,

First of all great feature added on Kuvera platform..!

I was trying to buy some gold but whenever I select a particular payment mode and proceed, I get an error showing Payment unsuccessful.I tried this more than 5-7 times and everytime i got the same error.I even tried with different modes as well but same result every time.

Gaurav Rastogi

September 28, 2019 AT 10:48

Oh, that’s not good at all. Have shared your email and query with the team working on gold. They will reach out shortly.

Update 1 /

You Pincode had trailing white spaces which could have been the cause of the error. We have removed them now. Could you pls try again and update?

amit budhiraja

September 29, 2019 AT 04:25

Hello, I am an existing customer and feel comfortable on mutual fund segment, I found it interesting about buying gold on paper however i am looking to know the security related to it, If i plan to buy small sum of gold for next 20 years how do i get assurance company would exist and not run away. What is RBI and SEBI’s role in protecting investors in case of something goes wrong with Augmont.

Gaurav Rastogi

September 30, 2019 AT 01:10

Hello Amit, for sale of digital gold Augmont follows RBI regulations and works with partners such as Brink’s India, to ensure that your gold is stored securely in their world-class vaults, and SEBI registered IDBI Security Trustees, whose role is to protect customer interests at all times.

Sandeep

October 1, 2019 AT 05:33

Hi Gaurav,

Firstly amazing new feature ..but I have same concerns as Mr. Amit B ..how is this investment in digital gold structured ..like in case of MFs there is regulation by AFMC and proper custodian structure. How is the investor safeguarded in case of any unforeseeable mishaps in digital gold investing. Request you to please elaborate.

Gaurav Rastogi

October 4, 2019 AT 01:49

Every milligram that a customer buys from Augmont is stored in Vaults and IDBI verifies the customer balance with the Vault balance and issues a certificate. In case of Kuvera or Augmont going bust, it’s the IDBI Trusteeship who will handle the distribution of gold among the buyers, this will be practically done by selling the Gold and passing on the money to the holders. This product is structured considering the RBI guidelines for Retail Gold Business with enough safeguards in place.

Lakshmanan Sekar

October 1, 2019 AT 01:53

Hi Mr. Gaurav,

I am all set to invest in gold. But I want 5000 Rs gold SIP option. So I no need to manually buy every month. Please let me know if SIP is available anytime soon???

Gaurav Rastogi

October 1, 2019 AT 01:58

Hello Mr Sekar, SIP option will be available very soon.

Tanvi

October 4, 2019 AT 19:38

Looking forward to this!

Phani

October 24, 2019 AT 21:41

Looking forward for SIP option for gold

Gaurav Rastogi

November 6, 2019 AT 02:03

Launching soon.

Nayan

November 13, 2019 AT 18:38

Looking forward to the gold sip option as a new year gift. Thanks a ton Gaurav for creating Kuvera 🙂

Tanveer

October 4, 2019 AT 07:23

Hi Gaurav,

This is a great feature that you have added.

I have a question here though. Since the prices of bold have shot up by from 3217/gm in Oct’18 to 3919/gm this date. In the 2 years before that, the pricing has more of less been the same. What might be the reason for this? And also, is there something like ‘timing’ of gold purchase? Since this is Diwali season and prices are to go up since there will be more buying spree.

However, I would like to know what is the relation in pricing changes between Gold Price vs USD vs INR.

I did a bit of research on my own but could not find any evidence of all 3 being interlinked.

I would really appreciate your help on this. Regards

Gaurav Rastogi

October 14, 2019 AT 06:05

Hello Tanveer, we do not believe in timing, either in MF or in gold. Periodically buying gold, just like periodically buying MF, will have the best diversification effect on your portfolio.

Gold, like other commodities such as Oil, is priced in USD. So when USD strengthens, the price of Gold in INR goes up.

Nimit

October 5, 2019 AT 06:57

Just in case, KUVERA or AUGMONT or BRINKS fails (becomes bankrupt), what is the security of investments?

Gaurav Rastogi

October 7, 2019 AT 01:30

Every milligram that a customer buys from Augmont is stored in Vaults and IDBI verifies the customer balance with the Vault balance and issues a certificate. In case of Kuvera or Augmont going bust it’s the IDBI Trusteeship who will handle the distribution of gold among the buyers, this will be practically done by selling the Gold and passing on the money to the holders This product is structured considering the RBI guidelines for Retail Gold Business with enough safeguards in place.

Abhijit

October 7, 2019 AT 04:19

Hi Gaurav,

Will the selling price be the same as the buying price here?

