This article explores why passive investing is a smarter choice compared to active investing. But before we get into the reasons, let’s understand the difference between the two investing approaches.

Active investing

Active investing involves frequent buying and selling securities based on their short-term performance, with the goal of outperforming the average market returns. This “short term” could be weeks, days, or even hours.

Passive investing

Passive investing, on the other hand, is a “buy and hold” strategy in which investments are held over longer periods, often years. The aim is to match the average market returns instead of outperforming them. This typically means investing in mutual funds that track an index, or index funds.

Cost of Investing and which approach is better?

Confused about what strategy works for you as an individual investor? How do you make a choice? For any investing strategy, you need to look at the following considerations:

1. Cost of Risk

Active investing, whether through actively managed mutual funds or picking individual stocks, inherently carries a greater risk than the passive approach. This is because the find manager or the investor bets on specific securities to outperform the market. Passive investing only aims to replicate the market (specifically, the index it is tracking), and therefore, the element of additional risk is lesser. Does the additional risk in active investing offer any guarantee of alpha returns (higher than the index)? We’ll look at data in the next section to answer this question.

2. Cost of fee

Passive funds are less expensive than active funds. In fact, some have expense ratios that are only a quarter of those charged by active funds. Active funds are more expensive because they need additional resources for constant research, analysis and forecasting. In addition, they also include transaction costs like SEBI turnover fees, stamp duty, GST, and Security Transaction Tax (STT), which can add up to a significant cost with frequent trading.

3. Cost of taxes

Passive investing fares better, because longer-held investments qualify for lower long-term capital gains (LTCG) tax rates of 10%, compared to short-term rates of 15%. By holding passive investments longer, taxes on capital gains are deferred, allowing a larger capital base to grow and enhancing returns.

Interested to invest in index funds? Start here.

Performance of Active Funds vs Passive Funds

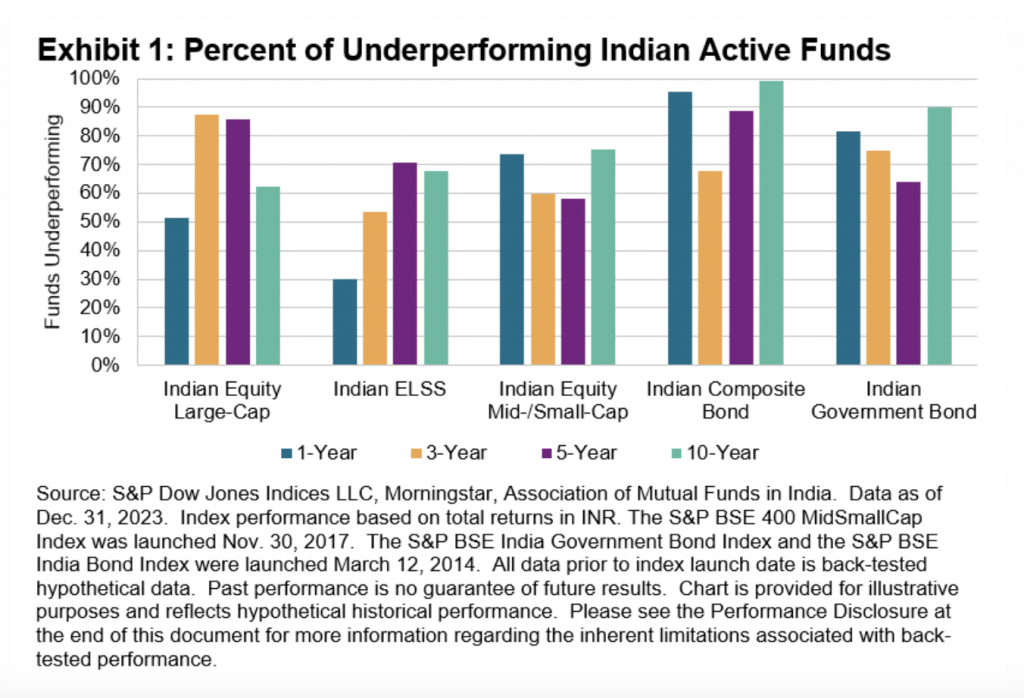

Active funds aim to exceed benchmarks like the Nifty 50 or BSE 500, but data shows they often fall short. Over the last three to five years, only a few large-cap mutual funds have consistently outperformed the Nifty 50 index, and these funds typically show more volatility in their returns. Here’s a look at data from SPIVA India Year-End 2023 report.

