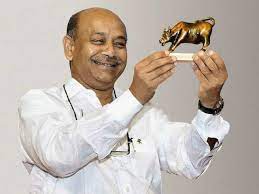

An Indian billionaire who started his career as a ball bearing seller and went on to become the founder of one of the biggest and most loved retail chains in the country.

Yes, we are talking about the founder of DMart store, Mr. Radhakishan Damani. Apart from being a very successful business, he is also a very successful investor.

He manages his portfolio through his Investment firm, Bright Star Investments Limited and was ranked one of the 100 richest people in the world 2021 by Bloomberg. Damani publicly holds 6 stocks in his investment portfolio and total value of his stock portfolio is approx ₹102,077 crore (US$13 billion) in 2021.

His significant fortune is built through clever investments and a keen eye for spotting opportunities. Damani is known for being a man of few words, but his actions speak volumes. He has consistently shown his ability to create wealth through his investment strategies.

Here are three investing principles that have helped Radhakishan Damani achieve great success:

1 – Value Investing

Radhakishan Damani believes in investing in undervalued companies that have the potential to grow in the future. For example, he acquired a stake in VST Industries when its market price was lower than its intrinsic value, and held on to his investment until the company’s stock price increased significantly.

2 – Long-Term Vision

Damani invests in companies that have strong fundamentals and growth potential, and holds on to his investments for the long term. For instance, he invested in Avenue Supermarts during its IPO and has held on to his stake, even during market downturns.

3 – Risk Management

Damani manages his risks well by diversifying his investment portfolio and avoiding overexposure to any single sector. For instance, he does not concentrate his investment to one sector and generally invests in a range of sectors, including retail, real estate, and finance, to mitigate the risk of any one investment underperforming.

Radhakishan Damani’s success story is an inspiration for budding investors and businessmen alike, and his investment principles can serve as a guide to achieving financial success.

Conclusion

Legendary investors have left an indelible mark on the world of finance and investment, and their insights and strategies continue to inspire and inform investors of all backgrounds and experience levels. Whether it’s Warren Buffett’s emphasis on long-term value or Benjamin Graham’s focus on intrinsic value, the lessons and philosophies of these investors offer valuable insights into the art and science of investing. By studying the approaches of these investing legends, we can gain a deeper understanding of the markets, develop sound investment strategies, and potentially achieve long-term financial success. Stay tuned to our “Investing with Legends” series to know more about their investing principles.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.

#MutualFundSahiHai #KuveraSabseSahiHai! #PersonalFinance