The way all risk markets are trending one may believe that valuations don’t matter at all. Higher for longer and buy the dip are the buzz words. While this may be true in the short or medium term (up to 5 years), long term future returns have historically been quite sensitive to starting valuation multiples.

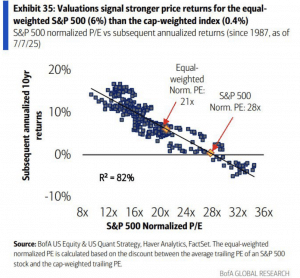

Research from Bank of America using data for S&P 500 from 1987 to 2025 shows that the forward 10 year returns have been inversely correlated to starting PE levels. At current normalised PE of 28x Bank of America estimates that the forward 10 year returns on S&P 500 will be around 0.4% p.a.

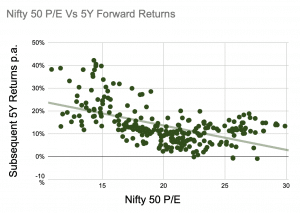

Back home, we looked at data going back to 1999 and compared the Nifty 50 P/E with the subsequent 5 year annualised return.

At the current Nifty 50 PE of 22.2, the expectation of future 5 year return is ~11%, not as buoyant as what the new investors who have started investing post-COVID have come to expect. As our markets mature our expectation is that the inverse relation between starting PE and subsequent long term future returns will only get stronger.

There is not a single dabbler in scrip who does not steadfastly believe: first, that a crash sooner or later, is inevitable; and, secondly, that he himself will escape it.

When the luck turns, and the crack play is sauve qui peut, or devil take the hindmost, no one fancies that the last mail train from Panic station will leave him behind.

In this, as in other respects, ‘Men deem all men mortal but themselves.’

: Letter to “The Times”

When “surfs up” and a big wave is forming, as a seasoned surfer you have to ride it. But not with blinders on or with no heed to safety. Same for investing. This rally may well continue for 6m or 3y, only time will tell. However in the long run the market is a weighing machine and there is enough evidence that the weight of current valuations will keep long term gains lower than expected.

One easy check is to not let your asset allocation drift to higher risk driven by the current euphoria. In the MF portfolios on Kuvera, we see that equity MF allocation has increased from 69% in Jan 2020 to 89% in Jul 2025. While asset allocation based rebalancing is obvious very few follow it with discipline. Keep your asset allocation in line and you will differentiate yourself from the average investor over time.

That’s the Spirit!

On March 2, 1908, Bal Gangadhar Tilak delivered a speech in Maharashtra’s Solapur. Addressing about 3,000 people gathered at an event organized by the Temperance Society, the noted freedom fighter spoke about the evils of consuming liquor and how alcohol sales were helping the British imperial government to fill its coffers.

Now, we are not here to give you a history lesson. The only reason we are talking about Tilak’s speech is to point out an irony. A hundred and seventeen years after Tilak’s speech, and 105 years after his death, an Indian company named in his honor has taken a giant stride forward to boost its alcohol consumption. Sorry, what?

Well, we are talking about Tilaknagar Industries Ltd buying the Imperial Blue whisky brand from French multinational Pernod Ricard for about Rs 4,150 crore, or around $486 million.

The irony aside, the acquisition is significant for more reasons than one. It marks the transfer of one of the country’s largest-selling liquor brands from the world’s second-largest wine-and-spirits maker to Tilaknagar.

For Pernod Ricard, the deal helps it to shed a brand that it considers local and less central to its business than its premium global labels like Chivas Regal, Jameson Irish Whiskey, Absolut vodka, and Ballantine’s. It is also the biggest takeover deal in India’s liquor industry in more than a decade, next only to Diageo’s purchase of United Spirits in 2013 for almost $2 billion.

Tilaknagar was founded by Mahadev L Dahanukar as the Maharashtra Sugar Mills Ltd in 1933. Dahanukar later changed the company’s name to Tilaknagar “as a mark of respect for his guide”, the company says on its website. Today, the company is run by the fourth generation of the Dahanukar family.

