What do you need in your deposit account?

We asked our users what they value the most in a deposit or a savings account.

The top two needs were –

1/ Higher interest rate or returns

2/ High liquidity – to be able to access the money quickly

When we look at the existing options, none of them fulfils both the requirements. It is always a tradeoff – if you need higher returns (FD) you need to sacrifice liquidity and lock-in your money for long durations. If you have instant liquidity (savings or current account) then you need to settle for lower returns.

Ideally, we would want to be able to earn more on our cash while also have the peace of mind that the money is available in case of any emergency.

We designed SaveSmart for this

It provides you with both of the above – a rate of return linked to a basket of liquid funds from the top mutual fund companies in India and instant liquidity of up to Rs 2 lakh a day. And the rest can be withdrawn in as little as one business day. Rs 2 lakh of instant liquidity will either cover all your emergency expenses or buy you enough time to get the remaining money in your bank account.

Finally, you have a deposit solution that you want. Returns linked to liquid funds, and instant liquidity of up to Rs 2 lakhs for any expense. There is no need to leave your money in low return savings or checking account or locked in a fixed deposit.

This is the deposit account you have been looking for.

How does SaveSmart work?

We have built an algorithm that invests your money in liquid funds from the largest and most reputed fund houses. This ensures your money earns low risk liquid fund returns. Our algorithm also ensures that you have the highest liquidity available to you as instant redemption in case you need the money immediately. So, while each of the liquid fund in our basket offers only Rs 50k instant liquidity, by investing in them smartly we can offer our users up to Rs 2 lakh of instant liquidity.

How do I deposit into SaveSmart?

Just go to SaveSmart page and add money to your SaveSmart amount. If you need KYC we will help you do that too. You don’t have to worry about how much gets invested in which liquid fund, we handle that. Deposit made today in SaveSmart will reflect in your account in up to two business days as per the settlement timelines of liquid funds.

How do I withdraw from SaveSmart?

Equally easy. Once you have made a SaveSmart deposit, go to the SaveSmart tab on your portfolio page. Click on “Manage” and make a withdrawal. At the time of withdrawal, we will inform you how much can be withdrawn instantly. Again, you don’t have to worry about how much to withdraw from which underlying liquid fund. We optimise that for you automatically.

What about the risk?

Liquid funds are debt funds that invest in short-term fixed-interest generating money market instruments. These are funds that take the least amount of risk. They are widely considered to be an ideal investment avenue for an emergency fund. However, unlike money in your bank, liquid funds do not have institutional risk, i.e the risk of your bank going under.