In some digital gold buying schemes I have found that buying and selling prices are different. How bout in this case?

Gaurav Rastogi

October 7, 2019 AT 04:31

Hello Abhijit, the difference in buying and selling price is called the bid-ask spread. It is true for all assets that trade in real time – equity, ETF, commodities including gold etc.

You can learn more here – https://www.investopedia.com/terms/b/bid-and-ask.asp

Dr pradip trivedi

October 8, 2019 AT 11:50

Good..but what is city of which the rate is applied. Can we start SIP

Ramesh Balakrishnan

October 10, 2019 AT 05:24

Is there any additional costs involved apart from GST?

Gaurav Rastogi

October 12, 2019 AT 13:02

None.

Ramesh Balakrishnan

October 14, 2019 AT 06:47

For the first time, i felt cheated using Kuvera. Bought gold today and clicked ‘Sell’ button just to check the selling price. There is 100Rs difference between buying and selling price, which is huge. This is not mentioned anywhere in the home page, Yes, i understand you need to generate a profit along with your partner Augmont, but full disclosure will be highly appreciated.

Ramesh Balakrishnan

October 14, 2019 AT 06:47

*100Rs per gram.

Pratik

October 13, 2019 AT 17:53

Hi, what are tax implication on capital gain in Digital gold and what is the minimum weight required for physical delivery?

Gaurav Rastogi

October 14, 2019 AT 07:35

Tax implications are same as physical gold, upto 3years it’s Short term, more than 3 years its long term CGT

Rohit Dinde

October 21, 2019 AT 03:27

Can we get physical gold by delivery.

Gaurav Rastogi

November 6, 2019 AT 02:08

This is under development.

SAURABH PANDEY

July 19, 2020 AT 19:45

Is it mmtc gold

Gaurav Rastogi

July 20, 2020 AT 11:02

Augmont gold

Harish

October 25, 2019 AT 05:55

Hi Gaurav , adding gold element in kuvera is a great feature . I have got a query when buying rate for ex is 3950 and selling rate is only 3850 for 24K carat pure gold . Could you please explain how the customer is benefited on the price difference arose between buying and selling gold .What profit can customer take in when he loses 100 rs per gram while selling .This is not explained anywhere in kuvera post and this could clarify all customers buying in your platform how to generate atleast some profitable amount while selling gold in short or long term. Awaiting your response on behalf of all customers in kuvera .

Gaurav Rastogi

November 6, 2019 AT 02:18

Hello Harish, all equities and commodities (gold included) trade with a bid offer. Over time the price rises above the bid offer and that’s how you make a profit. It can happen in the short or the long term.

You can read about the bid offer (or bid ask) here –

https://www.investopedia.com/terms/b/bid-and-ask.asp

https://www.investopedia.com/terms/b/bid-askspread.asp

Avishek Sharma

November 8, 2019 AT 14:12

From Kuvera i do not see the options to get the Gold Home Delivery while selling Gold. Is this Feature available for now.

Gaurav Rastogi

November 11, 2019 AT 02:12

We are working on it. We will have home delivery enabled soon.

Jagroop

December 19, 2019 AT 08:27

Not able to share this highly Informative article by you on whatsapp. This article is much worth sharing with near dear ones. Regards

Pradeep

January 1, 2020 AT 09:14

I am an existing customer of Kuvera. Buying Equity MF since a year. I am really interested to buy gold. Whether home delivery of gold is enabled now? and Whether IDBI trustees provide any certificate to the customer directly so that we can have a proof of buying gold and go redeem if Kuvera and Augmont goes bankrupt?. Waiting for your reply eagerly on behalf of all Kuvera customers

Gaurav Rastogi

January 2, 2020 AT 01:44

Home delivery has not been activated yet, we will have it soon. IDBI trustee does a weekly physical audit and provides certificate at the overall holding level.

Ashwin

January 6, 2020 AT 22:09

Hi Gaurav. Landed on the Kuvera site from a reddit article. Amazing UI. Just came across this write-up and must say very nicely done research. I have a small query. Just compared the gold prices of buy side with another online provider’s buy side gold price of the same karat/purity. There is a small difference of about Rs. 62 per gm with Kuvera offering better prices than the other provider. Curious to know what could be the reason. Asking here rather than asking there because I am sure I will get a better reply here. 🙂

(Also, on a side note, Kuvera’s prices are better than even day’s gold price)

Keep up the good work!

Gaurav Rastogi

January 8, 2020 AT 11:57

Thanks, Ashwin. We partner with the best in class. So credit where it is due, all the credit goes to Augmont and the team.

