Top news

India’s foreign exchange reserves (Forex) increased by USD 2.56 billion to reach USD 644.15 Billion for the week ending May 10.

Shares of Indegene got listed at a premium of 45% over issue price of Rs 452 and shares of TBO Tek got listed at a premium of 55% over issue price of Rs 920. The IPO of Go Digit General Insurance got over subscribed by 9.60 times.

Bajaj AMC, DSP AMC, WOC AMC, Samco AMC and SBI AMC have launched the NFOs for Bajaj Finserv Multi Asset Allocation, DSP Nifty Bank Index Fund, WOC Special Opportunities Fund, Samco Special Opportunities Fund and SBI Automotive Opportunities Fund. The NFOs closes on 27th May for Bajaj AMC and DSP AMC, 29th May for WOC AMC and 31st May for Samco AMC and SBI AMC.

Index Returns

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | 1.9% | 23.6% | 15.2% | 21.5 | 3.9 |

| NIFTY NEXT 50 | 5.0% | 64.4% | 23.2% | 22.3 | 4.1 |

| S&P BSE SENSEX | 1.7% | 20.1% | 17.9% | 23.6 | 3.6 |

| S&P BSE SmallCap | 4.8% | 59.3% | 35.2% | 33.4 | 3.6 |

| S&P BSE MidCap | 4.4% | 62.7% | 26.9% | 30.4 | 3.9 |

| NASDAQ 100 | 2.1% | 34.4% | 12.7% | 33.2 | 3.4 |

| S&P 500 | 1.5% | 26.5% | 10.4% | 27.6 | 4.8 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Quant PSU | 10.1% | NA | NA |

| HDFC Defence | 9.9% | NA | NA |

| LIC MF Infrastructure | 9.9% | 81.0% | 38.3% |

| Canara Robeco Infrastructure | 9.7% | 72.2% | 38.2% |

| Bandhan Infrastructure | 8.8% | 84.9% | 39.0% |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| JM ELSS Tax Saver | 5.4% | 51.9% | 25.3% |

| HSBC ELSS Tax Saver | 4.8% | 42.5% | 20.9% |

| Kotak ELSS Tax Saver | 4.3% | 42.8% | 23.7% |

| Motilal Oswal ELSS Tax Saver | 4.3% | 58.7% | 27.8% |

| Shriram ELSS Tax Saver | 4.3% | 41.2% | 20.0% |

| Stocks (Market cap > Rs 50k Cr) | 1W | 1Y | 5Y |

|---|---|---|---|

| Hindustan Zinc | 29.4% | 90.1% | 18.3% |

| Mazagon Dock Shipbuilders | 24.6% | 240.6% | NA |

| Linde India | 23.8% | 140.0% | 77.0% |

| ABB India | 19.9% | 114.1% | 50.5% |

| Oberoi Realty | 19.5% | 78.7% | 27.2% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| ICICI Prudential FMCG | -0.6% | 12.6% | 19.5% |

| DSP World Agriculture | -0.2% | -6.4% | -8.7% |

| ICICI Prudential Regular Gold | -0.1% | 20.0% | 14.1% |

| Bharat Bond FoF April 2025 | 0.0% | 7.0% | 5.1% |

| Mirae Asset NYSE FANG ETF FoF | 0.0% | 83.2% | 26.7% |

| Stocks (Market cap > Rs 50k Cr) | 1W | 1Y | 5Y |

|---|---|---|---|

| Bank Of India | -11.5% | 59.6% | 8.6% |

| Tata Motors | -8.2% | 81.5% | 40.1% |

| Mankind Pharma | -3.7% | 53.8% | NA |

| Tube Investments of India | -3.6% | 41.9% | 58.9% |

| Tata Consultancy Services | -3.2% | 17.7% | 12.7% |

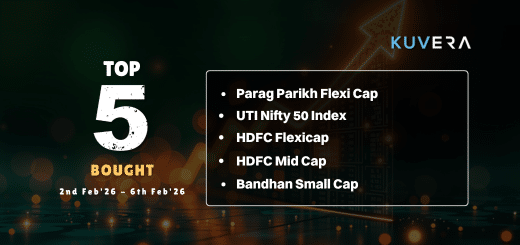

Bought and Sold

| Most Bought MF | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Flexi Cap | 0.3% | 36.9% | 22.9% |

| Quant Small Cap | 3.4% | 65.9% | 35.6% |

| UTI Nifty 50 Index | 2.2% | 23.6% | 16.3% |

| Quant Mid Cap | 4.5% | 74.5% | 35.7% |

| Quant Infrastructure | 3.7% | 78.3% | 38.4% |

| Most sold MF | 1W | 1Y | 3Y |

|---|---|---|---|

| Kotak Equity Arbitrage | 0.2% | 8.60% | 6.50% |

| Tata Small Cap | 5.0% | 47.1% | 32.7% |

| Nippon India Banking & Financial... | 2.0% | 25.6% | 21.8% |

| HDFC Nifty200 Momentum 30..... | 4.6% | NA | NA |

| Tata Digital India | 2.8% | 36.0% | 19.00% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Axis Nifty 50 Index | 1.9% | 24.6% | NA |

| Bandhan Small Cap | 4.6% | 73.0% | NA |

| Axis Small Cap | 4.8% | 40.0% | 29.5% |

| UTI Nifty Next 50 Index | 5.0% | 64.9% | 21.3% |

| Bandhan Core Equity | 3.7% | 58.3% | 23.6% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Tata Motors | -8.2% | 81.5% | 40.1% |

| 14.9% | 403.7% | NA | |

| Bharat Heavy Electricals | 9.8% | 267.5% | 37.0% |

| Tata Power Company | 5.5% | 106.4% | 48.1% |

| Adani Power | 3.8% | 169.2% | 73.6% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Super Micro Computer | 11.2% | 440.8% | 113.7% |

| NVIDIA Corporation | 2.9% | 195.8% | 88.4% |

| Meta Platforms | -0.9% | 92.1% | 20.5% |

| Netflix, Inc. | 1.7% | 70.0% | 11.8% |

| Amazon.com | -1.5% | 58.9% | 14.6% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.

Disclaimer: Mutual Fund investments are subject to market risks. Read all scheme related documents carefully.

Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Investment in the securities is subject to market risks. Read all the related documents carefully before investing.

The securities quoted are for illustration only and are not recommendatory.

This market update was initially published by Livemint.

#MutualFundSahiHai, #KuveraSabseSahiHai!

Swapan Kumar Bhattacharyya

May 20, 2024 AT 09:28

Excellent