How will the deal benefit Tilaknagar? For one, it helps India’s biggest maker of brandy with brands such as Mansion House and Courrier Napoleon to establish a big foothold in the whisky segment overnight.

Whisky is the largest alcoholic segment in India, where the size of the overall market is projected to touch $61.35 billion in 2025-26, according to credit ratings and research firm Crisil. Whisky is also growing faster and commands a higher margin than other segments such as brandy, gin or rum, where Tilaknagar already has a strong presence.

Imperial Blue is one of India’s largest mass-market whisky brands, competing with the likes of United Spirits’ McDowell’s No. 1, Allied Blenders’ Officers’ Choice and Pernod Ricard’s Royal Stag. The brand recorded sales of 22.4 million 9-litre cases and revenue of Rs 3,047 crore in 2024-25. That’s slightly more than double Tilaknagar’s total revenue currently.

So, will Tilaknagar be able to digest Imperial Blue? The company remains in high spirits, financially speaking. While its revenue grew only 2.9% in 2024-25 to Rs 1,434 crore, its adjusted EBITDA jumped almost 22% to Rs 226 crore and adjusted net profit surged 42% to Rs 201 crore.

On the stock market, Tilaknagar’s shares have soared 140% since touching a one-year low in early April, hitting a one-year high on Thursday and giving it a market capitalization of around Rs 9,787 crore. Clearly, investors have rallied behind the company. All it needs to do now is avoid a hangover!

tl;dr Hear the article in brief instead?

Go Shopping

Tilaknagar wasn’t the only company sprinting across Deal Street this week. Two other companies made similar bold moves. While a top jewellery brand took a foothold in West Asia, a pharmaceutical major made inroads into Africa.

Titan, India’s most prominent watch and jewellery brand, signed an agreement to acquire a 67% stake in the UAE-based luxury brand Damas from Qatar’s Mannai Corp at an enterprise value of about $283 million, or about Rs 2,445 crore. Titan also holds an option to buy the remaining 33% stake after December 2029, paving the way for full ownership.

Titan has been present in the UAE since October 2020 through its Tanishq stores. It currently operates seven stores in the UAE and will now get access to 146 Damas stores across the UAE, Saudi Arabia, Qatar, Oman, Kuwait, and Bahrain. Titan aims to leverage Damas’ well-established brand and customer base, tapping into the Gulf region’s growing demand for culturally resonant luxury jewellery. The acquisition will also help Titan to cater to the large Indian diaspora in the Gulf region and compete with the Joyalukkas, Kalyan Jewellers and Malabar Gold.

The deal comes at a time when Titan’s jewellery segment has seen a moderation in growth. Sales growth slowed to 17% in the first quarter, compared to around 25% in previous quarters. What growth there was came largely from low-margin coin sales, rather than the higher-margin studded or plain gold jewellery segments. With high gold prices dampening domestic demand, Titan’s push into the Gulf region could prove timely and strategic.

Hyderabad-based pharmaceutical major Natco Pharma also struck a large deal this week. Natco said it will buy a 35.75% stake in South African pharmaceutical firm Adcock Ingram Holdings for about Rs 2,000 crore. Adcock, one of South Africa’s leading pharmaceutical companies, generated revenue of $536 million in the financial year ended June 2024.

Natco aims to bolster Adcock Ingram’s market leadership and expand its product portfolio across the African continent. These acquisitions signal a confident outward push by Indian companies seeking new growth frontiers, especially considering the volatile global environment and the uncertainty over trade deals. Onwards and upwards!

The Deal is Done

Talking about trade deals, India and Britain finally signed a bilateral agreement this week after three years of talks to slash tariffs on a wide range of goods from textiles to whisky and cars and allow businesses greater market access.

The Comprehensive Economic and Trade Agreement, signed during a visit by Prime Minister Narendra Modi, comes in the wake of the chaos in international trade unleashed by US President Donald Trump since he took office in January. So, how will this pact change trade ties between India and the UK? And what sectors will it affect the most?