Bhabani Shankar Tripathi

January 10, 2020 AT 10:41

What is the cut-off time for purchasing gold which gets allocated by start of next day? Is it same like mutual funds?

Also just wanted to clarify that gold purchase made on Weekends or holidays get allocated on the first working day after weekend or holiday?

Gaurav Rastogi

January 20, 2020 AT 01:59

The gold gets allotted within hours that it is purchased. There’s no cut-off time like a mutual fund. Even on weekends or any other holiday, the gold gets allotted at the price which is displayed while making the payment.

padam

January 16, 2020 AT 16:46

Hey Gaurav, purchased my first eGOLD today. Thanks for this initiative. I think GOLD is best way to balance the portfolio. E want to check below with you.

Other than my Kuvera account, I did not get any email confirmation for the gold purchased. When I purchase MF, I can always find them in the MF house main websites. How do I track my gold (other than in my Kuvera port folio)?

Gaurav Rastogi

January 20, 2020 AT 01:08

You can always write to Augmont and get the gold statement from them. They do not, however, send a confirmation email as AMCs do.

Gaurav Rastogi

February 6, 2020 AT 00:53

Yes, there is some misunderstanding. We will call and clarify.

Srujan

February 1, 2020 AT 14:23

In the article above, under the sub-heading ‘How Digital Gold works?’, it mentions that ‘… when you sell, we sell ***some*** of your gold at the then market price…’.

So, does that mean that you will be charging an overhead other than the selling price of Gold at that moment? If yes, how much is that overhead?

Thanking you

Gaurav Rastogi

February 3, 2020 AT 03:59

No charges except the selling price of gold.

Raj V

February 1, 2020 AT 18:03

Hi, Gaurav, I own gold ETF units bought on another platform. Will i stand to benefit by switching those into digital gold, or is it advisable to just stop further investment in it and start a different SIP in digital gold in Kuvera. If switching is advisable, please advise options

Gaurav Rastogi

February 3, 2020 AT 03:55

Taxes and costs will be involved in switching and then it will depend on how long you are holding the ETF for. Would recommend keep the ETF and start a SIP in digi gold for future purchases.

Abhishek Das

February 4, 2020 AT 13:53

What is the taxation on selling digital gold units?

Gaurav Rastogi

February 6, 2020 AT 01:02

It’s the same as selling physical gold.

Vinay

February 15, 2020 AT 08:41

I am impressed with the quality of service provided by Kuvera & this article gives me another reason to move everything to Kuvera. I wanted some clarification on the article before I shift. You have shown the returns of the gold ETF & gold funds compared to actual gold returns. However, no comparison with how the returns are for the digital gold. Can you please add that so we can make an informed decision. Keeping in mind the bid offer difference.

Also I read about the bid offer spread but 100 per gram seems quiet a bit. If anyone keeps going on investing for 20-30 years in gold, they’ll end up with let’s say 100 plus grams of gold, then the redemption difference would be nearly 10,000! Kindly elaborate on this.

Gaurav Rastogi

March 3, 2020 AT 02:41

Digital gold tracks physical gold returns 1:1, as real gold is being bought stored and sold in your name. Bid offer is true for all commodity and equity markets. Even gold funds and ETFs will buy at ask and sell at the bid. So they have to pay this spread as well.

Veena

May 19, 2021 AT 14:53

Pls clarify , if i buy 1 gm every month for a year at different buy prices and at the end of the year i want to sell the 12 gms, the sale rate will be considered as on the date of sale right ? or is the difference of Rs 100 calculated for the respective buy prices?

Gaurav Rastogi

August 20, 2021 AT 04:32

At the date of sale.

Ashish

March 6, 2020 AT 17:50

Gold SIP is not available currently due to issues with Yes bank APIs. Could you please explain ?

Gaurav Rastogi

March 7, 2020 AT 04:16

We use razorpay payment gateway for mandate setup and they use Yes bank APIs for the same. We are working on resolving this quickly.

Harish

March 9, 2020 AT 15:37

by when can we expect “Gold gifting & delivery” feature to get enabled in Kuvera?

Monu

March 27, 2020 AT 14:34

When is the best time to buy gold and by which means?

Gaurav Rastogi

September 3, 2021 AT 03:55

Do a gold SIP.

Satyendra Kumar

April 9, 2020 AT 09:00

Which plan invest for good return Equity or gold plan

Gaurav Rastogi

April 9, 2020 AT 13:51

A mix of the two.

Mohammed tehseen

April 16, 2020 AT 21:24

Can I get physical gold at my home delivered upon request in exchange to digital gold.

