In the world of economics, various indicators provide valuable insights into the health and performance of an economy. To make wise financial decisions you need to familiarise yourself with these indicators.

This is essential for understanding economic trends, making informed decisions, and assessing the overall economic landscape.

In this blog, we will explore several important economic indicators, including Consumer Price Index (CPI), Wholesale Price Index (WPI), Fiscal Deficit, Cash Reserve Ratio (CRR), Manufacturing Purchasing Managers’ Index (PMI), and Forex Reserves.

1) Consumer Price Index (CPI)

The CPI measures changes in the average prices of a basket of goods and services consumed by households. It provides insights into inflationary trends, allowing policymakers and investors to gauge the purchasing power of consumers and make informed decisions regarding monetary policies and investments.

In simple terms, the Consumer Price Index (CPI) is a measure that tells us how the prices of goods and services change over time. It helps us understand inflation, which is the general increase in prices. The CPI tracks a basket of commonly purchased items, such as food, housing, transportation, and healthcare, and compares their prices to a base period.

By doing this, the CPI gives us an idea of how much more or less we have to pay for things compared to before. It helps us understand how the cost of living is changing and how our purchasing power may be affected.

2) Wholesale Price Index (WPI)

The WPI tracks changes in the average prices of goods sold in bulk by wholesalers. It serves as an indicator of inflationary pressures in the production and distribution stages of the supply chain. The WPI is crucial for policymakers, businesses, and investors to assess cost fluctuations and plan their strategies accordingly.

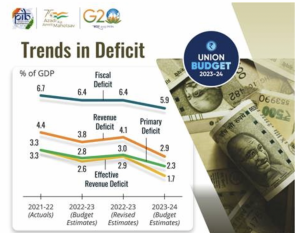

3) Fiscal Deficit

Fiscal deficit represents the gap between a government’s total spending and its total revenue. It reflects the extent to which a government relies on borrowing or other sources to fund its expenses. Monitoring fiscal deficit is important to evaluate a country’s fiscal health, as excessive deficits can lead to issues such as high inflation, increased borrowing costs, and economic instability.

4) Cash Reserve Ratio (CRR)

CRR is the portion of a bank’s deposits that it must maintain with the central bank. It is set by monetary authorities to manage liquidity in the banking system. Adjustments in CRR influence the amount of funds available for lending, impacting interest rates, money supply, and overall economic stability.

5) Manufacturing Purchasing Managers’ Index (PMI)

The PMI is an indicator of the economic health of the manufacturing sector. It measures factors such as new orders, production, employment, supplier deliveries, and inventories. A PMI above 50 indicates expansion, while below 50 signifies contraction. Tracking PMI data helps assess business activity, growth prospects, and overall economic performance.

In May, the manufacturing sector in India showed a significantly positive outlook, as indicated by the rise in the S&P Global India Manufacturing Purchasing Managers’ Index (PMI). According to reports from Reuters, the PMI increased from 57.2 in April to 58.7 in May, driven by robust demand.

6) Forex Reserves

Forex reserves refer to a country’s holdings of foreign currencies and precious metals. They serve as a cushion to maintain stability in foreign exchange markets and meet international payment obligations. Higher forex reserves indicate a country’s ability to handle external shocks and maintain confidence in its currency.

According to the latest data provided by the Reserve Bank of India (RBI) on Friday, India’s forex reserves decreased by $2.9 billion and currently amount to $593.2 billion as of June 23.

The largest component of India’s forex reserves, foreign currency assets, witnessed a decline of $2.21 billion, reaching $525.4 billion. It’s important to note that changes in foreign currency assets, when expressed in dollar terms, encompass the impact of currency fluctuations of other currencies held within the RBI’s reserves.

Conclusion

Understanding key economic indicators is crucial for individuals, policymakers, and businesses alike. The CPI, WPI, fiscal deficit, CRR, Manufacturing PMI, and forex reserves provide valuable insights into inflation, economic growth, monetary policies, and overall economic stability. By monitoring these indicators, one can make informed decisions, anticipate economic trends, and navigate the ever-changing economic landscape with confidence.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch here: Key investment mistakes to avoid in 2023.

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.