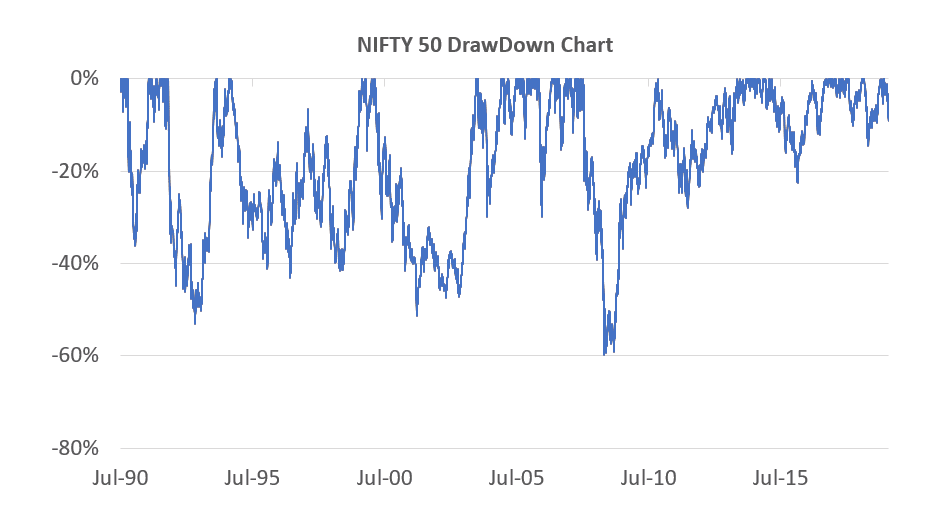

A drawdown is defined as –

“A drawdown is a peak-to-trough decline during a specific period for an investment”

For eg. Nifty 50 went from 12,088 to 10,980 since early June or a Drawdown of ~10%. The markets are almost always in a drawdown. Only 6% of trading days since 1990 produced new market highs i.e for 94% of trading days the market was in a drawdown. The average drawdown for NIFTY 50 over the past 29 years has been -18%!!

The chart below shows how much the Nifty index was down on that date from the last all-time high. Spend some time in understanding it properly.

So what about a -10% drawdown.

Nifty 50 has been in a -10% or worse drawdown in 59% of the trading days since 1990.

Read the above sentence again.

How about 1-years return after a -10% or worse drawdown? There is a 68% chance that the 1-year return after a -10% drawdown will be positive. The average 1-year return observed over the past 30 years post a -10% or worse draw is 21%. Of course your odds improve considerably the longer you are willing to hold equity index. Remember, invest for the long run.

If that sounds exciting, do know the downside too. The worst 1-year return observed post a -10% or worse draw is -50%!! You can still lose half of what is left. But, the best 1-year return observed post a -10% or worse draw is 312%.

What if the market sinks another 10% for a drawdown of 20%? 39% of the time Nifty has been in a -20% or worse draw since 1990. Avg 1-year return is 27%, and you can still lose 44% from there in the worst recorded case.

So, there you go. It is never as bad as it seems. The historical odds are good and the only requirement from the investor is to avoid the behaviour gap.

DSP Mutual Fund has marked down its investment in non-convertible debentures (NCDs) of Coffee Day Natural Resources Pvt Ltd (CDNRPL) by half. In communication by the fund house it was specified that DSP Credit Risk Funds exposure to NCDs of CDNRPL was Rs 69 crores as on July 29, 2019. The fund house also said that the exposure is secured by a pledge on the listed shares of CDEL and a land parcel.

As per a Finance Ministry Statement, the National Housing Bank (NHB) is infusing an additional ₹10,000 crore in NBFCs from Friday with a view to improving the flow of funds for housing loans. This would be in addition to two existing refinance schemes of the NHB.

On Thursday US President, Donald Trump announced that he would impose a 10% tariff on $300 billion of Chinese imports. On the other hand, Beijing has promised to respond if the US insists on additional tariffs on Chinese imports. Amidst the abrupt escalation of the trade war between the world’s largest economies stocks across nations were trading low during the week.