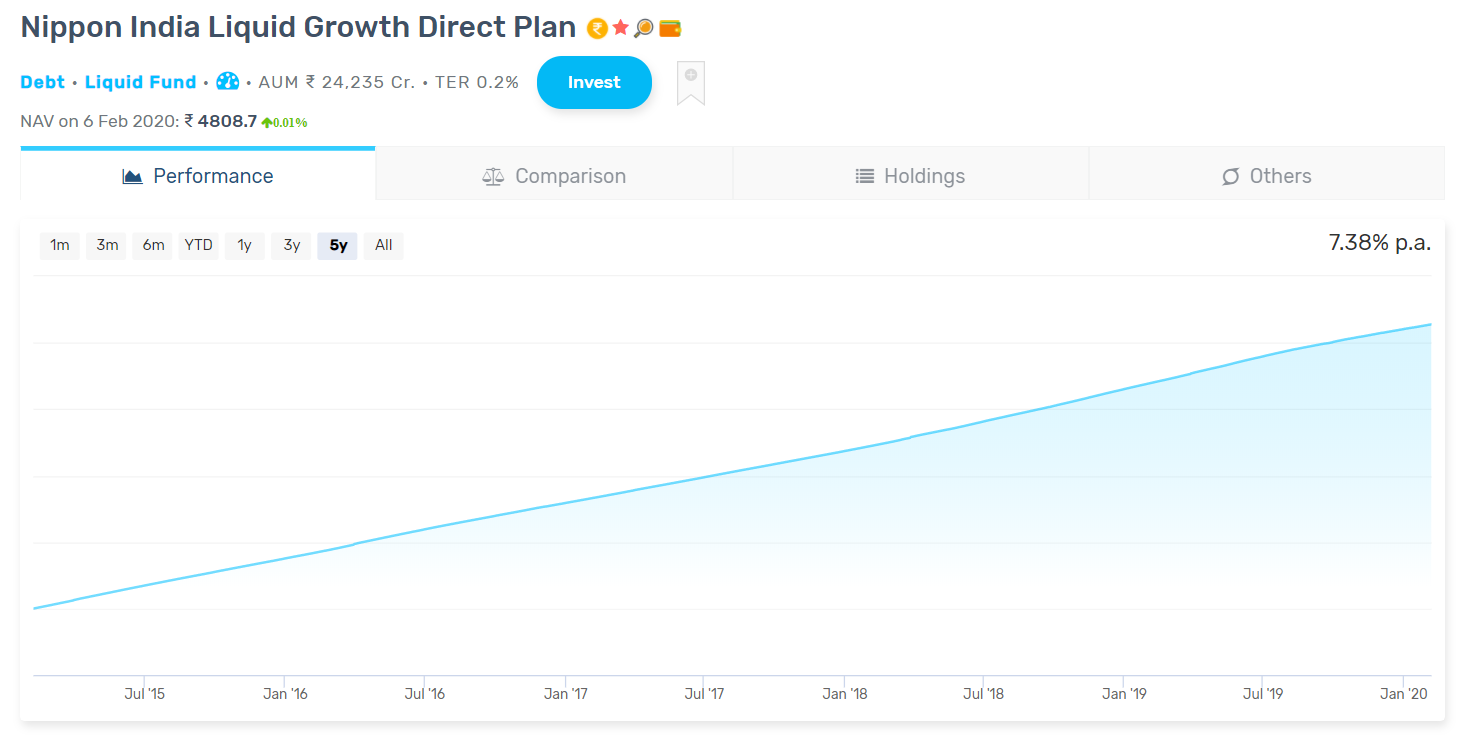

Below is an example of one of the liquid funds in our basket. However, as always, past performance should not be used to guide future performance and we request investors to do all due diligence as required.

So what are you waiting for?

Start SaveSmart now. And #each1teach1, let your friends know too – for every new friend who joins and starts a SaveSmart account of Rs 20,000 or more we will gift you Rs 201 worth of Amazon Pay gift card.

I need a debit card too…

Oh, you read our mind. A monthly save option and a debit card option is coming to SaveSmart soon.

Did we miss anything? Write to us at support@kuvera.in and we will answer any remaining query.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!

Taranath Kamath

February 13, 2020 AT 02:00

Understand the process of Savesmart.

Wanted to know this. Wouldn’t the STCG on investing in liquid funds spoil the extra interest i gained via investing in Savesmart/liquid funds?

Gaurav Rastogi

February 15, 2020 AT 07:31

STCG on debt funds is taxed at slab rate which is the same as the taxation of interest earned in a bank account.

Shubham Gupta

March 4, 2020 AT 12:05

I really loved the Smart Save account but request add a feature to schedule withdrawals from the same. I have sips scheduled from my bank account and I would like to automatically withdraw money from the SmartSave account a day before to maximize my interest. It would be perfect with that feature.

Gaurav Rastogi

March 7, 2020 AT 04:17

We are building something along these lines.

Shubham Gupta

May 7, 2020 AT 07:22

When will this feature be available?

Shoaib Bijapure

March 25, 2020 AT 04:26

Can I withdraw entire amount at once if it’s below 2 lakhs in save smart account by nilling the account?

Gaurav Rastogi

April 16, 2020 AT 01:39

You can withdraw the entire amount, however large, at any time.

