The stock market has witnessed remarkable highs and devastating lows throughout history. From economic downturns to unforeseen events, stock market crashes have had a profound impact on investors and the global economy.

In this blog, we delve into the history of stock market crashes, highlighting the top 5 crashes that have left an indelible mark.

1) The Great Depression (1929)

The Great Depression stands as one of the most severe financial crises in history. Triggered by the Wall Street Crash of 1929, the stock market plummeted, leading to widespread bankruptcies, unemployment, and economic hardship across the globe.

2) Black Monday (1987)

Black Monday, occurring on October 19, 1987, saw the stock markets worldwide experience a significant crash. In a single day, stock indices dropped dramatically, causing panic selling and triggering a global recession. The crash was attributed to factors like computer trading, high valuations, and geopolitical tensions.

3) Dot-Com Bubble Burst (2000)

The turn of the millennium witnessed the bursting of the dot-com bubble. Fueled by excessive speculation in internet-based companies, stock prices reached astronomical levels before sharply declining. Many internet startups and tech companies faced massive losses, resulting in widespread market turmoil.

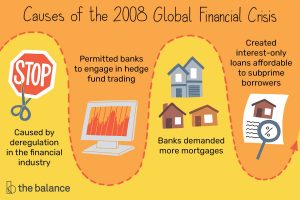

4) Global Financial Crisis (2008)

The collapse of Lehman Brothers in September 2008 set off a domino effect that led to the global financial crisis. The crisis stemmed from the bursting of the US housing bubble and the subsequent subprime mortgage crisis. Stock markets worldwide experienced substantial declines, leading to a severe recession and necessitating government intervention to stabilize the economy.

5) COVID-19 Pandemic Crash (2020)

The outbreak of the COVID-19 pandemic in early 2020 triggered one of the most rapid and severe stock market crashes in history. As countries imposed lockdowns and economic activities stalled, stock markets plummeted globally. Uncertainty and fear prevailed, causing volatility and unprecedented market swings.

Conclusion

Throughout history, stock market crashes have shaped the financial landscape, leaving a lasting impact on economies and investors. The Great Depression, Black Monday, the Dot-Com Bubble Burst, the Global Financial Crisis, and the COVID-19 Pandemic Crash stand out as the top 5 stock market crashes of all time. By understanding the causes and consequences of these crashes, we can gain valuable insights into the importance of diversification, risk management, and staying informed. While the future remains uncertain, learning from the past can help us navigate the dynamic world of investing more effectively.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch here: Investing in Flexi cap funds

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.