Continuing our series on Indian AMCs’ annual reports, today we look at the highlights of HDFC MF Yearbook 2024 India in Amritkal

Let’s get started?

Before we begin, don’t forget to check out @Kuvera_In’s insights from investors – India Rising | 2023 Review and 2024 Outlook.

Download: https://kuvera.in/IndiaRising_2024Outlook

- The Year Gone By

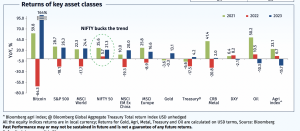

In 2023, assets that struggled in the earlier year rebounded, while previous strong performers faced challenges.

?? Indian markets performed strongly with positive returns in 9 out of 10 years.

??Global equities, including developed markets, rebounded in 2023 while China faced growth challenges.

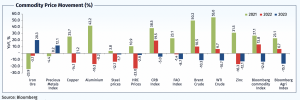

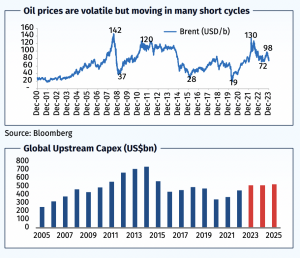

In 2023, most commodities experienced corrections, except for Gold and Iron Ore, while Oil maintained a relatively stable range throughout the year.

- Global Economy

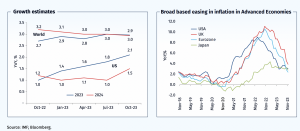

??World economic growth in 2023 fared better than expected

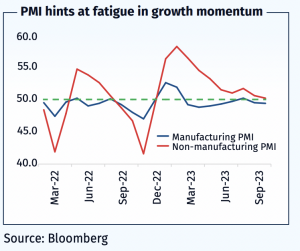

??US growth surprised on the upside while China disappointed

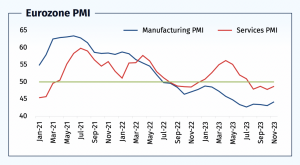

??EU remained lackluster

??Global inflation eased in response to monetary tightening and supply chain normalization

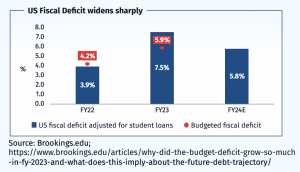

?? The US fiscal deficit widened sharply and boosted growth further

?? Deficit was higher by ~USD 1 trillion in 2023 (vis-à-vis 2022) driven by fall in income taxes

Accumulated savings have dwindled in recent years, potentially dampening private consumption. Elevated mortgage rates are expected to continue suppressing demand in the US housing sector.

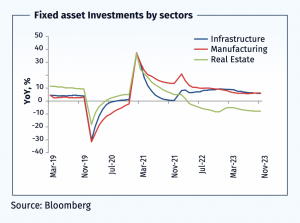

Real estate struggled, exports remained weak, consumption stayed steady, and infrastructure investment grew robustly with government support.

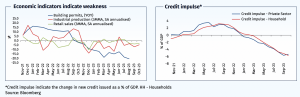

Eurozone growth was hampered by rising natural gas prices, subdued consumer sentiment, the Ukraine war, and a modest Chinese recovery.

Economic activity indicators saw across-the-board weakness.

III. Indian Economy

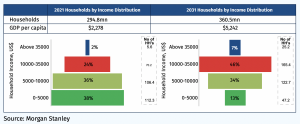

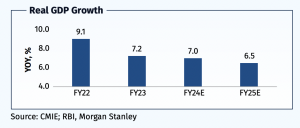

India is on the road to becoming the world’s 3rd-largest economy in the next five years while continuing to grow at double the global rate. ?

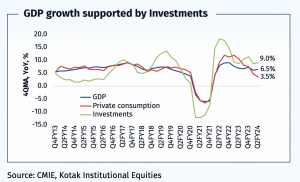

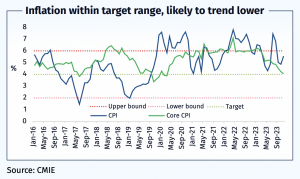

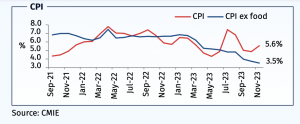

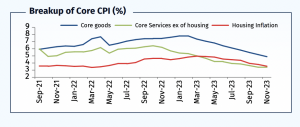

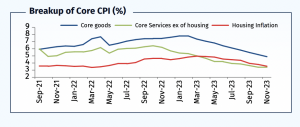

Robust growth driven by investment, manageable current account, stable inflation within the (2-6)% target range, and easing Core CPI.

