Recently India left behind China to become the world’s most populated country. With this drastic increase in population, there is another significant demographic change that is happening within the country.

India, known for its vibrant and youthful population, is experiencing a demographic shift that has significant implications for its economy and, in turn, for regular investors. A recent report called ‘India Aging Report 2023’ by UNFPA reveals that the country’s elderly population is on the rise. As the country’s elderly population steadily grows, we find ourselves at a critical juncture where challenges and opportunities converge.

In this blog, we will delve into the multifaceted impact of India’s aging population on the economy and explore the strategies that investors can employ to navigate this evolving demographic landscape.

The Demographic Transition

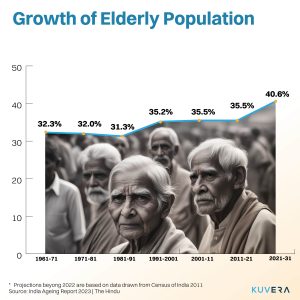

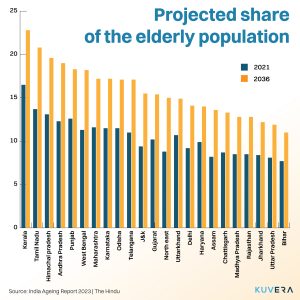

For decades, India has been celebrated for its youthful population, which has contributed to its economic dynamism. However, recent data signals a shift. According to Census 2011, India is now home to 104 million individuals aged 60 and above, constituting 8.6% of the entire population. The decadal growth rate of the elderly population is estimated to be at 41%, and projections indicate that by 2050, the percentage of elderly citizens will double to 20.8% of the total population.

Additionally, as we progress through this century, the elderly population is expected to surpass the number of children aged zero to 14, marking a profound demographic shift.

The Economic Implications

As the share of elderly population increases, the following sectors of the economy will be impacted:

- Healthcare Sector: With an aging population comes an increased demand for healthcare services. Hospitals, pharmaceutical companies, and healthcare providers are poised for significant growth.

- Pension and Insurance Industries: As the elderly population expands, the demand for pension and insurance products will surge. Companies offering retirement planning services and insurance coverage tailored to seniors may witness substantial growth.

- Real Estate and Senior Living: The need for senior-friendly housing and assisted living facilities is on the rise. Real estate developers catering to this demographic can anticipate robust returns. Real estate investment trusts (REITs) specializing in senior living communities will become a need.

- Consumer Goods: The spending patterns of the elderly differ from younger demographics. Consumer goods companies may need to adapt their product offerings. Investors can monitor companies that successfully tap into this market.

- Technology and Healthcare Innovation: The intersection of technology and healthcare is particularly promising. Innovations in telemedicine, wearables, and assistive devices for the elderly present investment opportunities.

Preparing for the Future

To navigate this evolving economic landscape, regular investors should consider several key strategies:

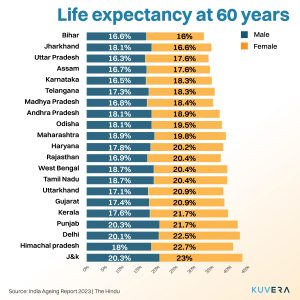

Strategic Retirement Planning: With the increasing life expectancy in India, prioritizing retirement planning is now more critical than ever. Securing a robust retirement plan at an early stage is indispensable to ensure your financial well-being during retirement.

Essential Health and Life Insurance: Investing in health and life insurance assumes paramount significance in covering your healthcare costs. Initiating early investments in these policies becomes pivotal in safeguarding your and your family’s financial future.

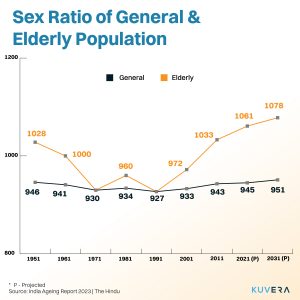

Empowering Women in Financial Planning: An intriguing trend emerges as data shows that sex ratio in the elderly population is higher than in the youth. This means that the women are outliving the men.

This unique aspect of life expectancy underscores the need for women to prioritize retirement planning even more than men. Despite being more prone to neglecting this aspect, women should recognize the significance of securing their financial future through strategic retirement planning.

Moreover, considering the longer lifespan, women should consider investing more substantially in health insurance compared to men. This proactive approach not only safeguards their well-being but also reflects a prudent strategy for managing healthcare expenses effectively.

Embrace the Long-Term Vision: Embracing a long-term perspective for investments is not just important but imperative. As life expectancy rises, nurturing a long-term investment approach becomes the cornerstone of financial success, ensuring that your assets align with the extended span of your life.

Conclusion

India’s aging population is more than just a demographic statistic; it’s a transformative force reshaping the nation’s economic landscape. Investors who stay attuned to these shifts and strategically position themselves in sectors poised for growth can potentially capitalise on the silver lining of India’s aging population. As we navigate these uncharted waters, one thing remains clear: adaptability and foresight will be key for investors looking to thrive in this changing environment.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube: Investing with legends series

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.