Data discoveries of the week. We look the income distribution chart of India, pace of Fed’s rate hikes, US household savings data, Hang Sang Index historic movement, shift in India’s oil suppliers and more.

1. You are in the top 10% income bracket in India.

If your monthly income is more than ₹25,000, then you are in India's top 10% income bracket. If the monthly income is more than ₹65,000, you are in the top 5%. pic.twitter.com/X3XXbiSERX

— Khalid Anis Ansari (@KhalidAAnsari4) November 2, 2022

2. This cycle of Fed’s rate hike is the fastest rate hikes in decades.

This the fastest pace of rate hikes in decades. #FOMC pic.twitter.com/6z9cBcQxhB

— Kathy Jones (@KathyJones) November 2, 2022

3. In the US, declining real incomes being offset by spendings from household savings. How long will it last?

Households saved about $2.2T during the initial pandemic and pandemic stimulus. Have spent out $0.7T of that maintaining consumption in the face of flat/declining real incomes. Still leaves about $1.5T–which could easily last a year. pic.twitter.com/zbBarTrgd5

— Jason Furman (@jasonfurman) October 28, 2022

4. Hong Kong’s Hang Sang Index saw a record slump after Xi Jinping secured 3rd term following a week long congress.

This is worse than I thought. The Hang Sang Index has reached 2008 Great Financial Crisis levels. pic.twitter.com/q1jlkvCc2q

— Ayesha Tariq, CFA (@AyeshaTariq) October 28, 2022

5. With $2.21T, Apple’s has the largest market capital, equivalent to that of Meta, Amazon and Alphabet combined.

Wow! The market cap of $AAPL now equals $GOOG, $AMZN, and $META *combined* ? pic.twitter.com/OdX9QEeE2u

— Quartr (@Quartr_App) November 3, 2022

7. At 946,000 barrels a day, Russia becomes the largest oil supplier to India.

#SATnews from Sputnik News@PradeepKTaneja @SurjeetDhanji @ateevdang @sanfunhindu @VyasNeena @ashutosh83B @PankajPachauri

Russia has emerged as India’s top oil supplier in October 2022, surpassing Arab countries, the data published by energy cargo tracker Vortexa showed. pic.twitter.com/kCyySROf6R

— South Asia Times (@southasiatimes) November 3, 2022

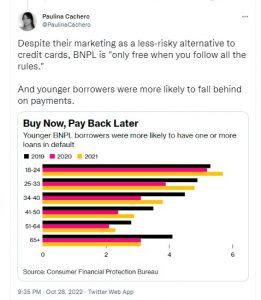

8. We have said it in the past and we are saying it again, BNPL is a slippery slope that most can’t handle.

9. Data showing performance of US funds compared to benchmark S&P 500 index over last 10 years.

Question to DIY stock and fund pickers:

If 90% of full-time professional money managers fail to beat the market/benchmark, why do you believe you can?

See data;https://t.co/iSEXsc8stQ pic.twitter.com/gPVYA6ZF47

— Alan Smith (@AlanJLSmith) October 26, 2022

10. It all comes down the simple but most effective rule.

Golden rule in investing

And life:

Control what you can and let go of what you can’t.

H/T @safalniveshak pic.twitter.com/SwfKnE5mEr

— Alan Smith (@AlanJLSmith) November 2, 2022

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Check out our “Kuvera Insights” on Youtube and learn from the industry experts.

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.

#MutualFundSahiHai #KuveraSabseSahiHai! #PersonalFinance