Before we go into details, let’s take a broader view. For India, it is the biggest trade deal with a developed economy and could set the tone for similar agreements with the European Union and other countries. It is also Britain’s biggest trade deal since 2020 when it left the EU, its closest trading partner. The CETA can not only reshape the $23 billion goods trade between India and UK but also affect other areas such as services, intellectual property, and government procurement.

Now, over to the main changes that the agreement will bring. Under the agreement, $6.5 billion—or 45%—of Indian exports like textiles, footwear, automobiles, seafood, and fresh fruits, will enter the UK duty-free. These goods earlier attracted tariffs of 4% to 16%. Only a few farm products like rice won’t come under the pact. The remaining $8 billion of exports—covering petroleum, pharmaceuticals, diamonds, and aircraft components—already had zero duty access.

On its part, India will eliminate tariffs on 90% of British goods. To begin with, tariffs on 64% of UK goods will be reduced to zero immediately. These goods include aircraft parts, machinery, electronics, and salmon. Over the next 10 years India will phase out tariffs on another 26% of goods such as chocolates, soft drinks, cosmetics, and auto parts.

India will immediately reduce tariffs on Scotch whisky to 75% from 150%, and further to 40% over the next decade. Similarly, the tariffs on brandy and rum will go down to 110% initially and then to 75%. This could benefit companies such as Diageo, the owner of United Spirits.

The agreement marks a big shift for the automobile sector. Under the pact, India will cut duties to 10% within five years from up to 110% currently under a quota system. In return, the UK will allow greater access to electric and hybrid vehicles from India. This could benefit both Tata Motors and Mahindra & Mahindra.

The Indian government has also offered several other major concessions to the UK. For instance, the government will open about 40,000 high-value contracts from central ministries and departments in sectors such as transport, renewable energy, and infrastructure to British companies. Critics say this marks a major shift away from using public procurement as a tool to develop local industries, help SMEs grow, create jobs at home, and reduce import dependence.

Overall, while the trade deal will benefit several industries, it will have an adverse effect on some other areas. Who eventually wins and loses will be clear in the coming years.

Let’s be Boring

Moving back from economic news to the corporate sector, Neville Noronha, the CEO of retail chain Dmart’s parent Avenue Supermarts Ltd, offered a significant lesson this week in a letter to the company’s shareholders.

As he prepares to step down in January 2026 after over two decades at the helm, Noronha doesn’t look back with dramatic anecdotes or triumphant declarations. Instead, he focuses on something profoundly unglamorous: the daily routine. Indeed, his parting message reads like a quiet manifesto on how to build a Rs 3-trillion company without fanfare.

In a world of hyper-growth buzzwords and innovation mantras, Noronha’s description of the business as “boring” is as countercultural as it is revealing. “True bliss,” he writes, “is to be in that flow of just doing simple stuff and liking to do the simple stuff.” This, for him, is not resignation, it’s philosophy.

Over the past 21 years, Noronha steered DMart from obscurity into one of India’s most consistently profitable retailers. For 13 of those years, the company operated almost unnoticed, refining its model slowly. Its secret? A deep, almost obsessive respect for repetition. “Sharpening, observing, reflecting, doing—repeat,” he notes, describing how the team honed operations with the rigour of craftspeople rather than tech disruptors.

This ethos crystallised into what he calls the “Spontaneous Automatic” model, an internal culture in which employees are trained so deeply in their roles that they respond instantly and accurately to any situation. It’s not about reacting to chaos, but about being so well prepared that chaos doesn’t stand a chance.

In a business like retail, where thin margins leave little room for error, Noronha argues that competitive advantage doesn’t come from flashy differentiation but from relentless consistency. While 90% of DMart’s operations may look similar to competitors, he says, it is the remaining 10%—done better, every single day—that creates the edge.

That repetition, however, doesn’t mean stagnation. DMart has quietly adapted to India’s shifting retail landscape, whether through its expanding DMart Ready online platform or its ability to scale store count with uniform discipline. It offers choice to customers, not by chasing trends but by reliably offering the right product at the right price in the right

quantity.

Noronha’s version of leadership isn’t top-down. “Leaders know the least,” he declares, advocating for a flat structure where subordinates, not executives, hold the real knowledge of how retail works. His role, he believes, was simply to enable this knowledge to thrive, free of unnecessary KPIs or meetings.

