How to avoid the pitfalls of smallcap investing? In this episode of #KuveraInsights, Navneet Munot, Chief Investment Officer – SBI MF, Bijoy Idicheriah, Asst. Editor – Cogencis Information Services and Gaurav Rastogi, Founder & CEO – Kuvera.in discuss the ups and downs of investing in Small-cap Funds and the deep research that backs investment decisions in the stocks chosen.

Regardless of whether you think it is a good time to start investing in small caps again, don’t do that based on past returns. A detailed study that covers all equity Mutual Funds in India going back to 2003 finds that investing based on past returns has not worked.

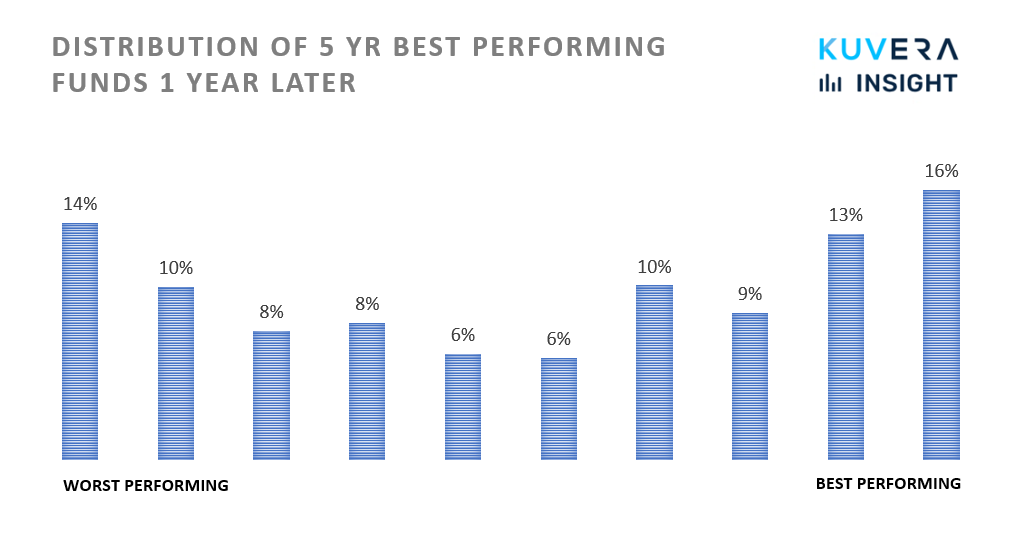

The chart below shows what would have happened if you invested in the top 10% of funds based on past 5 year returns. Let’s spend some time on this because what the chart says is nothing short of revolutionary.

- 14% of the best-performing funds based on 5 year past data were part of the worst-performing funds 1 year later.

- A mere 16% of the best-performing funds based on 5 year past data continued to be part of the best performing funds 1 year later.

- Only ~56% of the best-performing funds based on 5 years past data continue to be in the top half of the funds by performance 1 year later.

Read more here.

Vodafone Idea Ltd has paid the principal and interest amount to Mutual Funds and banks for non convertible debentures (NCDs) that matured on July 10, 2020. Franklin Templeton Mutual Fund, which had created segregated portfolios in 6 debt schemes with exposure to Vodafone Idea Ltd has received payment of Rs 1252 crore. UTI Mutual Fund and Nippon India Mutual Fund have received Rs 166 crore and Rs 121 crore respectively. Investors holding units in the pertaining segregated portfolios will receive proportionate payments from the AMCs. The payment from segregated portfolio is independent of the winding up process of 6 debt schemes of Franklin Templeton.

Equity mutual funds witnessed inflows of Rs 241 crore in the month of May 2020, down 95.4% from May inflows of Rs 5,267 crore. Large cap and multi cap funds witnessed outflows of Rs 778 crore and Rs 213 crore respectively while midcap and smallcap funds saw inflows of Rs 37 crore and Rs 249 crore respectively. The net assets under management (AUM) of the mutual fund industry grew 2.56% to Rs 25.5 lakh crore in June, compared to Rs 24.3 lakh crore in the previous month.

SEBI has amended the SEBI (Investment Advisers) Regulations (2013), strengthening the regulatory framework for investment advisers. The market regulator has mandated that an individual would have the option to register as an investment adviser or provide distribution services as a distributor, but not both. Non-individual investment advisers who wish to provide distribution services as well can do so through a separate division/department of the organisation. Such organisations would need to maintain an arm’s length relationship between the two activities.

|

|

|

|

|

|

|

|

|

Movers & Shakers

1/ Mirae Asset Mutual Fund has launched the NFO for Mirae Asset Banking & PSU Debt Fund. The scheme would predominantly invest in debt instruments of banks, Public Sector Undertakings, Public Financial Institutions and Municipal Bonds. The scheme will be managed by Mahendra Jajoo. The NFO will be open for subscription until 20 July.

2/ ICICI Prudential Mutual Fund has announced that Atul Patel ceases to be co fund manager of ICICI Prudential Multicap Fund. Rajat Chandak has been appointed in his stead. Sankaran Naren will continue as existing co-fund manager.

3/ BOI AXA Mutual Fund has announced that Ravi Prakash Gupta ceases to be Associate Director of BOI AXA Trustee Services Private Limited.

Quote of the week:

Great things are not done by impulse, but by a series of small things brought together.

: George Eliot

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!

myfatFIRE

July 15, 2020 AT 02:21

S&P BSE SmallCap 1.6% -7.2% -7.0% -682.3 1.9

Small cap PE doesn’t look correct.

Gaurav Rastogi

July 20, 2020 AT 11:04

Noted

Girish Purushottam Zarkar

July 24, 2020 AT 07:32

I am interested in investing some amount in small cap MF. Which I have to invest please guide.

Gaurav Rastogi

July 27, 2020 AT 05:27

Motilal Oswal Small Cap Index Direct plan is a good one.

https://kuvera.in/explore/motilal-oswal-nifty-smallcap-250-index-growth–MOSIGD-GR