Gaurav Rastogi

April 18, 2020 AT 02:49

Not yet, this feature is in the works.

Saptarshi Mondal

April 18, 2020 AT 08:25

When will the gold gifting and delivery get introduced? Are you working on that? Eagerly waiting for that. Loving Kuvera day by day. ❤

karthi padmaraj

April 18, 2020 AT 11:36

Income tax is applicable on the profit amount or not?

Dinesh

April 25, 2020 AT 16:46

very nice feature on Kuvera. I recently bought 10gm gold on Kuvera. Will I get a GST invoice for the same ?

Gaurav Rastogi

April 28, 2020 AT 00:52

Yes

Muralikrishnan

April 26, 2020 AT 14:06

Why gold purchase and sell looks loss in kuvera while it’s digital gold on same day

Gaurav Rastogi

April 28, 2020 AT 00:51

It is the bid-ask spread that’s true for all commodities – https://www.investopedia.com/terms/b/bid-askspread.asp

Satyendra

May 6, 2020 AT 20:56

Hlo sir which fund are good digital gold ya equity which are good return

Gaurav Rastogi

May 21, 2020 AT 08:42

You need both in a proper asset allocation.

Veejay M Kummar

May 1, 2020 AT 05:14

Can we convert Digital Gold to physical Gold if yes then how on Kuvera

Gaurav Rastogi

May 22, 2020 AT 08:56

Yes you can, it is a feature we will launch on Kuvera soon.

sk

May 20, 2020 AT 18:48

How is the selling price of gold which I bought on Kuvera decided? what is the margin that is taken up by Kuvera and/or its partner that is managing the E-gold?

Gaurav Rastogi

May 21, 2020 AT 08:13

There is no margin taken by us. Gold like all commodity trades with a bid-ask. Even a gold ETF or MF will pay this bid-ask when they buy gold on your behalf.

https://www.investopedia.com/terms/b/bid-askspread.asp

Hari

June 14, 2020 AT 02:13

Dear sir,

Do you have any plans to add other commodities such as silver?

Trilok

June 23, 2020 AT 18:54

Why there is difference in sell price and buy price in a same time?

Gaurav Rastogi

June 24, 2020 AT 02:31

Hello Trilok, it is called the bid ask spread – https://www.investopedia.com/terms/b/bid-askspread.asp

Anyone buying or selling gold in the financial markets ( ETF, MF, etc) have to pay this.

Mohammed Shahid saifi

July 4, 2020 AT 17:16

How much GST on gold?

Is on both buying and selling?

Gaurav Rastogi

July 6, 2020 AT 04:29

3% GST and only on buying.

Samuel

November 22, 2020 AT 22:56

HI Gaurav,

In the above calculations on Gold Mutual Funds/ETFs vs digital gold and their returns, have you considered the GST?

I would like to know if the comparisons still hold good if we are paying a GST of 3% at the time of buying.

Regards

Sam

Gaurav Rastogi

November 23, 2020 AT 02:59

Yes, includes 3% GST

Vishal

July 7, 2020 AT 13:14

Does Kuvera charge any fees for maintaining Gold storing vault/facility?

Gaurav Rastogi

September 15, 2020 AT 02:44

None

Tejaswi

July 8, 2020 AT 06:18

Excellent Blog Gaurav, I throughly enjoyed and grasped the content. Thank you for such insights, it will help me build a better portfolio.

Swapnil

July 13, 2020 AT 12:53

Is there option available to convert digital gold to physical gold and collect it as home delivery or at any showroom?

Gaurav Rastogi

July 13, 2020 AT 14:21

We are working on integrating that option.

Tejas

August 12, 2020 AT 14:49

Do we have delivery option for gold?

Gaurav Rastogi

August 17, 2020 AT 03:13

We dont have it yet, but it is in our plans.

Munmun

August 19, 2020 AT 08:37

Digital Gold attracts 3% GST whereas the expense ratio for gold ETF is 0.5 to 1%.

The selling price of digital Gold is ~Rs 100 less than buying price.

Going by above 2 points who is Digital gold cheaper than Gold ETF?

Gaurav Rastogi

August 31, 2020 AT 01:11

1/ ETF and MF pay the same or maybe higher bid-offer as well. It is not disclosed, you don’t see it doesn’t mean they are not paying it.

2/ ETF and MF have historically not tracked the price of gold closely. This is true for Indian gold ETFs as much as it is for global gold ETFs. So if your return does not match the street price of gold then don’t be surprised.