India’s per capita income is projected to more than double in the next 8 years, driving increased consumer spending.

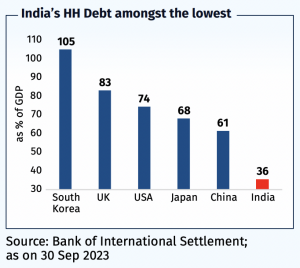

Also, India’s household debt is among the world’s lowest.

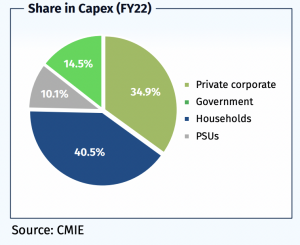

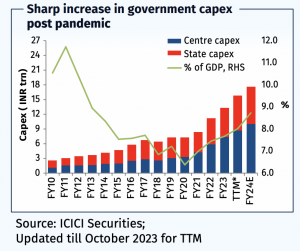

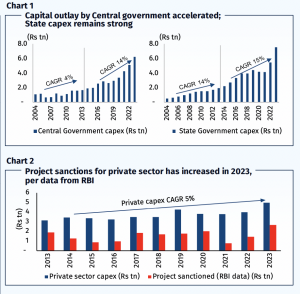

Government capex has risen sharply post-pandemic and Centre + state capex is estimated to rise to ~6% of GDP in FY24 from 3.6% in FY20.

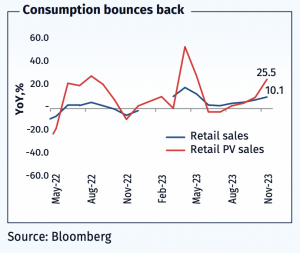

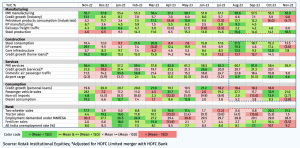

India’s growth has shown remarkable resilience with most high frequency indicators growing at a steady pace.

However, savings decline, IT job losses and waning pent-up demand could impact urban consumption.

In 2023, high inflation and rural challenges affected consumption, but easing inflation, higher food prices, and elections offer optimism.

- Indian Equity Markets

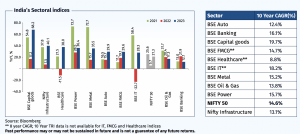

?? Performance of Indian equities was supported by resilient growth, strong corporate earnings and steady DII flows

?? All major sectors ended 2023 with +ve returns.

?? Capital Goods did better due to the government’s continued focus on capex. Auto, Healthcare, Infra outperformed the rest significantly.

In the last one year, only 7/100 of the stocks have delivered negative returns 53/100 stocks have delivered >40% returns.

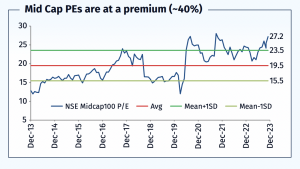

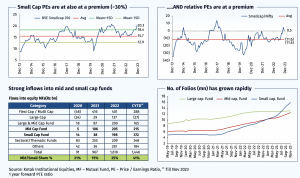

? Mid and small-cap funds see strong inflows

? Small Cap PEs are at a premium

? No. of folios shoots up ?

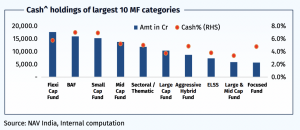

In the last decade, MFs: 3x increase in investor folios, Monthly SIPs >Rs. 17,000 crore (40% of Equity AUM), MF ownership in NSE listed companies up to 8.8% (from 6.4% in Sep 18), ~INR 1,43,000 crore cash in equity/equity-oriented hybrid schemes (5.5% of equity AUM).

