CAMS recently released its ‘Women Power in Mutual Fund 2024’ on the occasion of International Women’s Day highlighting the significant strides Indian women have made in the financial domain, especially in mutual fund investments.

The report offers compelling insights into the evolving landscape of women investors in India, underlining their growing influence and participation in the financial market.

As financial independence among women increases, coupled with a heightened awareness of financial assets as a means for wealth creation, the gender gap in the traditionally male-dominated investment sphere is gradually closing. This shift is observable beyond the confines of top-tier cities, reflecting a broader change in women’s attitudes toward personal wealth management.

“With growing financial independence and increasing awareness about financial assets led to wealth creation, the gender divide is narrowing in the traditionally male-dominated investment space. The trend is not restricted to top tier cities which is another indicator of changing behavior of women towards personal wealth management.” said the report.

Let’s take a look at all the key findings of the report;

A Surge in Women Mutual Fund Investors

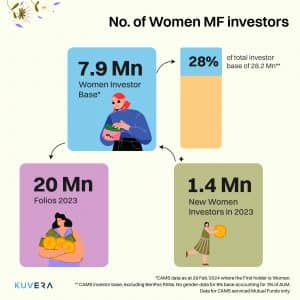

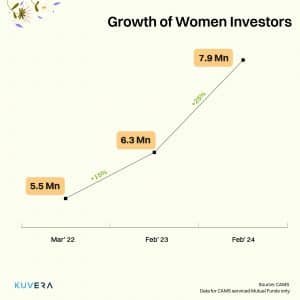

As of February 2024, CAMS data highlights a remarkable surge in women’s participation in mutual funds, with approximately 79 lakh women investors holding around 2 crore folios. This represents a substantial 25% increase in the women investor base over the year, signaling a positive trend in financial empowerment and literacy among Indian women.

Unprecedented Growth in Assets Under Management (AuM)

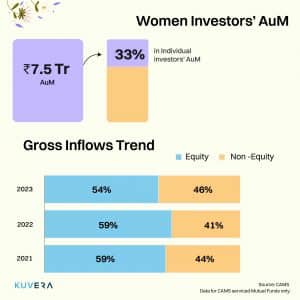

The financial prowess of women investors is further underscored by the significant growth in Assets Under Management (AuM). From 2017 to February 2024, women investors’ AuM skyrocketed from ₹98,000 crore to an impressive ₹7.5 trillion. This growth has elevated their share to 33% of the total individual investors’ AuM in 2024.

Equity Investments Witness Robust Inflows

The appetite for equity investments among women has seen a remarkable uptick. In 2023 alone, gross inflows in equity schemes surged by 33% to ₹1.3 lakh crore from ₹0.98 lakh crore in the previous year.

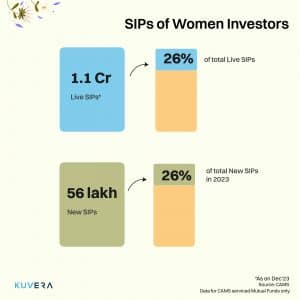

The Rise of SIPs

SIPs have emerged as a favored investment vehicle for women, with average SIP sizes at ₹3,738.

26% of all live and new SIPs in 2023 were attributed to women investors. This preference for SIPs underscores women’s strategic and long-term approach to investing, emphasizing regular savings and diversification.

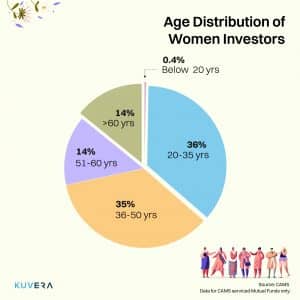

Active-Investors: Young Women Lead the Way

The report also sheds light on the demographics of women investors in India, revealing that the most active investor group comprises women aged 20-35 years.

This demographic shift is encouraging, as it signifies the early adoption of investment habits among young women, setting the foundation for financial independence and security.

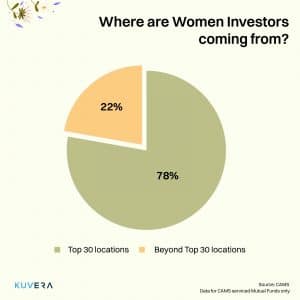

T30 Cities: The Hub of Women Investors

As expected, the majority of female investors hail from the T30 cities, holding a significant share of the investment pie. This concentration in urban areas suggests higher financial literacy and access to investment opportunities.

Embracing Financial Empowerment

The findings from the CAMS report shed light on how Indian women are investing and their growing footprint in India’s mutual fund sector but also highlight the broader trend of financial empowerment among women.

As we look forward to more women joining the ranks of investors, the focus shifts to enhancing financial education, simplifying investment processes, and creating inclusive products that meet the unique needs and goals of women investors.

The report also highlights the growing number of women distributors within the mutual fund industry. With 43,000 women registered as distributors and 20,000 managing assets worth Rs.1,23,629 crore, their impact is significant.

In 2023, these women achieved sales of Rs.43,236 crore, opened over 555,000 new accounts, and started more than 517,000 new SIPs. This showcases the growing role of women in mutual funds, both in managing large sums and in expanding the market.

Conclusion

The trajectory of women investors in India is on an impressive upswing, with 2024 marking a year of notable achievements and milestones. As we continue to empower and educate more women about the benefits of mutual fund investments, the future looks promising for achieving greater financial inclusion and equality.

Stay tuned to Kuvera for more insights and updates from the world of finance, economy, and investing, as we champion the cause of women’s financial empowerment.

FAQs

1. Where do women invest in India?

The report shows that 76% of Indian women investors invest in equity only, while 6% of them invest in non-equity instruments and 18% have exposure to both.

2. What is the percentage of female investors in India?

As of Feb 2024, India women investor base stands at 7.9 Mn which is 28% of Investor base of 28.2 Mn.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch here: ELSS: Saving tax through mutual funds

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.