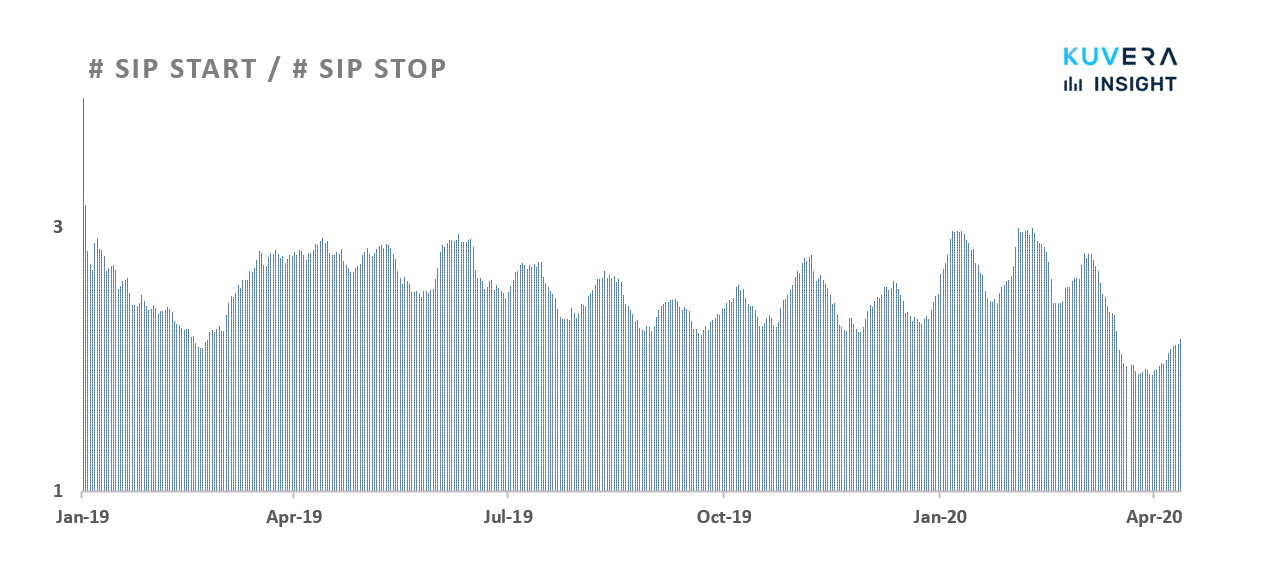

The industry SIP closure ratio hit 71% in March 2020, surpassing the 11-month average of 57.4%, even as the monthly SIP inflow figure reached a 12 month high in March. The closure ratio measures the number of SIPs stopped or expired to the number of new SIPs registered. On Kuvera we saw SIP start to SIP stop ratio fall in early March, but it stayed comfortably above 2 new SIPs started for each SIP stopped or a SIP closure ratio of under 35%.