Index Returns

| Index | Weekly open | Weekly close | Change |

| BSE Sensex | 37,882.79 | 37,118.22 | -2.02% |

| Nifty | 11,284.30 | 10,997.35 | -2.54% |

| S&P BSE SmallCap | 13,060.34 | 12,496.35 | -4.32% |

| S&P BSE MidCap | 13,856.19 | 13,546.92 | -2.23% |

Source- BSE/NSE

Top 5 best performing funds

| Name | Week | 3Y | Category |

| ABSL Gold | 3.3% | 3.7% | Fund of Funds |

| Reliance Gold Saving | 1.9% | 3.0% | Fund of Funds |

| Kotak Gold | 1.9% | 3.5% | Fund of Funds |

| Quantum Gold Saving | 1.9% | 3.2% | Fund of Funds |

| IDBI Gold | 1.7% | 1.8% | Fund of Funds |

Source – Kuvera.in

Top 5 worst performing funds

| Name | Week | 3Y | Category |

| HSBC Infrastructure | -5.4% | -4.0% | Sectoral |

| IPRU India Opp | -5.3% | NA | Sectoral |

| Reliance Tax Saver | -5.1% | 2.3% | ELSS |

| Canara Robeco Small Cap | -5.0% | -8.9% | Small Cap |

| DSP World Mining | -4.8% | 8.1% | Fund of Funds |

Source – Kuvera.in

What investors bought

We saw the most inflows in these 5 Funds –

| Name | 1Y | 3Y | Category |

| Mirae Asset Large Cap | 1.8% | 12.1% | Large Cap |

| Mirae Asset Midcap | NA | NA | Mid Cap |

| HDFC Small Cap | -13.6% | 10.4% | Small Cap |

| Mirae Asset Emerging Bluechip | 3.1% | 13.9% | Large & Mid Cap |

| Parag Parikh LTE | 0.1% | 11.6% | Multi Cap |

Source – Kuvera.in

What investors sold

We saw the most outflows in these 5 Funds –

| Name | 1Y | 3Y | Category |

| HDFC Mid Cap | -12.3% | 6.3% | Mid Cap |

| ABSL Equity Hybrid 95 | -3.8% | 6.1% | Hybrid |

| Reliance Equity Hybrid | -7.1% | 6.8% | Hybrid |

| SBI Blue Chip | -1.7% | 7.5% | Large Cap |

| Kotak Standard Multicap | -0.9% | 11.1% | Multi Cap |

Source – Kuvera.in

Movers & Shakers

1/ SBI Mutual Fund has appointed Milind Agrawal (Equity Research Analyst) as Fund Manager of SBI Banking & Financial Services Fund.

2/ G Narayanan and Jaideep Singh have been appointed as Independent Directors on the board of Canara Robeco Asset Management Company Limited.

3/ Sandip Ghose has been appointed as Independent Director on the board of Motilal Oswal Trustee Company Limited.

4/ Aditya Birla Sun Life Mutual Fund has appointed Balasubramanian (Chief Executive Officer) as Managing Director of the AMC.

Quote of the week:

You get recessions, you have stock market declines. If you don’t understand that’s going to happen, then you’re not ready, you won’t do well in the markets.

— Peter Lynch

Feature Showcase: Tax Harvesting

Tax Harvesting is a technique that utilises the ₹1 Lakh annual LTCG exemption by selling and buying back part of your investment such that you “realise” gains and not pay taxes on them. At a 10% LTCG tax rate, you could save up to Rs 10,000 in LTCG taxes every year by doing this diligently.

Do not wait for February / March to harvest taxes. Do it as early in the financial year as possible – you may not have gains later to harvest!

Like all our features, Tax Harvesting optimizes on your entire portfolio – bought on Kuvera or imported from elsewhere.

Start harvesting today.

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!