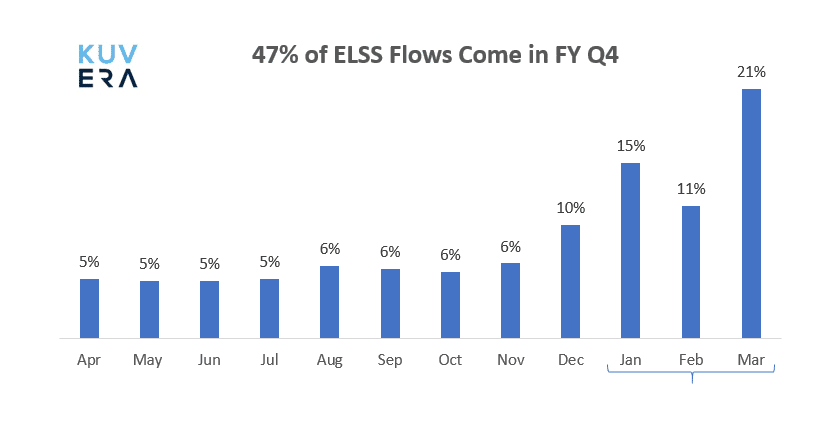

In this financial year, we have 1 week’s time left for tax saving. Data from Kuvera indicates that 47% of the ELSS investments on Kuvera are made in the last quarter of the financial year. Visit our ELSS Help Center to learn everything you need to know to save taxes while investing in Mutual Funds. You can find ELSS funds on Kuvera here.

The mutual fund industry witnessed SIP inflows of Rs 8,513 crore in February, a rise of 5.2% from the same month last year. The total SIP contribution in the first 11 months of the current financial year rose to Rs 91,443 crore as compared with Rs 84,638 crore in April-February 2018-19. AMFI data indicates that mutual funds added an average of 9.95 lakh SIPs per month during the financial year 2019-20, with an average ticket size of Rs 2,750.

Switch to Direct plans. Think about this, you will pay more in commissions in your investing life than what you lost in the markets last week.

And the commission once paid, is not coming back. It is not a mark to market loss.

So stop paying commissions and use this opportunity to switch to Direct.

|

|

|

|

|

|

|

Movers & Shakers

1/ Nippon India Mutual Fund has appointed Ritesh Nathmal Rathod as Research Analyst of Nippon Life India Asset Management Limited, effective from 16 March 2020.

2/ SBI Mutual Fund has announced that Nicolas Simon ceases to be the Deputy Chief Executive Officer and Key Personnel of SBI Funds Management Private Limited. Denys de Campigneulles has been appointed in his stead, with effect from 07 March 2020.

Quote of the week:

Beware the investment activity that produces applause; the great moves are usually greeted by yawns.

: Warren Buffet

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!