Equity Large-Cap Funds

The S&P BSE 100 gained 23.2% in 2023, and ~ 52% of active managers underperformed the benchmark over this period.

Underperformance rates were significantly high over the three- and five-year periods, at 87.5% and 85.7%, respectively.

Active managers produced relatively better results over the 10-year period, with the underperformance rate dropping to 62.1%.

Equity Mid-/Small-Cap Funds

Here, data gets more interesting. In 2023, the S&P BSE 400 MidSmallCap Index saw a gain of 44.0%, but 73.6% of active managers in this category did not perform as well. Over a decade, ending December 2023, Indian Equity Mid-/Small-Cap funds showed the poorest long-term performance among equity categories on the SPIVA India Scorecard, with 75.4% trailing behind the index.

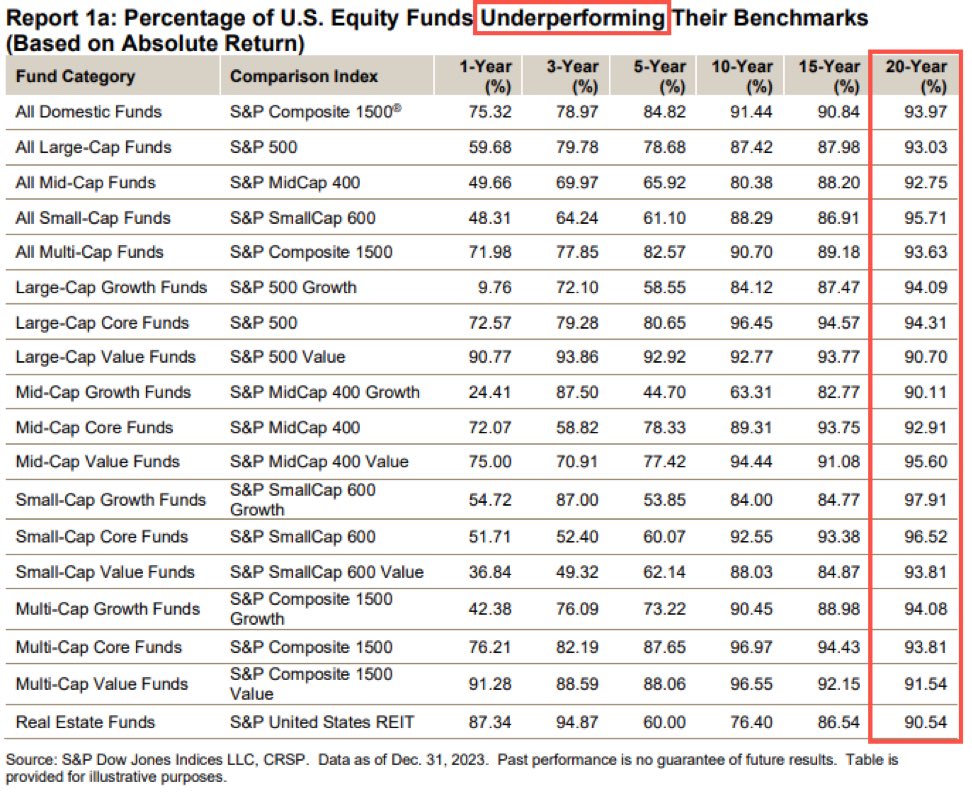

US Data

Data from the US is even more interesting!

As you can see, a vast majority of funds across categories, and across periods have underperformed.

Clearly, Passive investing offers greater cost advantages along with the guarantee of close to market returns. For individual investors, passive investments in index would probably yield better returns than actively managed portfolios.

Why, then, would one want to take an active investing approach? Greed is the prime driver. These investors prefer actively managed funds to avoid being “average,” accepting the risk of underperforming for the chance to exceed average returns. It’s a case of market-matching returns not being as impressive as outperforming the market. But then, what are the chances of that happening?

Other advantages of Passive investing

Passive investing also avoids many active investment pitfalls, such as biases, risk aversion or recklessness based on past investments, reliance on second-hand tips, and the fear of missing out (FOMO). When choosing between passive and active investing, look at the costs and behavioural factors, too. You’ll know which is the smarter choice.

Cover image courtesy: https://storyset.com/people People illustrations by Storyset

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch here: Index funds explained

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.