Vanesh

April 17, 2020 AT 08:13

What is charge of savesmart in deposit and withdrawal?

Gaurav Rastogi

April 18, 2020 AT 02:48

No charge.

karthi padmaraj

April 18, 2020 AT 11:17

Will the interest calculated on daily basis? If I’m holding fund in this account for 5 days then will I get interest for that 5day?

Gaurav Rastogi

April 21, 2020 AT 03:59

The interest will reflect in the increased NAV daily.

VISHAL KHAREDIA

April 24, 2020 AT 02:29

1. Is there any charge for withdrawal of whole money before one year like MF?

2. Is it like saving bank account, we can save and withdraw the at any time and any sum of money?

Gaurav Rastogi

June 22, 2020 AT 03:12

1/ There is a small fee (0.07% or less) charged by the AMC when withdrawn before 7 days. After 7 days their is no withdrawal charges. We do not charge any fees.

2/ You can withdraw any time and any sum of money.

Ashish

April 26, 2020 AT 14:14

Can I link the bank mandates for SIPs to SaveSmart Account? Can I change my bank mandate for my existing SIPs to Savesmart account?

Gaurav Rastogi

April 28, 2020 AT 00:49

Yes you can Ashish. If in doubt email support@kuvera.in

Arvind

May 3, 2020 AT 01:05

I am quite bit impressed, but some queries

What is the minimum time we have to deposit and how to watch/know the NAV of our investment for best withdrawal time

Shivram Manohar Revankar

June 3, 2020 AT 19:36

What’s is expense ratio for save smart

Gaurav Rastogi

June 6, 2020 AT 03:50

It is simply the expense ratio of the direct underlying liquid funds.

Arunava Sinha

June 12, 2020 AT 02:30

In Save smart, what is the tax implication

STCG and LTCG rate and when it will be classified as LTCG

Gaurav Rastogi

June 16, 2020 AT 02:32

Same as for liquid funds – so debt classification.

Dipti

June 27, 2020 AT 15:18

Why don’t we have savesmart for NRE or NRO.

Gaurav Rastogi

June 29, 2020 AT 03:24

Insta redemption on liquid funds is not available for NRE accounts, unfortunately.

Ramanathan

October 27, 2020 AT 08:57

I happened to read in one of the comments that insta redemption is not possible for NRE accounts. What does this mean? I am an NRI and was looking forward to start depositing in SaveSmart from my NRE account.

Kirtikumar Giripunje

October 29, 2020 AT 15:36

I can’t withdraw money from my account it show technical issue try after some time

Gaurav Rastogi

October 30, 2020 AT 03:09

Please email us at support@kuvera.in and we will resolve.

Jignesh

November 9, 2020 AT 16:57

Is there a switch/STP option in Savesmart to switch/transfer money to equity?

Gaurav Rastogi

November 17, 2020 AT 03:43

We don’t have that feature, and yes it will be a useful option. For up to Rs 2 lakh though you can do instant redemption and then buy at the same day NAV.

Lakshmi Tejas M A

December 3, 2020 AT 13:25

With falling interests do you still recommend to use save smart or FD?

Sanyam Jain

April 29, 2021 AT 08:13

I see that SaveSmart now invests in 5 funds instead of 4(previously), does that mean liquidity has improved to 2.5Lakhs ?

Gurvinder singh

October 20, 2021 AT 06:12

What is the time peroid for savesmart?? As, I am new on this app and also new in investment… I Searched alot and finally started investing in this app, I am 28yrs old. Please suggest me some tips…

@GauravRastogi ji

Gaurav Rastogi

November 1, 2021 AT 00:49

There is no time limit for keeping money in SaveSmart.

Hiral Shah

January 6, 2022 AT 18:39

Before sometimes I’ve tried to invest in savesmart but due to some technical reason payment was not completed. Since that day, whenever I place order it shows your last order is in progress. Please look into it.

Gaurav Rastogi

January 7, 2022 AT 14:52

Pls email us on support@kuvera.in