The much anticipated PSU disinvestment announcement came on Wednesday, November 20, 2019, by the Union Finance Minister Nirmala Sitharaman. It is being hailed as another positive step by the government in a series of market boosting reforms. The government will be reducing its stake in 5 public sector enterprises including BPCL. The government expects to raise Rs 78,400 Crores through this exercise.

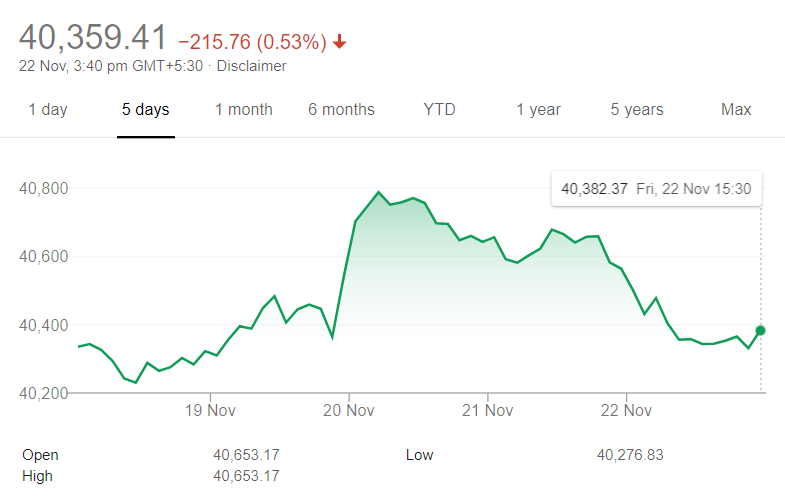

BSE Sensex made another new all-time high this week. The index touched an intraday high of 40,800 on Wednesday. Even though the news flow has been less than ideal, equity indices have continued to make new highs reminding us of two important lessons. First, market timing is a fool’s errand. Second, that the risk in equities is not being invested.

Muthoot Finance Ltd has entered an agreement to acquire IDBI Asset Management Ltd and IDBI MF Trustee Company Ltd. This lays the foundations for Muthoot Finance’s entry into the mutual fund segment. Muthoot Finance disclosed details of the Share Purchase Agreement in a filing with BSE (Bombay Stock Exchange) on November 22, 2019. The proposed acquisition is expected to be completed by February 20, 2020. We do not foresee any material impact on the performance of IDBI mutual fund schemes during the handover.

In its filing with the exchange, Muthoot Finance stated that:

“Muthoot Finance plans to utilise the Group’s existing branch network (4500+ branches), customer outreach and brand visibility in further strengthening the mutual fund asset base of the target entities and bringing a novel customer experience with focus on Tier 2 and 3 cities.”

SEBI made positive strides in increasing transparency in Portfolio Management Services (PMS) funds. The market regulator has proposed that all PMS schemes should offer Direct plans. The minimum investment in PMS schemes will be increased from Rs 25 lakh to Rs 50 lakh. In a surprise move that will reduce competition, the required net worth of the PMS managers would hereon be Rs 5 crore, from the earlier Rs 2 crore.

Franklin Templeton Asset Management has proposed to include provisions related to the creation of segregated portfolios in the following scheme(s), effective December 26, 2019:

- Franklin India Liquid Fund

- Franklin India Overnight Fund

- Franklin India Floating Rate Fund

- Franklin India Savings Fund

- Franklin India Government Securities Fund

- Franklin India Corporate Debt Fund

- Franklin India Dynamic Accrual Fund

- Franklin India Low Duration Fund

- Franklin India Short Term Income Plan

- Franklin India Income Opportunities Fund

- Franklin India Ultra Short Bond Fund

- Franklin India Credit Risk Fund

- Franklin India Banking & PSU Debt Fund

- Franklin India Equity Hybrid Fund

- Franklin India Debt Hybrid Fund

- Franklin India Pension Plan

- Franklin India Equity Savings Fund

The AMC has published a notice and sent email communications to its existing investors with details of provision for portfolio segregation. The provision is to ensure fair treatment to all investors in case of a credit event and to deal with liquidity risk.

|

|

|

|

|

Movers & Shakers

1/ Aditya Birla Sun Life Trustee Private Limited has approved the change in the name of Aditya Birla Sun Life Short Term Opportunities Fund to Aditya Birla Sun Life Short Term Fund with effect from 21 November 2019.

2/ Sundaram Mutual Fund has announced that K N Sivasubramanian has been appointed as an Independent Director on the Board of the Company. Further, Prof Rishikesha T Krishnan has stepped down from the Board of the Company.

Quote of the week:

It takes a long time to learn how to do nothing.

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!