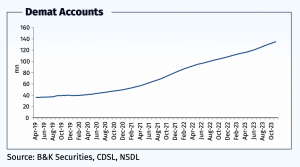

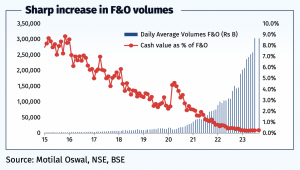

Demat accounts in India surged from 36 mn (Apr 2019) to 135 mn (Nov 2023), a ~3.8x rise in under 5 years. F&O activity spiked, led by retail investors.

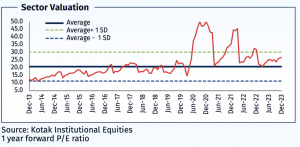

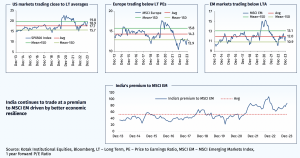

?? Most major markets are trading at close/lower to historical averages.

?? US trades at above long term averages while Europe and EMs are trading below LTAs.

- Sectoral Outlook

And now, a look at sector-wise outlook for 2024 by HDFC MF

Automobile OEMs

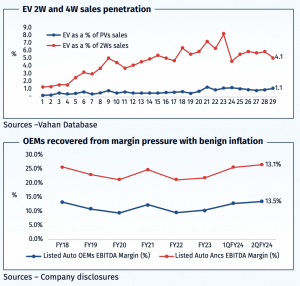

Govt’s stringent localisation norms refocus on established electric 2W/3W players, with new entrants struggling.

Meanwhile, select OEMs advance in the EV space, and China eclipses Japan and Europe as the top EV exporter.

……………

Automobile OEMs contd.

2024’s EV sector growth might slow amid rising inflation & interest rates. Valuation gaps between EV leaders and others are narrowing, driven by incumbents’ resurgence in tech, slightly raising sector valuation above the 20x PER historical average.

Banking & Financial Services

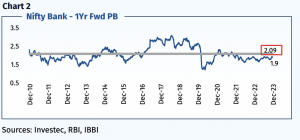

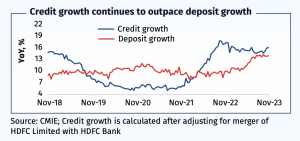

India’s credit to GDP at 70% is modest compared to the US’s >150%, hinting at a rise in credit growth as penetration deepens. Retail credit sees robust growth, driven by steady mortgages and a surge in unsecured advances.

Banking & Financial Services contd.

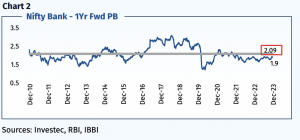

Valuations are ~10% below long-term average, yet profitability is up. Slower deposit than loan growth may raise costs or curb growth. RBI’s tighter unsecured loan rules might slow growth but enhance long-term asset quality.

……………

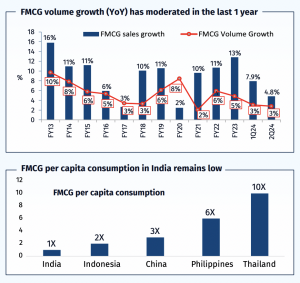

Consumer Staples (FMCG)

FMCG in India has lower per capita consumption than Asian peers, offering long-term growth through increased consumption and premiumization. Risks include saturation in big categories and the rise of private labels and D2C players.

……………..

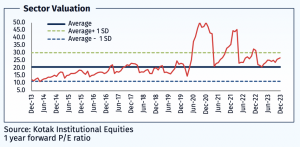

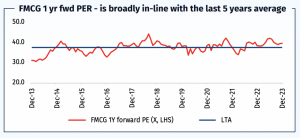

FMCG contd.

FMCG’s forward PER valuations stand at 40x, aligning with the 5-year average. The sector’s clear medium-to-long term earnings growth and robust return ratios justify these high multiples.

Capital Goods

India’s private capex cycle may rebound after a quiet decade, spurred by core industry revival and new-age manufacturing, plus export growth as countries diversify supply chains.

……………

Capital Goods contd.

Public capex, already robust, could strengthen with focused Central and State efforts.

Current valuations in this sector are running above the long-term average.