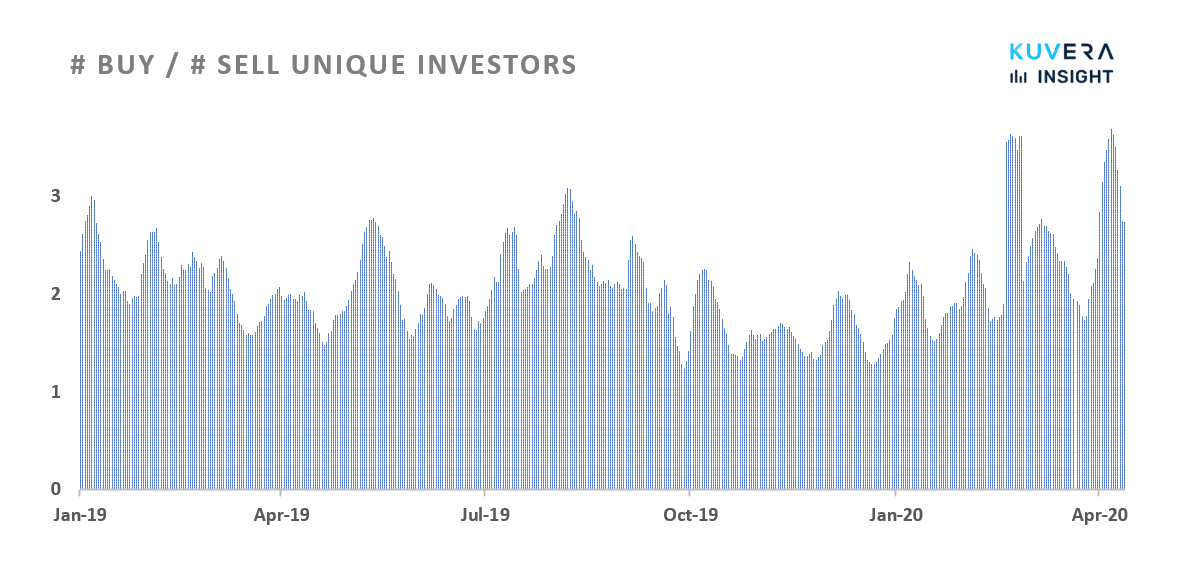

Similarly, the ratio of the number of unique investors who bought vs the number of unique investors who sold on Kuvera held steady and actually saw a jump post-Mar 20th. For every seller, during the crash, we have 3 net buyers, another very encouraging sign on the maturity of the retail investor.

While there is an industry distracting from the humble SIP by offering better market timing returns, they seldom deliver on the promise. SIP is based on two simple principles, cashflow matching – you invest when you get your paycheck and rupee cost averaging. In a qualitative study we ran, the large portion of SIP stoppage last few months has been due to cash flow issues as can be expected in the current situation.

It makes sense, if your salary is hit, you will stop your SIP.

Other than this, as long as your emergency funds are taken care of, to take benefit of rupee cost averaging that made the SIP so attractive in the first place an investor has to continue to invest during down markets. There is no averaging if you only buy in bull markets and stop the SIP in bear markets. Averaging requires that you have to buy low as well.

Or as this quick Q&A with Gaurav illustrates –

Q) Do you suggest to invest aggressively in a bear market?

A) Depends on your risk appetite. But it sure beats being aggressive in a bull market.

So what we are seeing on Kuvera is good investor behaviour and we sincerely hope it will continue as well.

Switch to Direct plans. Think about this, you will pay more in commissions in your investing life than what you lost in the markets last month.

And the commission once paid, is not coming back. It is not a mark to market loss.

So stop paying commissions and use this opportunity to switch to Direct.

Franklin Templeton AMC announced on 23 April that they have wound up 6 bond funds that took credit risk. These are:

- Franklin India Low Duration Fund

- Franklin India Ultra Short Bond Fund

- Franklin India Short Term Income Plan

- Franklin India Credit Risk Fund

- Franklin India Dynamic Accrual Fund

- Franklin India Income Opportunities Fund

You can read our blog about this here. In short, Franklin Templeton is finding it difficult to sell existing assets in these funds to meet redemption demands. The fund house has thus decided to wind up these funds. The above 6 schemes are closed for all new transactions. As and when Franklin can redeem the bonds or they mature, the money will come to the scheme to be distributed to the unitholders proportionally. To understand the details of the payment process during the winding-up, please refer to this note from the AMC. The AMC has also published a few FAQs in this regard and you can refer to the FAQs here.

And some good news. The community of savers, investors and personal finance enthusiasts that we have is the best and motivates us every day to do better for them. Given what we all are living through, it makes this milestone all the more special and we wanted to share it with you.

|

|

|

|

|

|

|

Movers & Shakers

1/ Essel Mutual Fund has announced that Archit Shah ceases to be a Fund manager of its schemes. The AMC has changed fund management responsibilities for the relevant schemes. Saravana Kumar has been appointed in his stead, with effect from 21 April 2020.

2/ Aditya Birla Sun Life Mutual Fund has announced a change in Fund managerial responsibilities of its schemes with effect from 27 April 2020.

Quote of the week:

Take risks: if you win, you will be happy; if you lose, you will be wise.

: Swami Vivekananda.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!