Shakir

August 21, 2020 AT 13:28

Hello Gaurav,

Great feature. Could you provide more detail for investments into digital gold for NRIs (Not American or Canadian)? Are the returns generated from digital gold fully repatriable for NRI (Returns redeemed back to NRE accoun)?

Poonam

September 4, 2020 AT 09:31

Do prices of physical vary from digital gold ?

Gaurav Rastogi

September 6, 2020 AT 09:53

No,they don’t.

Shuchi Tripathi

September 11, 2020 AT 14:32

Thank you so much for providing a nice plateform for purchasing digital gold.

Kuldeep Sharma

September 14, 2020 AT 21:01

Hi Kuvera.

Digital Gold is a very nice feature.

The easiness of purchasing gold, no worries of keeping it makes the feature superb.

Also the thought of purchasing gold for a common man like me feels good and empowered and that also at much less value.

Will definitely recommend my friends ?

Also the mutual fund tracking/purchasing and the interface of the app is so amazing and beautiful.

All the fonts size, the font choosen, the colors used is so relaxing to see.

Good luck and more growth to Kuvera.

Gaurav Rastogi

September 15, 2020 AT 02:43

Thanks Kuldeep

Sanjeev Sood

September 15, 2020 AT 06:27

What is the minimum amount to be invested monthly?

Gaurav Rastogi

September 16, 2020 AT 10:39

~10 – 15% of your monthly MF SIP amount.

Vaibhav

October 11, 2020 AT 11:37

Suppose I purchase digital gold worth Rs.1 lakh via Kuvera. Now 5 years later, suppose Kuvera shuts down due to some reason. How do I access and monetize my digital gold in such scenario?

Gaurav Rastogi

November 17, 2020 AT 03:43

You can do it directly with Augmont.

Adnan Shaikh

October 19, 2020 AT 05:14

Hello Gaurav….Purchase receipt of Gold would be from Kuvera or Augmont ????

Gaurav Rastogi

October 20, 2020 AT 01:11

From Augmont

Adnan Shaikh

October 19, 2020 AT 05:22

Hi Gaurav….Can i purchase digital Gold directly from Augmont ???? If yes then what is the benefit of purchasing via Kuvera ???

Gaurav Rastogi

October 20, 2020 AT 01:11

You can see all your assets in one place on Kuvera and use it for goal planning etc. And the price (buy or sell) is the same as Augmont.

Akhileshwasr Singh

October 28, 2020 AT 16:29

Why there is a difference in purchase price and sell price of digital gold?

Gaurav Rastogi

October 29, 2020 AT 04:39

All commodities trade on a bid ask. Gold MF and ETF also pay this bid ask. Here is it available to you, in MF and ETF you dont know the bid ask you are paying.

https://www.investopedia.com/terms/b/bid-askspread.asp

Viraj

November 4, 2020 AT 10:19

Gaurav,

How much % of your portfolio should be allocated to digital gold? Why?

Gaurav Rastogi

November 9, 2020 AT 02:04

Around 15 – 20% would be ideal, for the reasons stated above.

Viraj

November 9, 2020 AT 03:07

Alright thanks!

SREE HARI

February 18, 2021 AT 07:22

Will e gold facilities us for raising any loan against this collateral. And if so what could be the procedure to adapt.

Gaurav Rastogi

February 21, 2021 AT 05:41

We are working on loan against e-gold.

Sudhi

March 11, 2021 AT 07:57

Hi Gaurav, What are the strategies in buying gold & how should it align with stock market movements ?

Dr. Rahul Dev Das

April 7, 2021 AT 01:11

Hello gourav sir, can you collaborate with some jewellery companies. So what ever gold we are buying in kuvera directly we can give our gold to jewels and they will make for us the gold ornaments in the occasion like wedding, dhanteras, rice ceremony etc. just we need to pay the making and delivery charges. So we can buy gold and silver jewellery from kuvera only. Thank you

Nikhil

June 12, 2021 AT 05:59

How can we track SGB in kuvera?

As they have interest too

Sudheer Palyam

June 24, 2021 AT 12:25

I manage all mine and family portfolio through Kuvera, it is so convenient to manage all in one place.

One thing which I have been looking for is ‘Digital Gold Physical Delivery’. For the last two years, Kuvera has been telling the gold delivery feature will be available soon. Is this feature really coming?

Vishal Bhardwaj

November 11, 2021 AT 03:28

Gaurav, can you elaborate on recent guidline from govt to avoid selling digital gold as unregulated asset.

Gaurav Rastogi

November 22, 2021 AT 01:31

We have emailed all our digital gold users on the next steps.