…………….

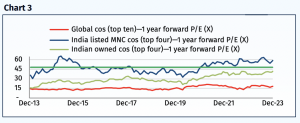

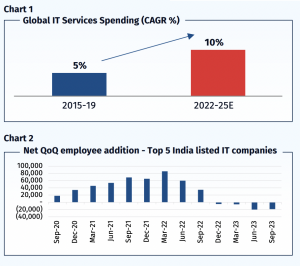

Indian IT Services

US economic outlook is crucial for short-term growth. Indian IT Services may benefit from a higher digital mix and offshoring comfort in the mid-term. Normalizing attrition and better utilization could boost margins.

…….

Indian IT Services contd.

After 2020/21’s re-rating, IT sector valuations dropped in 2022/H1 2023 amid global challenges. H2CY23 saw a re-rate with revenue recovery hopes for FY25. Current valuations are ~25% above long-term averages, with midcaps at a higher premium.

…….

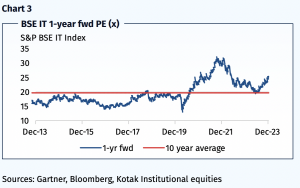

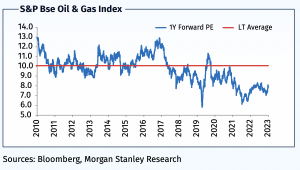

Oil & Gas

Auto fuel retailing’s low competitive intensity hints at long-term margin expansion. Firms diversifying into petrochemicals and natural gas could stabilize earnings.

Oil & Gas contd.

The S&P BSE Oil & Gas Index trades near its 10-year low in terms of 1-yr forward P/E, indicating potential valuation interest.

………..

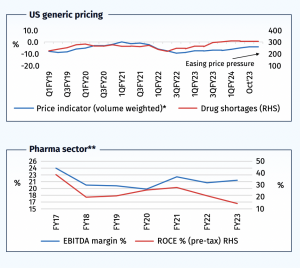

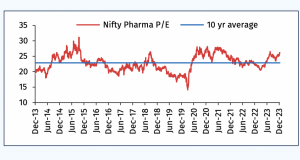

Pharmaceuticals

Easing cost pressures and sustained below trend-level US pricing erosion may result in better profitability.

…..

Pharmaceuticals contd.

But, investment opportunities will be selective given companies’ idiosyncratic growth drivers and differing investment cycles

Sector is trading at 26x 1-year forward P/E, a ~14% premium to its 10-year average

…..

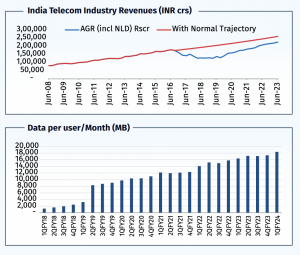

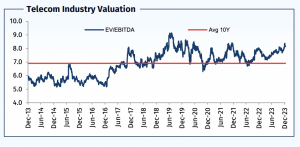

Telecom

With 5G adoption, global trends show data usage per user could double from 4G levels. This tech leap may boost telecom revenue as users upgrade for more data.

………

Telecom contd.

Indian Telecom Sector’s EV/EBITDA at 9x for FY25e is 12% above its historical average, compared to global rates ~6-7x.

………

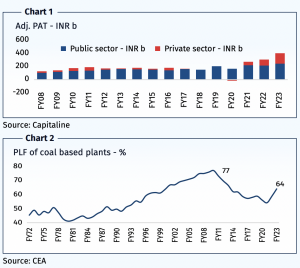

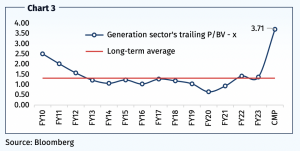

Outlook: Utilities

India’s electricity use is just 1/3rd of the global average. Rising income and economic activity signal strong demand growth, with electricity demand to GDP at ~0.9x.

….

Utilities contd.

Key drivers are increasing manufacturing, industrial activity, and appliance sales.

The sector valuations currently exceed historical averages.