In a market often obsessed with innovation and disruption, Noronha’s legacy will be remembered for something far rarer: doing the basics right, again and again, until excellence becomes second nature.

Market Wrap

India’s stock markets extended their losing streak for the fourth week and ended at a one-month low this Friday, as sentiment was weighed down by weak corporate earnings, foreign fund outflows and uncertainty over trade deals.

The BSE Sensex closed 0.4% lower this week while the Nifty 50 fell 0.5%. In the broader market, the small-cap index lost 3.5% while the mid-cap index declined 1.9%.

Eleven of the 16 major sectoral indices ended lower this week, led by a 4.1% drop in the IT index. The oil and gas index slumped 3.5%, dragged down by Reliance Industries, while disappointing earnings by Nestle and other consumer goods companies pushed the FMCG index 3.4% lower.

Nestle was also the biggest Nifty 50 loser, ending almost 8% down this week. Tata Group’s retail arm Trent, the owner of Zudio stores, was No.2 on the list of losers. Reliance was at No.3, clocking a loss of 5.7% for the week.

Tech Mahindra fell the most among IT stocks, followed by Infosys and HCL Tech. IndusInd Bank recorded the steepest drop among financials, followed by non-bank lenders Shriram Finance and Bajaj Finance.

At the other end of the spectrum, Zomato and Blinkit parent Eternal surged 20.7% on optimism about its quick-commerce business. ICICI Bank and HDFC Bank gained after reporting strong earnings. Drugmakers Cipla, Dr Reddy’s and Sun Pharma; automakers M&M and Tata Motors, and insurers HDFC Life and SBI Life were among the other gainers.

Earnings Snapshot

- Infosys beats estimates as profit rises 8.7% to Rs 6,921 crore; lifts annual revenue forecast

- UltraTech Cement consolidated net profit jumps 49% to Rs 2,226 crore, tops expectations

- Nestle India Q1 profit drops 12% to Rs 659 crore on higher costs

- Tata Consumer Products profit unchanged at Rs 334 crore, lags forecasts

- Bajaj Housing Finance profit rises 21% to Rs 583 crore

- Dr Reddy’s Labs consolidated net profit up 2% at Rs 1,418 crore, misses forecasts

- McDonald’s franchisee Westlife Foodworld Q1 profit plunges 62% to Rs 1.23 crore

- KFC operator Sapphire Foods swings to Rs 1.8 crore loss versus year-ago profit of Rs 8.5 crore

- Kingfisher beer maker United Breweries Q1 profit up 6% at Rs 184 crore

- Paytm swings to profit of Rs 123 crore versus year-ago loss of Rs 839 crore

- Zomato, Blinkit parent Eternal profit slumps 90% but revenue jumps 70%

Other Headlines

- SEBI allows Jane Street to resume trading after $567 million deposit

- National Securities Depository Ltd to launch IPO on July 30

- Tata Capital seeks valuation of $18-20 billion In IPO, reports Bloomberg

- Dairy products maker Milky Mist files DRHP for Rs 2,035 crore IPO

- Brigade Hotel Ventures launches Rs 760-crore IPO with price band of Rs 85-90

- Dr Reddy’s Labs plans to start selling generic obesity drugs in 87 countries next year

- Bajaj Finance MD Anup Saha resigns after four-month stint; Rajeev Jain returns to role

- IndusInd Bank to raise Rs 30,000 crore via debt, equity; allow Hindujas to name two directors

- SBI raises Rs 25,000 crore via share sale to institutional investors

- Enforcement Directorate probes Anil Ambani’s Reliance Group, searches 35 locations, reports Reuters

- Enforcement Directorate accuses Walmart-owned Myntra of breaching FDI rules

- French carmaker Renault plans to boost India production, launch more SUVs

- PayPal to launch cross-border platform linking UPI

That’s all for this week. Until next week, happy investing!

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch here: Investing in International Markets

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today. #MutualFundSahiHai #KuveraSabseSahiHai