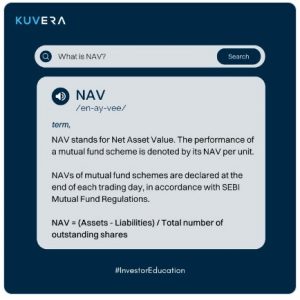

Net Asset Value (NAV) is a measure of the value of a company’s portfolio. It is calculated by subtracting liabilities from the market value of the company’s assets, and then dividing the result by the number of outstanding shares. NAV represents the per-share value of the company’s portfolio and is often used to determine the price at which the company’s shares can be bought or sold.

NAV is a way to find the value of a company. It’s like finding the value of your own possessions by adding up what they’re worth and subtracting what you owe. NAV does this for any given company and divides the result by the number of shares the company has. This gives you the value of each share.

NAV is primarily used to value investment companies such as mutual funds or exchange-traded funds (ETFs) that hold a portfolio of assets. However, the concept of NAV can be applied to any type of company or entity with assets and liabilities to calculate its overall value.

Use of NAV

NAV can be useful for the following reasons:

- Determines Share Price: NAV is used to determine the price at which shares in an investment company can be bought or sold.

- Reflects Portfolio Value: NAV reflects the current market value of an investment company’s portfolio, giving investors an idea of the portfolio’s worth.

- Comparison Tool: NAV can be used to compare the performance of different investment companies.

- Easy to Calculate: NAV is a simple calculation that can be performed using readily available information on a company’s assets and liabilities.

- Provides Information on Fund Performance: NAV can give investors an idea of how well an investment company’s portfolio has performed over time.

However, it is important to note that while NAV provides valuable information, it should not be used as the sole basis for investment decisions. Other factors such as market trends, economic conditions, and the company’s management should also be taken into consideration.

How is NAV calculated?

NAV is calculated as follows:

Normal Calculation:

If you are investing Rs. 1000 in your mutual fund scheme with a NAV of Rs 100, then you are eligible to buy ten units of the mutual fund. For instance, while investing Rs 2 lakh in X & Y Mutual Fund Scheme each, the Net Asset Value of X MF Scheme is Rs 15, and the value of Y MF Scheme is Rs 30.

There are units under MF Scheme assigned as under – i.e. X MF Scheme : Rs 2 Lakh / Rs 15 = 13,333 units, Y MF Scheme : Rs 2 Lakh / Rs 30 = 6666 units.

NAV calculation on a day-to-day basis:

Almost every single MF computes the market price of securities at the closure of market hours each day. The Asset Management Companies then deduct the outstanding liabilities and costs to compute the NAV of a specific day by implementing a proven formula, which is:

Net Asset Value (NAV) = Assets – (Liabilities + Costs) / Number of payable units

Mutual fund assets of mutual fund schemes are grouped into liquid cash and securities. Shares and securities primarily consist of money market tools like, debentures, equity instruments, commercial paper, bonds etc.

What role does NAV play in the performance of a fund?

While many investors misunderstand a stock price similar to a net asset value, they often assume that investing in a mutual fund scheme with a lower net asset value is of low cost and thus, could be a wise investment. However, the reality is that net asset value does not determine a mutual fund’s performance. Just because the price is lower does not mean you are making a better investment.

NAV’s role only shows how the primary assets have performed. However, it shouldn’t be considered a major parameter in the selection of mutual funds. There might be two distinct mutual fund schemes with the same securities’ portfolio, but the NAV of both these funds might differ drastically. If one scheme offered is Rs. 10 NAV, the other scheme might be Rs. 100 or above.

Therefore, you must analyse and go through the earlier performance of the mutual fund, total expense ratio, and other essential factors before making an investment decision.

Watch the YouTube video by Franklin Templeton India above to understand NAV in simpler terms and understand how you can avoid the common mistakes made by investors when buying mutual funds based on NAV.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch here: How to invest during a bear market?

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today. #MutualFundSahiHai #KuveraSabseSahiHai