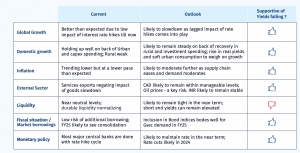

- Fixed Income Outlook

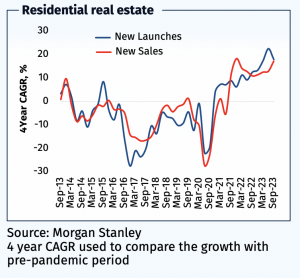

In FY25, HDFC MF expects steady ~6.5% GDP growth, driven by rural spending & HH capex.

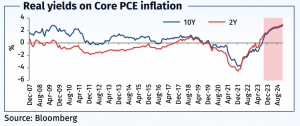

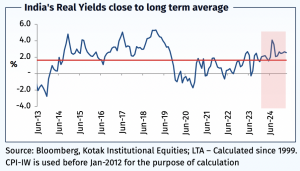

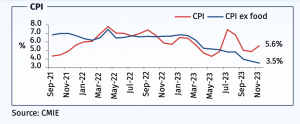

With an expected CPI dip to 4.5% in FY25, rising real yields may dampen consumption & growth.

——–

Inflation

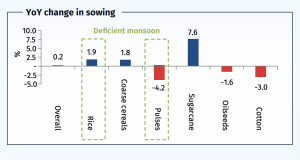

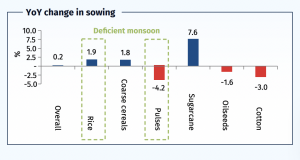

Uncertain crop yields likely due to uneven monsoon.

Low reservoirs may affect rabi sowing. Govt actions like duty cuts and increased imports aim to stabilize prices.

CPI likely to fall with weaker core CPI and normalizing food costs.

——–

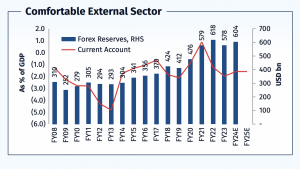

External Sector

India’s external sector shows resilience: Services exports counter oil price vulnerability, manageable current account, and strong forex reserves soften global monetary tightening’s impact.

——

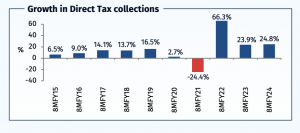

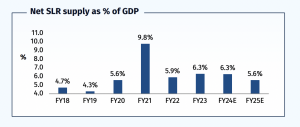

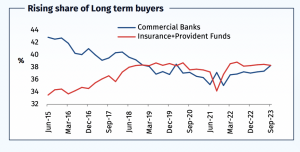

Fiscal Consolidation

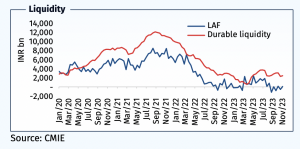

Fiscal deficit set to meet targets. Gsec demand-supply well balanced. Rising AUM by long-term buyers (Insurance & PF) ensures a steady demand for dated securities, especially long-duration bonds, boding well for a favourable yield outlook.

……

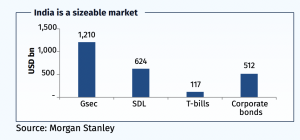

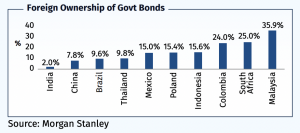

Inclusion of Indian Gsecs into Global Bond Index

JP Morgan announced it will Indian Gsecs to its Global Bond Index-EM. Expected lower yields and a diverse investor base to add stability. RBI’s strong forex reserves and stable FPI holdings should limit yield volatility.

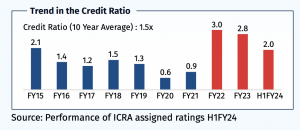

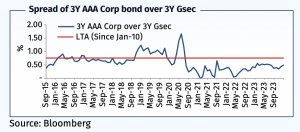

Corporate Credit

Credit quality remains robust. With private capex set to rise in the medium-term, the capex cycle is expected to boost credit demand and widen corporate spreads.

….

Final Word on Fixed Income

HDFC MF believes that the Bond Index inclusion and softening inflation bode well for yields. The long end likely to outperform, and it is time to increase duration.

And those were the highlights of HDFC MF 2024 outlook.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch here: Investing through various economic and market cycles

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.