Next in our series on #2024 Outlook for global and Indian markets and economy by India’s leading AMCs, we have @SBIMF 2024 Outlook Report.

As an aside, missed checking out @Kuvera_In’s insights from investors – India Rising | 2023 Review and 2024 Outlook?

Download: https://kuvera.in/IndiaRising_2024Outlook

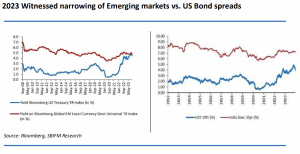

In 2023, the global macro environment was favorable for India, with better than expected global growth, milder export decline, controlled commodity costs, and manageable impacts of tighter monetary conditions reflected in narrower bond spreads & increased FII inflow. ??

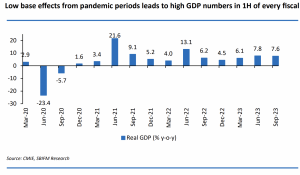

India’s real GDP in H1 FY24 grew by 7.7%, driven by investment and stronger manufacturing growth.

However, there is a risk of overestimation due to India’s single deflation method, which can exaggerate growth during periods of falling commodity costs.

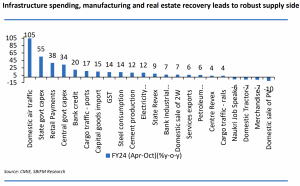

Government infrastructure thrust coupled with ongoing manufacturing sector and real estate recovery in India kept supply side of the economy robust, says the SBIMF report.

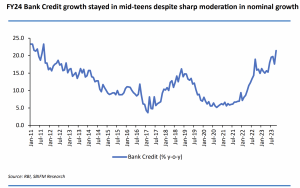

Despite the shift to single-digit growth in nominal GDP, bank credit has surged, averaging over 15% this year.

However, RBI’s efforts to control personal loans might slow down credit growth, with expectations of 11-12% growth for FY25.

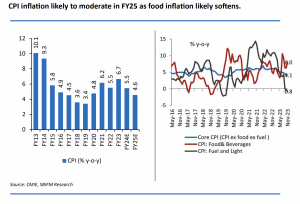

Core inflation is currently at a multi-year low due to controlled commodity expenses and sluggish consumer demand. However, food inflation remains a significant concern.

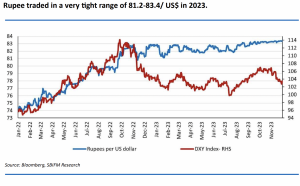

The US Dollar is expected to stay strong due to challenges in other developed economies, while in India, the rupee is likely to remain relatively stable in 2024, with a slight depreciation aligned with the REER.

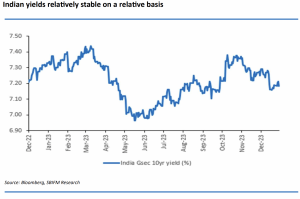

2023 Fixed Income market review: Volatile global, Stable Local

The markets had to adapt to continued Fed actions due to higher-than-target inflation and strong growth.

The Fed raised rates by an additional 100 basis points throughout the year, causing the 10-year US Treasury yield to climb from 3.30% in early April to 5% by mid-October.

Indian fixed income markets have broadly remained stable over the year with a marginal drop in yields on a y-o-y basis.

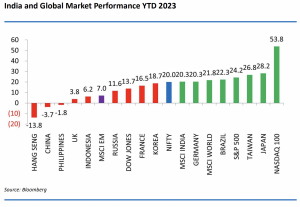

2023 Equity Market Review: Nifty 50 soared 20%, outpacing MSCI EM at 7%. However, Developed Markets like the US (S&P 500 & Nasdaq 100), Japan, Germany, and MSCI World outperformed India.

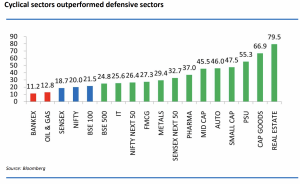

Real Estate rebounded, led by strong end-use demand and robust pricing. Government-led capex supported Industrial and Capital Goods sectors, signaling a multi-year demand cycle. Autos remained strong, while Banks and Commodities had a modest year. ??

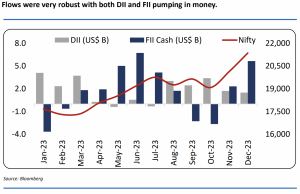

FIIs invested $20.0 Bn, rebounding from a $17.0 Bn outflow in 2022. Domestic institutional flows added $22.3 Bn, building on 2022’s $35.8 Bn, offering robust support to the markets.

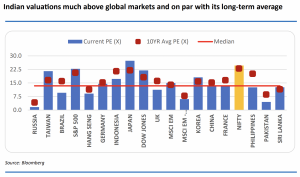

Unsurprisingly, Indian markets trade at valuations above global markets. However, Nifty valuations are on par with its long-term average at current levels.

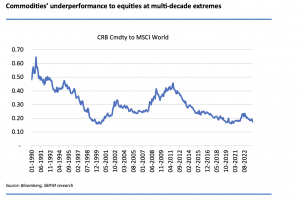

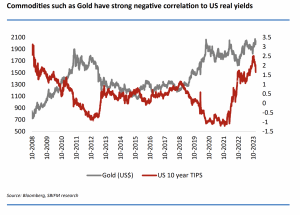

2024 Market Outlook: Recent shift from monetary accommodation to fiscal expansion favors hard assets like infrastructure, real estate, and commodities.

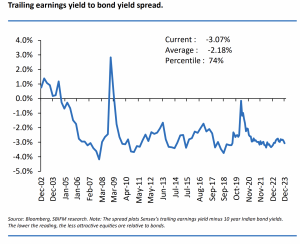

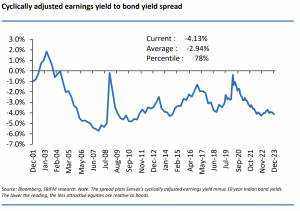

The spread between equity earnings yield and bond yields suggests equities are relatively expensive versus bonds. This is true both on trailing earnings and cyclically adjusted earnings-based yield spreads.

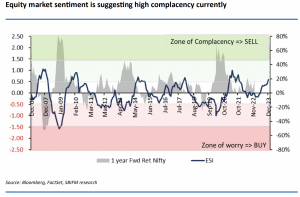

The report says, “Proprietary Equity market sentiment index has inched to levels suggesting heated sentiment and high complacency. As a contrarian indicator, such elevated readings are consistent with weak forward returns on equities.”

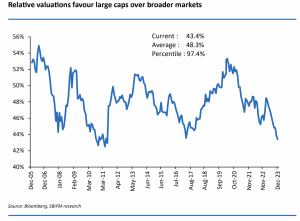

Large caps currently have the upper hand over broader markets. Sensex vs. BSE500 market cap ratio is at historic lows, suggesting potential for strong performance in large caps compared to mid and small caps.

As we enter 2024 with optimism, we recommend maintaining a diversified approach to asset allocation. This includes diversification not only within financial assets but also into physical assets and related opportunities.

That was a quick glance at @SBIMF 2024 outlook.

What do YOU think? Reply to tell us.

Follow @kuvera_in for more insights on markets and economy..

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch here: Investing through various economic and market cycles

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.